UBS could axe jobs as it overhauls wealth arm

The doom and gloom in the European banking sector looks set to continue in 2020, with UBS (UBSG.SW) reportedly planning to cut jobs as part of a restructure.

UBS said in a recent memo to staff it is restructuring its wealth management division. Bloomberg, which first reported the restructure, said the move could see as many as 500 jobs go globally.

UBS declined to comment. The memo, seen by Yahoo Finance UK, did not mention any job cuts but did talk about streamlining processes.

While the potential cuts would be a small proportion of UBS wealth management’s overall staff, any redundancies would extend the string of cutbacks at major banks. Over 75,000 jobs were axed from investment banking globally last year and over 80% of those cuts fell in Europe.

UBS executives said the changes at the wealth management division were meant to take it “to the next level,” according to the memo.

UBS’s co-heads of global wealth management, Iqbal Khan and Tom Naratil, wrote: “We firmly believe that we have some of the very best talent in the industry so let's play big, elevate our business and our clients, and realise our full potential.”

The overhaul comes amid pressure on UBS to improve performance. Third quarter profit fell 16% in 2019 and the bank said it would spend $100m (£75.9m) in the fourth quarter restructuring. The bank said it would balance “investments for growth while managing for efficiency.”

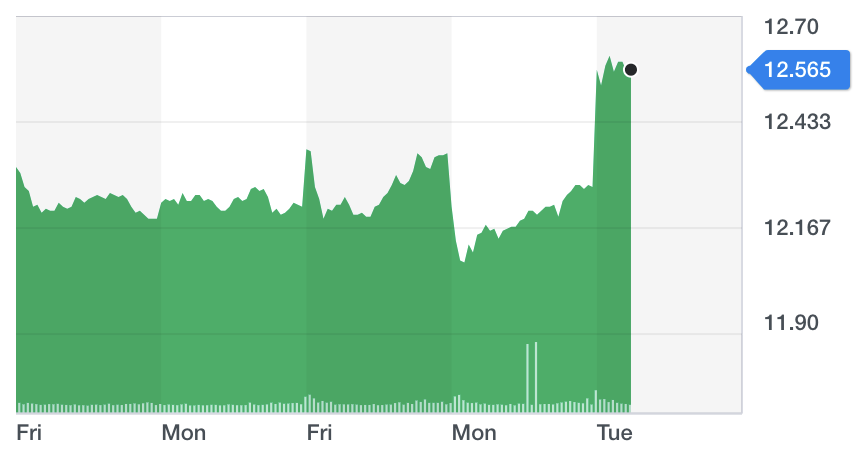

Shares in UBS were up 2.3% in Zurich in early trade on Tuesday.

The restructure flagged by Khan and Naratil will see the Europe, the Middle East, and Africa (EMEA) division split into three. Wealth management will also work more closely with other divisions of the bank and UBS will focus more on lending to wealthy clients.

The changes come after the arrival of Khan three months ago. The high profile executive was poached from Credit Suisse — a hire that sparked a spying scandal in Swiss bankings — and has been tasked with re-invigorating UBS’s wealth management division.

READ MORE: Credit Suisse exec quits over spying scandal

UBS has the biggest wealth management division in the world, with over $2.5tn of assets invested, but momentum at the division has slowed in recent years. Shares in the bank lagged European rivals last year partly as a result.

Analysts at Deutsche Bank said Tuesday they see “catch-up potential” under Khan, who they see “applying and executing the Credit Suisse playbook.”

The bank will deliver a strategy update alongside fourth quarter results on 21 January.

Yahoo Finance

Yahoo Finance