Uber use has declined for the first time among business travelers

For the past few years, traditional ground transportation has been disrupted by Uber. But now Uber is beginning to be disrupted by its fiercest competitor, Lyft.

For the first time, Uber use among business travelers dipped, according to Certify, which processes about 10 million expense reports for business travelers each quarter. In the third quarter of 2017, Uber made up 55% of business travel expenses, slipping a percentage point from the previous quarter.

Uber still dominates the category and has trounced the traditional players like taxis (7%) and car rentals (28%). But Lyft is growing quickly. Just last quarter, the smaller No. 2 ride-sharing company had 3% of the business expense market, according to Certify. This quarter, its share has ballooned to 11%.

“That’s just a significant jump for any vendor,” Certify CEO Robert Neveu told Yahoo Finance. “It stood out as an eyebrow raiser.”

The explanation as to why Lyft is surging and Uber is dipping isn’t necessarily tied to Uber’s scandal-ridden year that included sexual harassment allegations, misleading regulators, and more. In fact, data shows that rider behavior may not be significantly affected by scandal.

While smaller companies often allow employees to simply use their judgment to determine which vendor to use, larger companies have deals with certain “preferred vendors,” he said. Whereas previously Lyft may have not been on that list, they may now be.

“I think Lyft is now being added to many corporate travel policies allowing employees to use Lyft,” said Neveu. “We did see [an] increase six quarters ago with Uber as they got included on corporate ground transportation providers.”

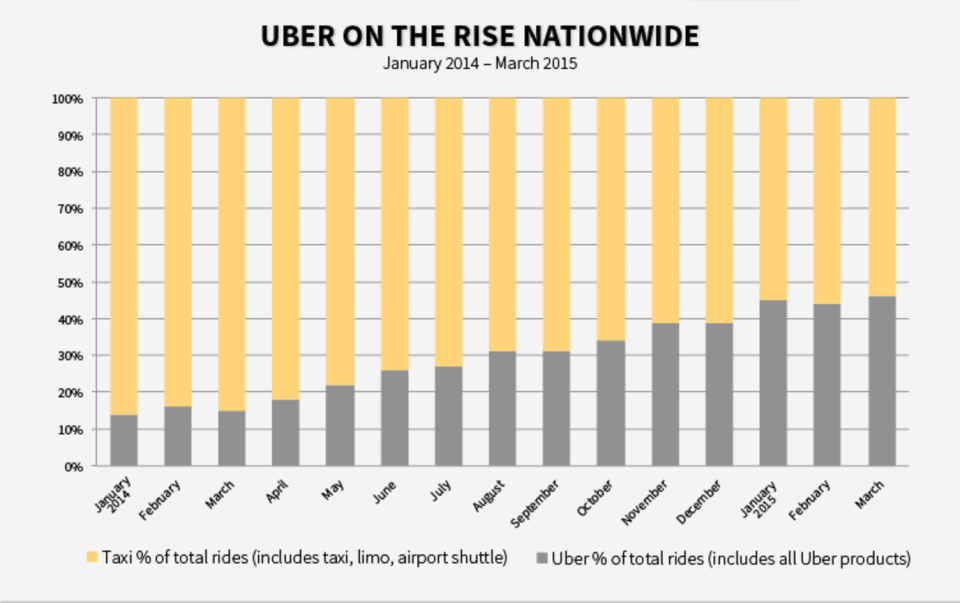

Certify has been putting out these reports since 2013, and began including Uber in 2015. Back in January 2014, Uber had just under 15% of the business travel market and by March 2015 it grew to 45%.

As Lyft is now more likely to be an approved-taxi company alongside Uber, individuals who might favor Lyft over Uber can then make that choice. So instead of reading this change as Uber losing users, it’s more accurate to see this shift as Lyft beginning to get the attention it enjoys from the general public from the business community. These numbers are, Neveu reminds, a special segment of data.

“We only have business traveler data. No consumer, no leisure travel,” he said. “Just expense reports.”

Ethan Wolff-Mann is a writer at Yahoo Finance. Follow him on Twitter @ewolffmann. Confidential tip line: emann[at]oath[.com].

Read More:

Former ambassador: Mexico has ‘moved on’ from NAFTA

Vanguard, genocide, and a $18 million campaign to get you to vote

Venmo is one step further to becoming a full-service digital wallet

ATM fees have shot up 55% in the past decade

Big bitcoin-friendly companies like Microsoft and Expedia hedge their bet

The real reason Mexico will never pay for the Trump’s wall: It’d be ‘treason’

How Waffle House’s hurricane response team prepares for disaster

Trump weighs slashing one of the most popular tax deductions

Yahoo Finance

Yahoo Finance