UFP Industries (UFPI) Q1 Earnings Top, Sales Miss, Down Y/Y

UFP Industries, Inc. UFPI reported mixed results for the first quarter of 2024. Earnings beat the Zacks Consensus Estimate but net sales missed the same. The top and bottom lines declined on a year-over-year basis. Lower pricing and organic unit sales hurt the company’s quarterly results.

Following the results, the company’s shares lost 2.7% during the trading session on Apr 30, 2024.

Earnings & Revenue Discussion

UFP Industries’ quarterly earnings came in at $1.96 per share, which surpassed the consensus mark of $1.62 by 21% but declined 1% from the year-ago quarter’s level of $1.98.

Net sales of $1.64 billion, however, lagged the consensus mark of $1.68 billion by 2.7% and declined 10% year over year. The downside was mainly due to a 9% fall in selling prices and a 1% decline in organic unit sales.

New product sales were $124 million. Contribution from new product sales rose to 7.6% from 7.4% in the prior-year quarter.

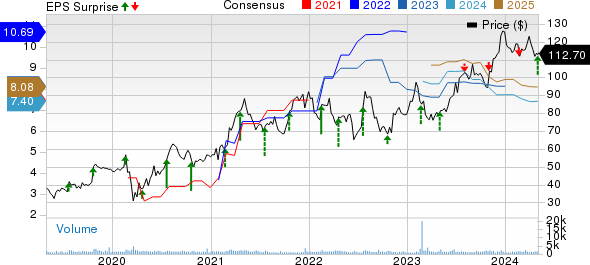

UFP Industries, Inc. Price, Consensus and EPS Surprise

UFP Industries, Inc. price-consensus-eps-surprise-chart | UFP Industries, Inc. Quote

Segment Discussion

UFP Retail Solutions: The segment reported net sales of $628.8 million for the quarter (below our projection of $699.4 million), which declined 17% year over year due to a 6% decline in selling prices and 8% lower organic unit sales. Also, a 3% reduction due to the transfer of certain sales to other segments added to the decline.

Adjusted EBITDA margin rose 240 basis points (bps) from the prior year to 8.8%.

UFP Packaging: The Packaging segment’s net sales totaled $424.4 million, down 13% from the year-ago period’s levels (below our expectation of $436.9 million). In the first quarter, selling prices declined 11% and organic unit sales were down 6% year over year. This was partially balanced by a 4% increase resulting from the transfer of certain sales from the retail segment.

Adjusted EBITDA margin fell 330 bps from the prior year to 10.4%.

UFP Construction: Net sales in the segment were $517.9 million, which remained at par with the year-ago level. Our model predicted net sales in the segment to be $474.6 million. This segment registered a 10% decrease in selling prices being counteracted by an 8% increase in organic unit sales and a 2% increase due to the transfer of certain sales from the retail segment.

Adjusted EBITDA margin contracted 160 bps from the prior year to 10.4%.

Operating Highlights

During the first quarter, selling, general and administrative expenses — accounting for 11.7% of net sales — increased 100 bps year over year.

Adjusted EBITDA of $180.8 million declined 10.5% year over year. Adjusted EBITDA margin also contracted 10 bps from the prior year to 11%.

Balance Sheet & Cash Flow

The company ended first-quarter 2024 with more than $2.2 billion in liquidity. Cash and cash equivalents were $979.7 million at the first-quarter end compared with $1.1 billion at the end of 2023. At the first-quarter end, net cash used in operating activities was $16.8 million compared with $37.1 million cash used in the corresponding year-ago period.

During 2023, capital expenditures totaled $49.1 million. In 2024, the company aims to allocate capital investments totaling up to $300 million. Around $100 million is earmarked for enhancing automation and implementing technological upgrades, while an additional $100 million will be allocated for constructing new facilities and augmenting capacity at current sites.

In the quarter, UFPI purchased approximately 319,000 shares at an average price of $114.74 under the share repurchase plan. On Jul 26, 2023, its board of directors authorized up to $200 million for share repurchases through Jul 31, 2024. Again, in April, the company repurchased 352,000 shares at an average share price of $114.15. Of this authorization, $97 million remained at April-end.

Outlook

For Lumber Market, UFP Industries maintains its expectation that lumber prices will persist at lower, historically typical levels throughout 2024, driven by existing supply and demand dynamics.

In regard to end-market demand, UFP Industries has adjusted its previous outlook based on recent macroeconomic data and revised expectations regarding potential cuts in federal interest rates in the latter part of 2024. Forecasts suggest a decline in demand for packaging and retail segments by mid-single digits, while demand for the construction segment is projected to fluctuate slightly, either increasing marginally or experiencing a slight decrease compared to 2023. The company foresees a continuation of subdued demand and competitive pricing conditions throughout most of 2024, with improvements expected in the latter half due to more favorable year-over-year comparisons.

Zacks Rank & Recent Construction Releases

UFPI currently carries a Zacks Rank #3 (Hold).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Owens Corning OC reported impressive results in first-quarter 2024, with earnings and net sales surpassing the Zacks Consensus Estimate. Earnings increased on a year-over-year basis despite a net sales decline. Sales declined due to lower sales volumes in the Insulation and Composites segments.

For the second quarter of 2024, Owens Corning expects net sales to be in line with the second quarter of 2023 while generating approximately 20% EBIT margins.

Masco Corporation MAS reported mixed results for first-quarter 2024, wherein earnings surpassed the Zacks Consensus Estimate, but net sales lagged the same. On a year-over-year basis earnings increased despite net sales decline.

Strong operational efficiency helped Masco deliver solid earnings. Masco’s focus on a balanced capital deployment strategy helped it return $212 million to shareholders via dividends and share repurchases.

Watsco, Inc. WSO reported tepid first-quarter 2024 results, with earnings and revenues lagging the Zacks Consensus Estimate. On a year-over-year basis, the top line grew while the bottom line dwindled.

Watsco’s first-quarter results reflect a seasonal sales trend, wherein the sales of HVAC equipment and other HVAC products declined year over year. Furthermore, high costs and expenses impacted the bottom line of the company. This was partially offset by increased sales volume for commercial refrigeration products.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

UFP Industries, Inc. (UFPI) : Free Stock Analysis Report

Watsco, Inc. (WSO) : Free Stock Analysis Report

Masco Corporation (MAS) : Free Stock Analysis Report

Owens Corning Inc (OC) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance