The jobs market has ‘no obvious relief on the horizon’

By Lucia Mutikani

WASHINGTON (Reuters) - The number of Americans filing new claims for unemployment benefits fell more than expected last week, but remained very high as the labor market recovery shows signs of strain amid a relentless COVID-19 pandemic and ebbing fiscal stimulus.

The weekly unemployment claims report from the Labor Department on Thursday, the most timely data on the economy's health, also showed more people exhausting their six-month eligibility for state unemployment benefits.

"There are still millions and millions on the nation's unemployment rolls because many of the jobs lost during the steepest downturn in economic history have not yet returned," said Chris Rupkey, chief economist at MUFG in New York.

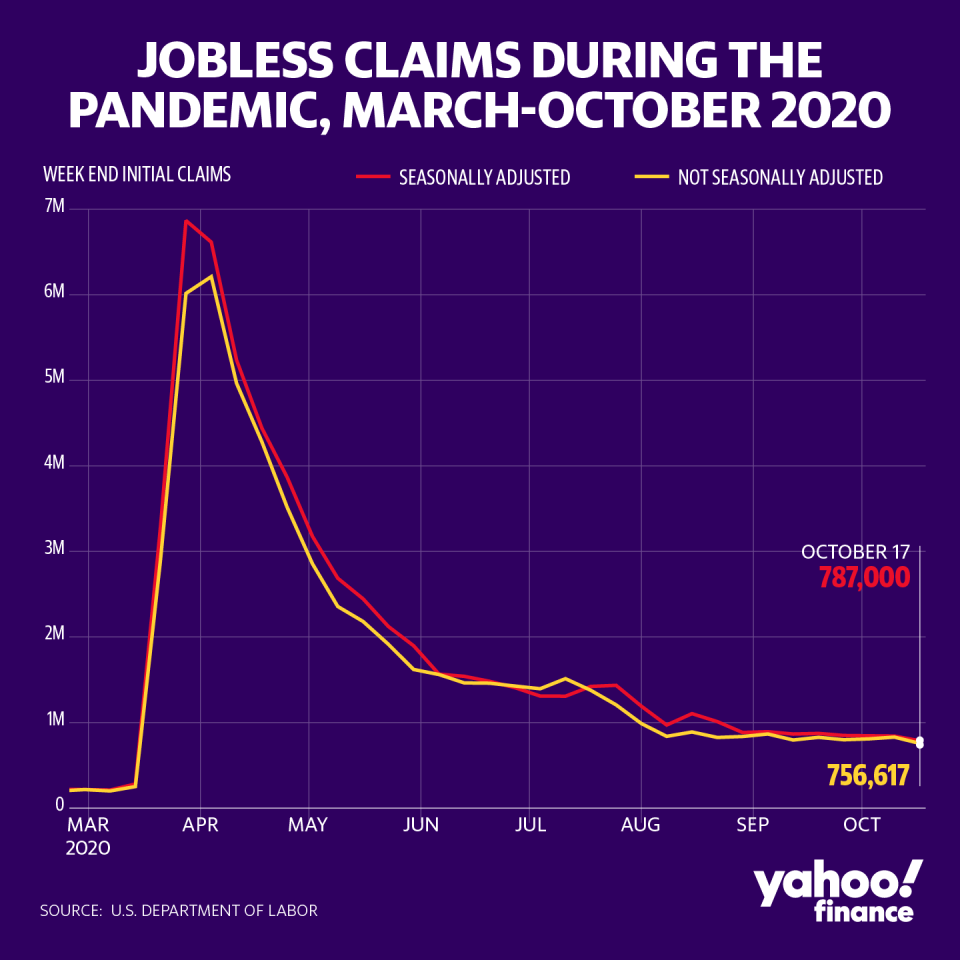

Initial claims for state unemployment benefits dropped 55,000 to a seasonally adjusted 787,000 for the week ended Oct. Data for the prior week was revised to show 56,000 fewer applications received than previously reported.

Economists polled by Reuters had forecast 860,000 claims in the latest week. California, the most populous state in the nation, has resumed the processing of new applications after a two-week pause in late September to combat fraud.

