UDR Q4 FFOA Meets Estimates, Revenues Up Y/Y, Dividend Hiked

UDR Inc. UDR reported fourth-quarter 2022 funds from operations as adjusted (FFOA) per share of 61 cents, in line with the Zacks Consensus Estimate. The figure increased 12.9% from the prior-year quarter’s 54 cents.

Quarterly results reflect a year-over-year rise in revenues driven by healthy operating trends and past accretive external growth investments. However, higher same-store expenses were a headwind. The company increased its annualized dividend payment.

Revenues from rental income climbed 14.8% year over year to $398.4 million. However, the top line missed the Zacks Consensus Estimate of $399.8 million.

For 2023, the company anticipates current resident collections to lie in the range of 98.3-98.7%, an improvement of 10 basis points (bps) at the midpoint compared with its 2022 results.

Per Tom Toomey, UDR’s chairman and CEO, “2022 was an exceptional year, with our 16 percent FFOA per share growth driven by robust operating fundamentals, our commitment to ongoing innovation, our award-winning ESG platform, and our value-accretive capital allocation decisions. With these results, our Board approved a 10.5 percent dividend increase, enhancing our already strong total return profile.”

In 2022, FFOA was $2.33 per share, in line with the Zacks Consensus Estimate. The figure increased 15.9% from the prior year’s $2.01 per share. Full-year revenues from rental income jumped 17.7% to $1.51 billion. The top line missed the Zacks Consensus Estimate of $1.52 billion.

Inside the Headlines

In the reported quarter, same-store revenues (with concessions reported on a cash basis) increased 10.1% year over year. Same-store expenses were up 6.8%. Consequently, the same-store net operating income (NOI), with concessions reported on a cash basis, improved 11.5%.

The residential REIT’s weighted average same-store physical occupancy decreased 20 bps year over year to 96.8%.

Portfolio Activity

In the fourth quarter, UDR completed the construction of 5421 at Dublin Station, a 220-home community in Dublin, CA, for $125 million and Vitruvian West Phase 3, a 405-home community adjacent to existing UDR communities in the Addison submarket of Dallas, TX, for $74 million.

UDR’s development pipeline totaled $332.5 million at the end of the reported quarter and was 57.2% funded. The active pipeline includes three communities for 715 homes.

At the end of the quarter, the company’s redevelopment pipeline of 1,623 homes aggregated $82 million and was 29.5% funded. This includes densification projects featuring the addition of 30 new apartment homes in one community.

The company’s Developer Capital Program investment aggregated $479.7 million with a weighted average return rate of 9.7% and a weighted average estimated remaining term of 3.7 years at the end of fourth-quarter 2022.

Balance Sheet Activity

As of Dec 31, 2022, UDR had $1 billion of liquidity.

The total debt was $5.5 billion as of the same date, with no remaining consolidated maturities until 2024. In addition, net debt-to-EBITDAre declined to 5.6X in the fourth quarter from the year-ago quarter’s 6.4X.

During the reported quarter, UDR settled all remaining common shares (around 3.2 million) under its previously announced forward equity sales agreements at a weighted average net share price, after adjustments, of $57.03 for $179.6 million.

It also repurchased 507,000 shares of its common stock at a weighted average price per share of $40.70 for nearly $20.6 million.

UDR ended the fourth quarter with a weighted average interest rate of 3.17% and weighted average years to maturity of 6.7 years.

Dividend Update

Concurrent with the earnings release, UDR’s board of directors announced a 2023 annualized dividend per share of $1.68, marking a year-over-year increase of 10.5%.

2023 Guidance

The company provided first-quarter and full-year 2023 guidance.

It expects first-quarter 2023 FFOA per share in the range of 59-61 cents. The Zacks Consensus Estimate for the same is pegged at 62 cents currently.

For 2023, FFOA per share is expected to be in the range of $2.45-$2.53. The Zacks Consensus Estimate for the same is presently pegged at 2.52 cents, which lies within the guided range.

For the full year, the company projects 5.5-7.5% year-over-year growth in same-store cash revenues while same-store NOI growth is estimated to be 6-8.5%.

Currently, UDR carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

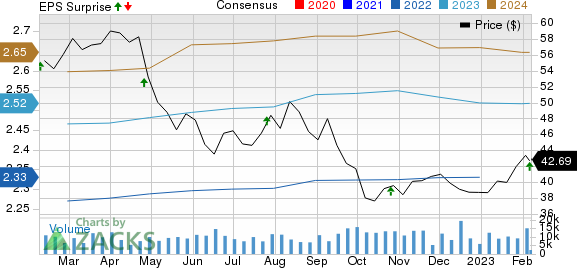

United Dominion Realty Trust, Inc. Price, Consensus and EPS Surprise

United Dominion Realty Trust, Inc. price-consensus-eps-surprise-chart | United Dominion Realty Trust, Inc. Quote

Performance of Other REITs

Mid-America Apartment Communities, Inc. MAA, commonly referred to as MAA, reported fourth-quarter 2022 core FFO per share of $2.32, surpassing the Zacks Consensus Estimate of $2.28. The reported number improved by 22.1% year over year.

This residential REIT’s quarterly results were driven by an increase in the average effective rent per unit for the same-store portfolio. MAA also issued its outlook for 2023.

Alexandria Real Estate Equities, Inc. ARE reported fourth-quarter 2022 AFFO per share of $2.14, surpassing the Zacks Consensus Estimate by a cent. The reported figure also compared favorably with the year-ago quarter’s $1.97.

ARE’s results reflected decent leasing activity and rental rate growth during the quarter.

Boston Properties Inc.’s BXP fourth-quarter 2022 FFO per share of $1.86 outpaced the Zacks Consensus Estimate of $1.84. The figure increased 18.7% year over year.

The quarterly figure also exceeded the mid-point of the company’s fourth-quarter guidance by a cent, reflecting portfolio outperformance. In addition, BXP experienced solid leasing activity in the quarter. The company revised its 2023 outlook for FFO per share.

Note: Anything related to earnings presented in this write-up represents FFO — a widely used metric to gauge the performance of REITs.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Boston Properties, Inc. (BXP) : Free Stock Analysis Report

United Dominion Realty Trust, Inc. (UDR) : Free Stock Analysis Report

Mid-America Apartment Communities, Inc. (MAA) : Free Stock Analysis Report

Alexandria Real Estate Equities, Inc. (ARE) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance