U.S. Steel's (X) Earnings & Revenues Beat Estimates in Q4

United States Steel Corporation X slipped to net loss of $680 million or $4.00 per share in fourth-quarter 2019 from net earnings of $592 million or $3.34 per share in the year-ago quarter.

Barring one-time items, adjusted loss per share came in at 64 cents against adjusted earnings per share of $1.82 in the prior-year quarter. The figure was narrower than the Zacks Consensus Estimate of a loss of $1.14.

Revenues fell 23.5% year over year to $2,824 million in the fourth quarter. Nevertheless, the top line beat the Zacks Consensus Estimate of $2,711.7 million.

2019 Results

In 2019, the company logged a net loss of $642 million or $3.75 per share against net earnings of $1,115 million or $6.25 recorded in 2018.

Net sales in 2019 fell 8.8% year over year to $12,937 million.

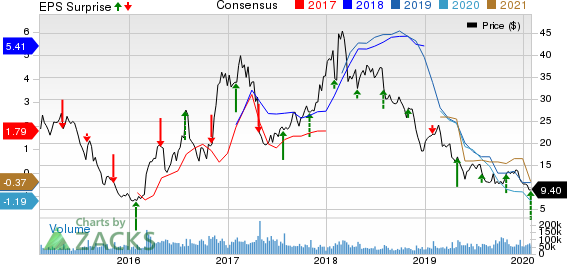

United States Steel Corporation Price, Consensus and EPS Surprise

United States Steel Corporation price-consensus-eps-surprise-chart | United States Steel Corporation Quote

Segment Highlights

Flat-Rolled: The Flat-Rolled segment incurred a net loss of $79 million in the fourth quarter against net earnings of $328 million in the year-ago quarter.

Steel shipments in the segment fell 7.9% year over year to 2,517,000 tons and average realized price per ton in the unit was $699, down 15.1% year over year.

U.S. Steel Europe: The segment posted a net loss of $30 million against net profit of $62 million in the year-ago quarter. Shipments in the segment dropped 29.5% year over year to 757,000 tons and average realized price per ton for the unit was $622, down 9.3% year over year.

Tubular: U.S. Steel’s Tubular segment’s losses widened year over year to a loss of $46 million in fourth-quarter 2019 from a loss of $3 million in fourth-quarter 2018.

Steel shipments declined 10.6% year over year to 193,000 tons. Average realized price per ton for the unit was $1,298, down 12.8% year over year.

Financials

U.S. Steel ended 2019 with cash and cash equivalents of $749 million, down 25.1% year over year. Long-term debt rose 56.6% year over year to $3,627 million.

Total cash from operating activities fell 27.3% year over year to $682 million in 2019.

Outlook

U.S. Steel expects first-quarter 2020 to witness slowdown due to lower first-quarter shipments in the Flat-rolled division as the company intends to prepare for the blast furnace outage at Gary Works in April 2020. Normal seasonality of the company’s mining operations is also expected to impact first-quarter results.

The company stated that it has achieved $75 million of run-rate fixed cost reductions. U.S. Steel also demonstrated flexibility by adjusting its 2020 capital spending to prioritize strategic investments. The company de-risked strategy execution by raising $1.1 billion of incremental capital.

Price Performance

Shares of U.S. Steel have plunged 58.3% in the past a year compared with the industry’s 22.8% decline.

Zacks Rank & Key Picks

U.S. Steel currently carries a Zacks Rank #5 (Strong Sell).

Few better-ranked stocks in the basic materials space are Daqo New Energy Corp DQ, Royal Gold, Inc RGLD and Sibanye Gold Limited SBGL, each currently sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Daqo New Energy has projected earnings growth rate of 326.3% for 2020. The company’s shares have rallied 30.5% in the past year.

Royal Gold has an estimated earnings growth rate of 83.5% for fiscal 2020. Its shares have returned 30.3% in the past year.

Sibanye Gold has an expected earnings growth rate of 587.5% for 2020. The company’s shares have surged 208.1% in the past year.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2019, while the S&P 500 gained and impressive +53.6%, five of our strategies returned +65.8%, +97.1%, +118.0%, +175.7% and even +186.7%.

This outperformance has not just been a recent phenomenon. From 2000 – 2019, while the S&P averaged +6.0% per year, our top strategies averaged up to +54.7% per year.

See their latest picks free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

DAQO New Energy Corp. (DQ) : Free Stock Analysis Report

Royal Gold, Inc. (RGLD) : Free Stock Analysis Report

Sibanye Gold Limited (SBGL) : Free Stock Analysis Report

United States Steel Corporation (X) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance