UBS profit falls 11% as it braces for jump in losses

Profit at Swiss banking giant UBS (UBSG.SW) fell in the second quarter of 2020, pushed lower by provisions to deal with an expected surge in credit losses.

UBS said in a statement on Tuesday that pre-tax profit was $1.2bn (£930m) in the second quarter, down 10% on last year. Net profit fell 11%. Income across the bank fell 1.7% to $7.4bn.

The bank saw strong profit growth at its investment bank and asset management business but was dragged down by its consumer and corporate banking arm, which braced for a surge in bad loans due to the COVID-19 pandemic.

The bank set aside $272m in the quarter to cover bad lending, including $127m reflecting updated global economic forecasts. It means UBS has now set aside over half a billion dollars to cover expected losses over the last six months.

Without the credit loss provisions in the second quarter, pre-tax profit would have risen by 5%.

UBS said credit provisions were likely to continue to grow in the second half of the year due to “continued uncertainty related to the pandemic.”

“As we continue to face a challenging environment, we are adapting and accelerating the pace of change, supporting our clients, employees, and the economies in which we operate, while remaining focused on our strategic priorities,” chief executive Sergio P Ermotti said in a statement.

Across the first half of 2020 as a whole, net profit rose 12% to $2.8bn and income rose 4% to $15.3bn.

“The strength, resilience, and diversification of our integrated business model have once again been confirmed by the strong second quarter results and the excellent first half,” Ermotti said.

The bank said it was “reviewing the mix between cash dividends and share repurchases”. UBS said it intends to maintain cash payouts at last year’s levels and could resume share buybacks in the fourth quarter of 2020 but said it was “premature to provide guidance.”

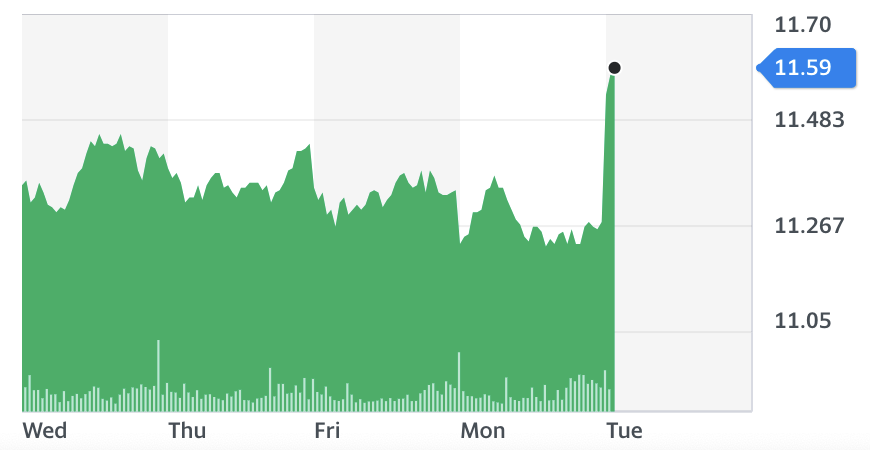

Shares rose nearly 3% in Zurich in early trading:

Banking analyst Amit Goel and team at Barclays said the results contained “a mixture of positives and negatives,” pointing to good news on shareholder cash returns but weaker-than-expected profits.

Yahoo Finance

Yahoo Finance