UK Becomes Safe Haven for Investors Spooked by France Chaos

(Bloomberg) -- As the UK prepares to head to the polls on Thursday, the country’s financial markets appear to be shedding their recent reputation for volatility.

Most Read from Bloomberg

Democrats Weigh Mid-July Vote to Formally Tap Biden as Nominee

Powerful Hurricane Beryl Aims at Jamaica After Grenada Strike

Trump Immunity Ruling Means Any Trial Before Election Unlikely

‘Upflation’ Is the New Retail Trend Driving Up Prices for US Consumers

Bonds Get Respite Amid Powell’s Disinflation Views: Markets Wrap

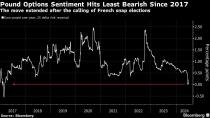

British stocks are near a record high, bond fluctuations have evaporated, and hedging against pound weakness is at a seven-year low. That marks a rethink by investors who imposed penalties on the country’s assets following the 2016 decision to leave the European Union and then Liz Truss’s disastrous premiership of 2022.

The backdrop also suggests comfort with the likelihood that the election will hand power to the opposition Labour Party, whose traditional support for higher taxes and trade unions has historically put it at odds with markets. Instead, the hope is Keir Starmer’s center-left platform will draw a line under a tumultuous period in British politics, especially at a time when volatility is growing in neighboring France and elsewhere.

“You could find the UK looking like an island of stability after 10 years of looking like the problem child in Europe,” said Shahab Jalinoos, global head of FX research at UBS Investment Bank in New York. “From the pound’s perspective, that’s a really good thing.”

Money managers at Franklin Templeton, Allianz Global Investors and RBC Wealth Management say they see UK assets as attractive compared to other places in Europe.

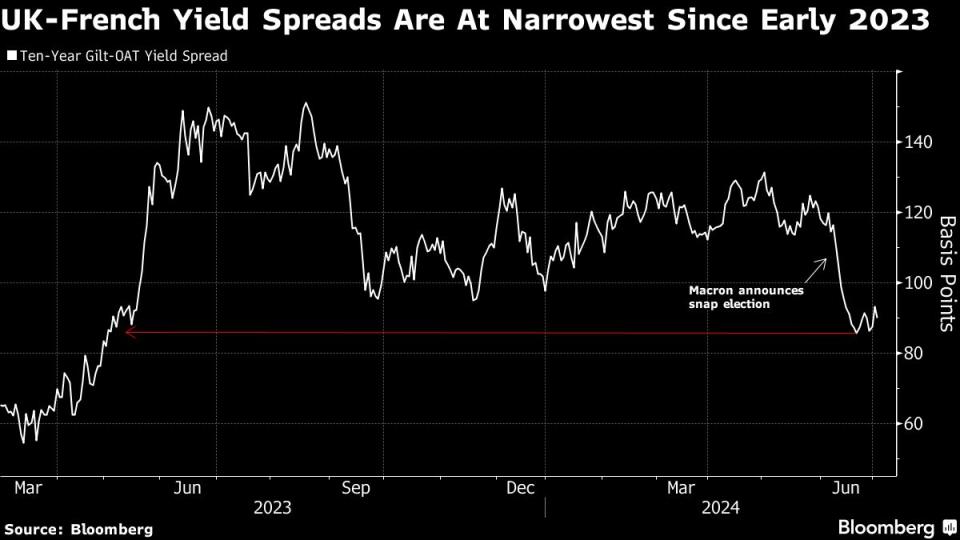

France is in the midst of a snap election in which the far right is projected to emerge as the largest party in its parliament, sending stocks to their lowest in five months and blowing out the risk premium on French bonds versus their German peers to the highest since 2012. That’s burnished the appeal of relative-value trades that benefit from the comparative calm of the UK.

