Uber 1, Amazon.com 0

Apparently, when Amazon.com (NASDAQ: AMZN) throws in the towel, it takes the form of a kitchen towel. The world's leading online retailer announced this week that it's shutting down Amazon Restaurants, the fledgling eatery delivery service that competes with Grubhub (NYSE: GRUB), DoorDash, Postmates, Uber Technologies' (NYSE: UBER) Uber Eats, and countless other upstart platforms. The restaurant service will be discontinued on June 24.

The end of Amazon Restaurants isn't a surprise. Amazon seemed to be an early leader in this niche when it rolled the service out on its home turf of Seattle in 2015, and it quickly expanded to nearly two dozen major U.S. cities and London -- but it never gained traction. Even now, when it's been promoting free restaurant meal deliveries since May, it's failed to gain the mindshare necessary to attract diners and, more importantly, drivers to its platform.

Amazon has done a lot of things right, but as with the Fire Phone, Amazon Local, and Askville, most Amazon fans won't even notice if it bows out from this secondary business.

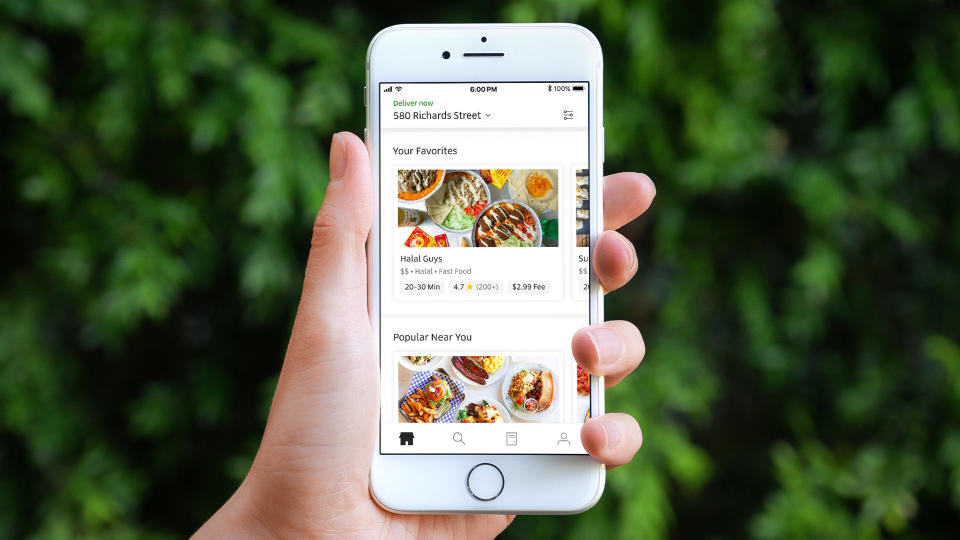

Image source: Apple.

One less mouth to feed

Shares of Grubhub soared 8% on Tuesday, the day Amazon revealed that it's shutting down Amazon Restaurants along with its smaller Daily Dish workplace lunch delivery service. Uber stock barely budged on the news, largely because the lion's share of its revenue continues to come from the personal mobility side of its business.

Uber isn't the pure play on meal delivery that Grubhub is, alongside privately held DoorDash and Postmastes, but it's still a needle-mover for Uber. In fact, Uber Eats is growing faster than its flagship ridesharing platform, and it also scratches a few important itches for the recent IPO.

For customers, Uber Eats is a way to keep regulars close. As it pointed out in its prospectus last month, folks who use both Uber and Uber Eats wind up scheduling 11.5 trips a month. The average number of trips riders take using the personal mobility platform comes in at just 4.5.

Uber Eats also helps expand the number of drivers on its platform. Uber Eats vehicles don't have to meet the same passenger quality standards as those for the personal mobility offering do. There are also people who would rather drive around warm meals instead of potentially chatty passengers.

Amazon Restaurants isn't afraid to throw money at a business, but it never seemed to put up the same kind of effort as the rivals it will leave behind when it bows out later this month. Uber Eats works because the service is aggressive with its promotions. It also helps that Uber already has millions of drivers worldwide making a living or supplementing other job incomes through the platform.

Uber's massive audience and driver base made it easy to build out Uber Eats. Amazon has always had the audience, but sometimes that's just half the battle.

More From The Motley Fool

John Mackey, CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool's board of directors. Rick Munarriz has no position in any of the stocks mentioned. The Motley Fool owns shares of and recommends Amazon. The Motley Fool recommends Grubhub and Uber Technologies. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance