The UK's biggest estate agent says Brexit negotiations are 'the biggest risk' to the housing market as growth slows

Shutterstock

LONDON — UK house price growth will slow sharply this year after decades of high growth, according to Countrywide, the UK's largest estate agency group.

It said growth would slow to 1.5% this year, down from 5% last year, citing Brexit negotiations as "the biggest risk" to the market's performance.

The report forecasted slowing growth in the north of England, the Midlands, and the south, particularly in London, where house prices have grown faster than any other region in the past two decades.

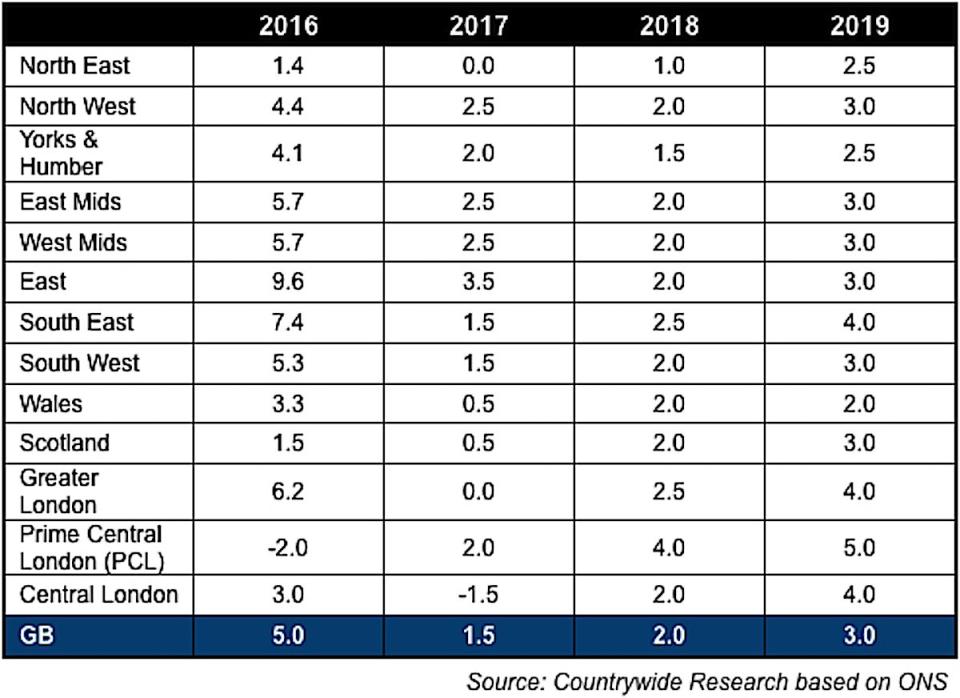

Countrywide Housing Forecasts – Annual house price growth (%)

Countrywide

The forecast forms part of a growing consensus that slow price growth has arrived in the UK. A survey released last week by the Royal Institute of Chartered Surveyors found the net balance of surveyors predicting price rises fell to +1% in July, down from +7% in June, suggesting price growth was near zero in the period.

Countrywide said confidence in the market will be volatile as Brexit negotiations continue, and be particularly vulnerable to poor employment figures. It said: "The outcome of these negotiations is the biggest risk to performance and is weighted to the downside."

The national market has been constrained by tightened mortgage lending as well as political uncertainty relating to Brexit, while price growth in expensive central London has been damaged by hikes to stamp duty last year.

Analysts say that the predicted return to bigger growth will be driven by a lack of tradeable housing stock, with builders consistently failing to deliver as many houses as there is demand for.

Fionnuala Earley, Countrywide’s Chief Economist, said (emphasis ours):

"Economic conditions for households will remain challenging over the next year as inflation eats into budgets and interest rates begin to rise. In addition, fewer landlord purchasers and the later age at which people buy, is affecting the level of demand. But we expect the UK economy to recover and wage growth to pick up in response to global growth. That, combined with a continued lack of housing supply, will help to support house prices.

"The housing market is sensitive to confidence which will be affected by the outcome of Brexit negotiations and the implications this will have – particularly on employment.”

NOW WATCH: Apple crushes earnings as focus shifts to the new iPhone

See Also:

Ad giant WPP: 'Our industry may be in danger of losing the plot'

The pound won't hit parity with the euro even if the Tory government collapses

SEE ALSO: Here are the factors slowing down the UK's 'stagnant' housing market

Yahoo Finance

Yahoo Finance