U.S. Dollar Index (DX) Futures Technical Analysis – Strengthens Over 99.245, Weakens Under 98.130

The U.S. Dollar advanced against a basket of major currencies on Monday, snapping a week of declines, as investors braced for prolonged uncertainty. Meanwhile, central banks and governments continued to launch a series of aggressive monetary and fiscal measures designed to combat the economic impact of the coronavirus pandemic. Additionally, over the weekend, governments tightened lockdown efforts creating more worries for investors over whether the spread of the virus can be controlled in a timely manner.

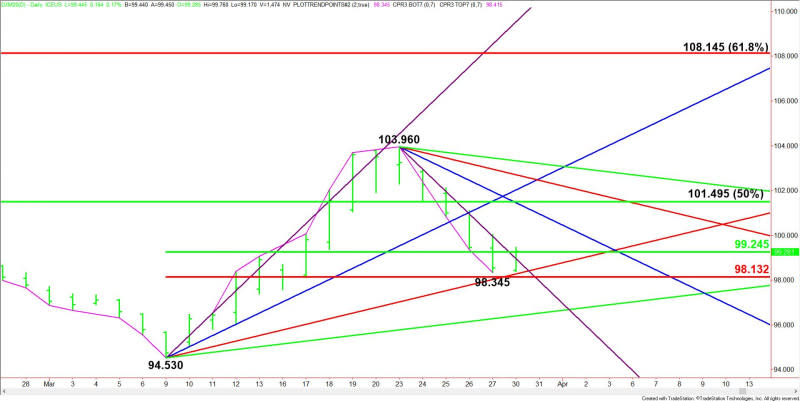

On Monday, June U.S. Dollar Index futures settled at 99.281, up 0.744 or +0.76%.

Concern about the spreading coronavirus and the economic impact of shutdowns continued to dominate foreign exchange markets as investors made decisions on both the economic impact of the virus and the rising number of new cases. However, some traders observed that the price moves on Monday were relatively well contained and much smaller than in recent sessions.

Daily Technical Analysis

The main trend is up according to the daily swing chart. A trade through 94.530 will change the main trend to down. A move through 103.960 will signal a resumption of the uptrend. Monday’s trade was inside the previous session’s range, which typically indicates investor indecision and impending volatility. It could also be an indication the market is going through a transition period after a five day break from the recent top.

The short-term range is 94.530 to 103.960. Its retracement zone at 99.245 to 98.130 was the first downside target. Friday’s low at 98.345 was made inside this zone

On the upside, the nearest resistance target is the long-term retracement zone at 101.495 to 108.145. This zone stopped the rally on March 23 at 103.960.

Short-Term Outlook

The direction of the June U.S. Dollar Index this week is likely to be determined by trader reaction to the retracement zone at 99.245 to 98.130.

Since the main trend is up, buyers are likely to come in on a test of this zone. They are going to try to form a potentially bullish secondary higher bottom.

Sellers are going to try to take out this zone in an effort to eventually challenge the main bottom at 94.530.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance