U.S. Seeks Bids for Domestic Low-Enriched Uranium to Counter Russian Influence

In a strategic move to jumpstart domestic uranium enrichment capacity in the U.S., the Department of Energy (DOE) has launched a request for proposals (RFP) to buy low-enriched uranium (LEU) from domestic suppliers.

The RFP will seek LEU through procurement contracts for indefinite quantity and indefinite delivery (IDIQ). It could result in awards of “two or more contracts, which will last for up to 10 years,” the DOE said on June 27. Proposals are due on Aug. 26, 2024. After awarding contracts, the agency intends to sell the LEU to utilities operating U.S. reactors “to support clean energy generation and sever reliance on Russian imports.”

According to the agency documents associated with the RFP, all LEU acquired through the contracts must be enriched and stored within the continental U.S. Contracts involving enrichment for commercial use must come from new U.S. capacity—including “new enrichment facilities or projects that expand the capacity of existing enrichment facilities,” the DOE said. The DOE also specified that it prefers LEU sourced from existing permitted U.S. mining and milling, as well as new conversion facilities. However, as a “next preference,” it will consider LEU sourced from newly permitted mining and milling facilities, existing conversion capacity, or from “allied or partner” nations.

A Significant Bid to Break Reliance on Russian Uranium

The solicitation is a marked effort by the U.S. executive branch to ensure a stable supply of LEU amid potential disruptions in the nuclear fuel market. The RFP notably follows President Biden’s May 13 enactment of a Congressional ban—by unanimous consent—on imports of unirradiated LEU produced in Russia. The Prohibiting Russian Uranium Imports Act (H.R. 1042), which the House of Representatives also passed by unanimous consent, takes effect on Aug. 11, 2024, and applies to at least 2040. As POWER has reported, Congress also passed the ADVANCE Act on June 18, which expands the definition of “covered fuel” to include fuel assemblies fabricated by Chinese state-owned entities.

LEU, in the legislative context, covers uranium products in any form, including uranium hexafluoride (UF6) and uranium oxide (UO2), in which uranium contains less than 20% uranium-235 (U-235). For relevant context, the existing fleet of U.S. nuclear reactors requires LEU enriched to no more than 5% weight percent of U-235. Under H.R. 1042, distinct annual ceilings are established to import unirradiated LEU produced in Russia or by a Russian entity, including those associated with separative work units (SWUs). Specifically, the import ceiling (representing the weight of the uranium content, regardless of its chemical forms) for 2024 is set at 476,536 kilograms, progressively decreasing to 459,083 kilograms by 2027.

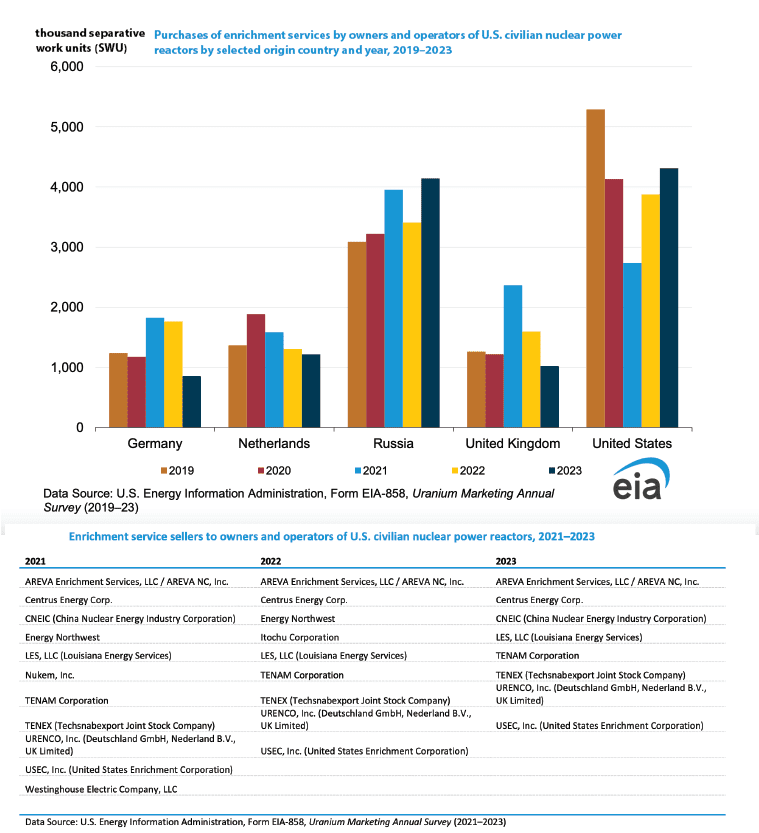

The Energy Information Administration (EIA), in its June 11–released annual uranium marketing update, suggests U.S. utilities purchased a total of 51.6 million pounds of U3O8e (equivalent) of deliveries from U.S. and foreign suppliers during 2023. Canada led foreign-origin sources (at 27% of total deliveries), followed by Australia and Kazakhstan (22% each). Russian-origin deliveries accounted for 12%, while U.S. material hovered at 5% of total deliveries. However, U.S. utilities purchased an estimated 4.1 million Russian-origin separative work units (SWU) in 2023—representing 27% of U.S. enriched uranium supply. U.S. enrichment plants provided 28%, while Western European plants provided 45%.

