UGI to Buy Stonehenge to Boost Base in Appalachian Basin

UGI Corporation’s UGI subsidiary UGI Energy Services, LLC inks a $190-milliondeal to acquire Stonehenge Appalachia, LLC from Stonehenge Energy Holdings, LLC, subject to customary regulatory and other closing conditions. The transaction is expected to be complete by Jan 31, 2022, and be immediately accretive to the utility’s adjusted earnings.

Located in Butler County, PA, the Stonehenge system includes more than 47 miles of pipeline and associated compression assets, and has a gathering capacity of 130 million cubic feet per day.

The deal is inline with UGI’s strategy of achieving earnings growth and rebalancing its business activities with increasing investments in natural gas and renewables. The expected acquisition of Stonehenge and the purchase of an ownership stake in the Pine Run gathering system expand presence in the Appalachian Basin.

Other Strategic Efforts

UGI’s acquisition of Columbia Midstream Group, LLC from TC Energy Corporation, now known as UGI Appalachia, has continuously recorded a strong performance. Midstream & Marketing reported a net income of $107 million for fiscal 2021, up 16.3% year over year. It further added 70,000 dekatherms (Dth) per day to its peaking capacity by initiating Bethlehem LNG plant’s service last December. UGI completed the purchase of Mountaineer for $540 million in September 2021.

UGI’s buyout of GHI Energy, LLC, a renewable natural gas company operating in California, is helping it expand its renewable product offerings and supporting its aim togrow in an environmentally-friendly way.

Moreover, in September 2021, its unit, Energy Services announced that it will partially fund a JV designed to develop several clusters of dairy farm digester projects to produce RNG from multiple farms in South Dakota.

Along with acquisitions, UGI disposed its 5.97% ownership interest in the Conemaugh coal-fired generating station in fiscal 2020 to reduce the total Scope I direct emissions by more than 30%. In May 2021, the utility announced plans to reduce Scope I GHG Emissions by 55% within 2025.

Peer Moves

Other gas distribution utilities, including Chesapeake Utilities Corporation CPK, Southwest Gas Holdings, Inc. SWX and MDU Resources Group, Inc. MDU are also expanding businesses on the back of their strategic capital investment plans.

Chesapeake Utilities’ propane subsidiary Sharp Energy acquired Diversified Energy Company’s propane operating assets in December 2021, thereby expanding its footprint in North and South Carolinas. The same is likely to be accretive to CPK's 2022 earnings, boosting gross margins by $11.3 million.

Chesapeake Utilities is also making strategic acquisitions to expand operations. CPK has invested $1.2 billion since 2015 to strengthen operations and anticipates investing in the range of $750 million to $1 billion in the 2021-2025 time frame.

Southwest Gas acquires Dominion Energy’s Questar Pipelines and certain associated affiliates for $1.545 billion in cash. SWX will also assume $430 million of Questar Pipelines' debt. This deal will be accretive to SWX’s 2022 earnings.

Southwest Gas invested $825.1 million in 2020 and is expected to have spent $650-$675 million during 2021 on the Natural Gas Operations segment. For the 2021-2023 period, it expects to make investments worth $2.1 billion. Of the planned capital budget, 45% will be used in increasing the safety and reliability of its existing operations while 36% will be allotted to new businesses and 19% to general plant.

MDU Resources’ unit Knife River Corporation completed the acquisition of two construction-related companies, concurrently in November, 2021. Those are Baker Rock Resources and Oregon Mainline Paving, which mark MDU’s expanding operations in the Pacific Northwest.

MDU spent $648 million in 2020 and $428.1 million in the first nine months of 2021. MDU has planned to invest $775 million in 2021. These investments will increase the reliability of its services and enable it to serve an increasing customer base, effectively.

Zacks Rank & Price Performance

UGI currently has a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

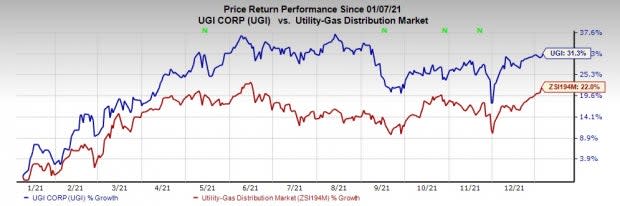

In the past year, shares of UGI have gained 31.3%, outperforming the industry’s 22% growth.

Image Source: Zacks Investment Research

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Southwest Gas Corporation (SWX) : Free Stock Analysis Report

Chesapeake Utilities Corporation (CPK) : Free Stock Analysis Report

UGI Corporation (UGI) : Free Stock Analysis Report

MDU Resources Group, Inc. (MDU) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance