Two Japanese Buyers of French Bonds Are Now Steering Clear

(Bloomberg) -- Two Japanese institutional investors with holdings of French government bonds said they’re unlikely to buy more of the debt for now despite its cheapness, citing concern that political turmoil will trigger further declines.

Most Read from Bloomberg

What to Know About the Deadly Flesh-Eating Bacteria Spreading in Japan

‘I Live in Hell’: Anti-Growth Fervor Grips US South After Pandemic Boom

Stocks Rise as Bullish Nvidia Call Boosts AI Trade: Markets Wrap

Citi Pitches Money-Moving ‘Crown Jewel’ as Central to Revamp

Flesh-Eating Bacteria That Can Kill in Two Days Spreads in Japan

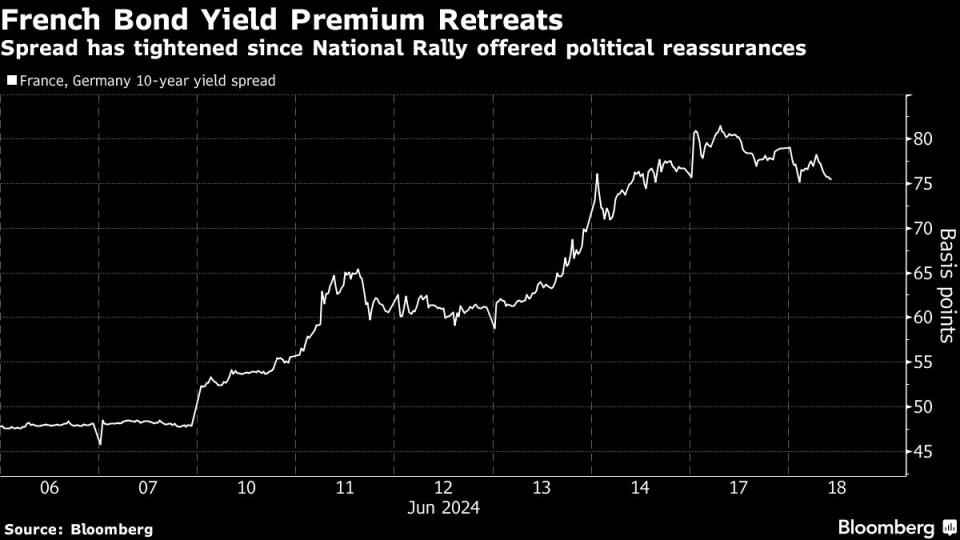

France’s 10-year bonds, which feature in the portfolios of many big Japanese investors, have dropped so much that the yield spread over safer German notes widened the most on record last week, according to data compiled by Bloomberg going back to 1990. It could widen further to as much as the 100 basis-point level, said Shinji Kunibe, lead portfolio manager at Sumitomo Mitsui DS Asset Management Co.’s global fixed-income group. It’s currently around 76 basis points.

“We are bearish on French government bonds in the short term,” said Kunibe. He’s holding onto the nation’s sovereign notes for now, but he said there’s a risk of being forced to sell them if they weaken further due to political risks.

Kenichiro Kitamura, general manager of the investment planning and research department at Meiji Yasuda Life Insurance Co., said that additional investment in French government bonds is possible, but he plans to take a wait-and-see stance for now to assess the political situation. The insurer holds French debt to diversify its holdings in currency terms.

For Japanese investors, French bonds are the second-most popular overseas debt after US notes. The investors hold ¥25 trillion in French debt including corporate bonds, compared with ¥159 trillion of US securities at the end of 2023, according to Ministry of Finance data.

Tokyo-based Taiju Life Insurance Co. is reducing its holdings of hedged foreign bonds, and the firm doesn’t have big holdings of French notes, said Hiroshi Nakamura, general manager of the investment management department. “We will probably maintain the current balance” of French debt, he said.

(Adds chart, details on French bond holdings, and one more investor comment.)

Most Read from Bloomberg Businessweek

Google DeepMind Shifts From Research Lab to AI Product Factory

Coke—and Dozens of Others—Pledged to Quit Russia. They’re Still There

Trump’s Planned Tariffs Would Tax US Households, Economists Warn

©2024 Bloomberg L.P.

Yahoo Finance

Yahoo Finance