[caption id="attachment_220680" align="alignnone" width="759"]

In 2023, U.S. civilian nuclear power operators delivered 34 million pounds of natural uranium feed to enrichers, with 39% going to U.S. suppliers and 61% to foreign suppliers. They also purchased 15 million SWUs for enrichment, paying an average of $106.97 per SWU, a 6% increase from the previous year. U.S. suppliers accounted for 28% of these SWUs, while foreign suppliers provided the remainder, including significant contributions from Russia, France, and other European countries. Source: EIA/2023 Uranium Marketing Annual Report[/caption]

Ensuring an Adequate Fuel Supply From Trusted Sources

According to the DOE, the RFP will be the first crucial measure to fortify domestic nuclear fuel supply chains. The “action will help spur the safe and responsible build-out of uranium enrichment capacity in the U.S., promote diversity in the market, and provide a reliable supply of commercial nuclear fuel to support the energy security and resilience of the American people and domestic industries, free from Russian influence,” it said. “Developing domestic capacity for LEU ensures an adequate fuel supply is available from trusted sources to maintain the current fleet of U.S. reactors and build a strong base to supply future deployments of cutting-edge nuclear technologies both at home and abroad.”

The agency noted that the RFP will leverage $2.7 billion unlocked by H.R. 1042. As directed in the FY2024 spending bill, that funding is dedicated to developing LEU and high-assay, low-enriched uranium (HALEU), a nuclear fuel material enriched to a higher degree (between 5% and 20%) than many advanced nuclear technologies will require.

At the end of 2023 and earlier this year, the agency issued separate RFPs for the purchase of enriched and deconverted HALEU. In March, it said it expects to award contracts for HALEU enrichment and deconversion services “later this summer to help spur demand for additional HALEU production and private investment.”

In tandem, the U.S. has moved to pursue international collaborations to boost its global nuclear supply chain. In December 2023, at COP28, it joined with Canada, France, Japan, and the UK to mobilize $4.2 billion to boost enriched uranium production capacity “free from Russian material and establish a resilient uranium supply market free from Russian influence.”

However, as POWER has reported, while nuclear fuel suppliers appear eager to expand their production capabilities, many underscore the need to underwrite the significant capital investment with long-term contracts. So far, London-based Urenco has said it may add multiple new centrifuges at its UUSA facility in Eunice, New Mexico (which is operated by Louisiana Energy Services). French nuclear fuel giant Orano is also reportedly mulling plans to build a uranium enrichment facility in the U.S.

Still, for now, current U.S. enrichment capacity can only meet a third of domestic needs, as think tank Third Way notes. “Beyond the western enrichers Urenco’s and Orano’s announced capacity expansions, additional federal support is necessary to overcome this enrichment bottleneck,” Rowen Price, Third Way policy advisor for Nuclear Energy, wrote in a recent note.

Price has called for a cohesive and collaborative approach involving multiple government agencies to enhance the security of the domestic nuclear fuel supply. “Many federal agencies work on nuclear energy development and deployment, including: the Departments of Energy (DOE), State, and Commerce; the National Nuclear Security Administration (NNSA); Nuclear Regulatory Commission; and White House offices and National Security Council,” she noted.

While the “DOE is acting quickly to implement the Russian uranium ban and establish sufficient LEU stockpiles for the transition to a Western-controlled supply chain,” the rigid statutory deadlines in place to end reliance on Russian fuel “limit schedule flexibility for implementing federal programs” Price wrote. Early collaboration with the NNSA, the State Department, and other agencies could help inform a strategy that “views domestic fuel availability as part of a broader fuel ecosystem among allies, and bolster DOE’s capacity to respond quickly to fuel infrastructure demands,” she added.

Much More Work Remains to Expand the Nuclear Fuel Supply Chain

The DOE acknowledges this to some extent. In its March 2023–released Pathways to Commercial Liftoff: Advanced Nuclear report, the agency posited that U.S. domestic nuclear capacity can scale from about 100 GW in 2023 to 300 GW by 2050. Supporting 200 GW of new nuclear by 2050, however, would require a massive build-out of the fuel supply chain capacity on a scale of between 200% to 300%, it notes.

For example, to support an additional 200 GW, the U.S. would need to expand its mining and milling operations by a further 50,000 million tons (MT) per year—growing 22 times its peak, the report says. U.S. conversion needs would meanwhile require an additional 65,000 MT—on the scale of four additional operating facilities if sized like Converdyn Metropolis Works, the nation’s sole conversion facility (which has the capacity to produce 15,000 MT per year of uranium in the form of UF6).

At the same time, it would need to increase its enrichment capability by an estimated 30 million SWU per year (six times higher than current capacity) “or about 40 million SWU per year to be energy independent,” the report says. Finally, the existing U.S. nuclear fuel-fabrication capacity is about 4,200 MT per year across Westinghouse, Framatome, and Global Nuclear Fuel-Americas. “This capacity serves to provide fuel to the existing U.S. fleet while also providing fuel for international nuclear power plants. It is projected that an additional ~5,000 MT annual capacity of fuel fabrication would be required to support an additional 200 GW of new nuclear capacity on the grid.”

The report suggests a range of potential solutions. To bridge LEU enrichment capacity gaps, it suggests public sector incentives, including off-take agreements, financial assistance, or low-cost loans to existing and new entrants into the market. “In the long-term, as demand is projected to grow, there may not be a need for any government intervention, as the short-term investment may clear the hurdle rate for return on invested capital,” it says.

That approach could also be valuable to jumpstart HALEU supply aligned with projected HALEU demand, the report suggests. To build out adequate fuel fabrication capacity, it indicates that “government and industry should follow deployment timelines and determine when it makes financial sense to either expand capacity or construct new fuel-fabrication facilities.” Meanwhile, loans could also be valuable to support the expansion of existing fuel-fabrication facilities or to bring new fuel facilities online. However, the industry could have a larger role to play if it stimulates market demand by signing agreements with fuel manufacturers, it says.

—Sonal Patel is a POWER senior editor (@sonalcpatel, @POWERmagazine).

Yahoo Finance

Yahoo Finance