Unadjusted claims fell 73,125 to 756,617 last week. Economists prefer the unadjusted number given earlier difficulties adjusting the claims data for seasonal fluctuations because of the economic shock caused by the pandemic. Including a government-funded program for the self-employed, gig workers and others who do not qualify for the regular state unemployment programs, 1.1 million people filed claims last week.

Claims have been stuck above their 665,000 peak during the 2007-09 Great Recession, though they have declined from a record 6.867 million in March. A more than $3 trillion rescue package early this year provided a lifeline for many businesses, allowing them to keep workers on payrolls. It also lifted economic activity from the downturn, which started in February.

With funding depleted, businesses, especially in the transportation industry, are either laying off or furloughing workers as demand remains subdued.

Economists expect claims will remain high amid a resurgence in new coronavirus cases around the country, which they say could lead to state and local government restrictions or more people shunning establishments like restaurants and bars.

Though Democratic House of Representatives Speaker Nancy Pelosi and Treasury Secretary Steven Mnuchin are working out details of a new relief package, a deal is unlikely before the Nov. 3 presidential election amid stiff opposition in the Republican-controlled Senate.

The pandemic, which has killed more than 221,000 Americans and caused the worst economic crisis in at least 73 years, could cost Republican President Donald Trump a second four-year term in the White House. Trump is trailing former Vice President and Democratic Party candidate Joe Biden in national opinion polls.

U.S stocks index futures extended losses after the claims data. The dollar was trading higher versus a basket of currencies. U.S. Treasury prices rose.

"With falling temperatures and the holidays a few weeks aways, there is no obvious relief on the horizon"

Last week's claims report covered the period during which the government surveyed businesses for the nonfarm payrolls component of October's employment report. Payrolls increased by 661,000 jobs in September, the smallest gain since the jobs recovery started in May.

"Further progress isn't assured especially now that virus cases are rising, which will result in restrictions of activity and business closures," said Rubeela Farooqi, chief U.S. economist at High Frequency Economics in White Plains, New York. "The labor market remains under stress with risk of permanent damage from an uncontrolled virus."

The claims report also showed a decline in the number of people on unemployment rolls in early October, but that was likely because many people had exhausted their eligibility for benefits, which are limited to six months in most states.

"The labor market is far from being out of the woods," Indeed economist AnnElizabeth Konkel wrote in a note, also pointing to the exhausting of benefits as why claims dropped. "With falling temperatures and the holidays a few weeks aways, there is no obvious relief on the horizon."

Comerica CIO John Lynch told Yahoo Finance's The First Trade that the exhausting of benefits supports his concerns over corporate earnings next year.

The number of people receiving benefits after an initial week of aid declined 1.024 million to 8.373 million in the week ending Oct. 10, the lowest since the pandemic started in the United States seven months ago.

At least 3.296 million workers filed for extended unemployment benefits in the week ending Oct. 3, up 509,823 from the prior week. A staggering 23.2 million people were on unemployment benefits at the beginning of October.

A report from the Federal Reserve on Wednesday showed employment increasing in almost all of its 12 districts in early October, though the U.S. central bank noted that "growth remained slow." The Fed said "employment gains were reported most consistently for manufacturing firms, although firms continued to report new furloughs and layoffs." It described the economy as growing at a "slight to modest" pace.

That is consistent with economists' projections for slower growth in the fourth quarter after what is believed to have been a record performance in the third quarter.

July-September quarter GDP growth estimates are as high as a 35.3% annualized rate.

The economy contracted at a 31.4% pace in the second quarter, the deepest decline since the government started keeping records in 1947. Growth estimates for the fourth quarter have been cut to as low as a 2.5% rate from above a 10% pace.

The government is scheduled to publish its snapshot of third quarter gross domestic product on Thursday.

(Reporting By Lucia Mutikani; Editing by Andrea Ricci and Jonathan Oatis)

This article was lightly edited by Yahoo Finance to include expert quotes.

Yahoo Finance

Yahoo Finance