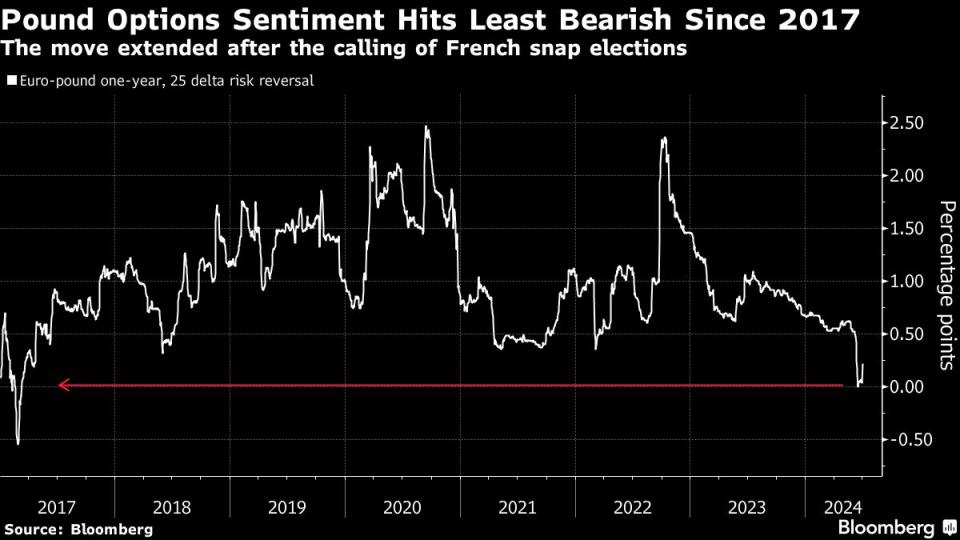

One popular expression is through the euro-pound exchange rate. The pound surged 0.5% to about 84 pence against the euro in June, briefly hitting its strongest level in almost two years in the middle of the month.

While the euro recouped some of those losses in the wake of the first round of France’s poll, analysts at Barclays Plc see the pound rally continuing, with potential for it to reach 80 pence against the common currency — a level not seen since the Brexit referendum.

At the same time, the latest Bank of America fund manager survey shows that global investors currently favor the UK and Spanish equity markets, with France the least preferred; France had been the favorite a month earlier.

Stock investors are particularly bullish on homebuilders, as Labour has vowed to reinstate mandatory housing targets and ease planning restrictions.

With most polls showing a landslide win for Labour and a wipeout for Prime Minister Rishi Sunak’s Conservative Party, the election is likely to be a “non-event” for markets, according to Gregor Hirt, multi-asset chief investment officer at Allianz Global Investors.

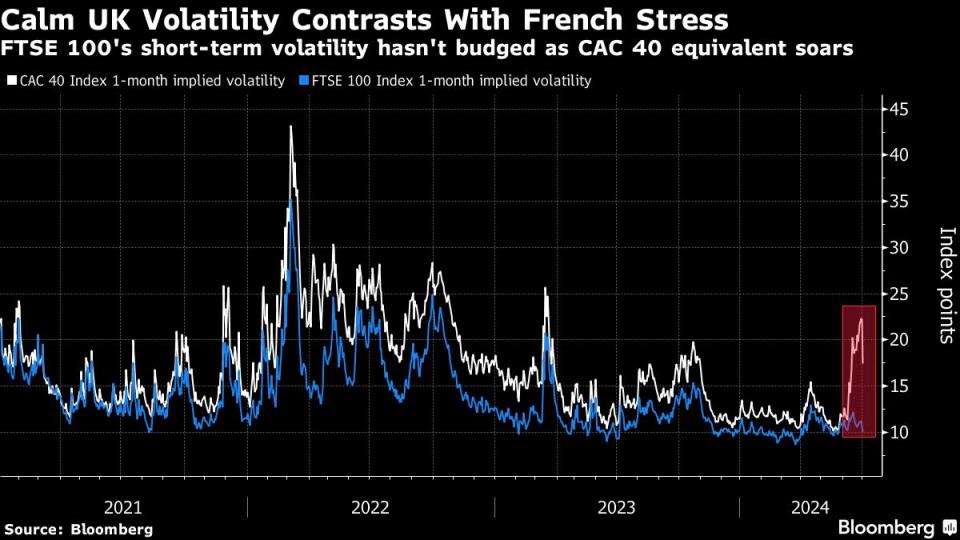

His view is reflected in one-month volatility for the FTSE 100, which hovers near its lowest levels of the year. In sharp contrast, swings in France’s CAC 40 shot up to its highest in more than a year in the run-up to the vote.

“We think the impact of the UK election is quite limited, mainly because it is a clear contest,” said Susana Cruz, a strategist at Liberum Capital Ltd.

That’s just how investors want it following 14 years turbulent years of Conservative Party rule, during which the country’s assets have danced to the tune of political drama.

Scotland’s referendum on independence, the Brexit vote, and the years of fractious negotiations that followed caused wild gyrations in the pound. At the last general election in 2019, meanwhile, investors fretted over former Labour leader Jeremy Corbyn’s left-wing policies including nationalization and worker stakes in companies.

And on-and-off lockdowns to slow the spread of Covid-19, alongside the nation’s faster rollout of vaccines, created further market turbulence during the pandemic.

More recently, Truss’s package of unfunded tax cuts roiled markets in 2022 after a sudden rise in bond yields triggered forced selling from leveraged pension fund strategies. Gilts plunged, forcing an extraordinary BOE intervention.

It’s a sign of how far sentiment has shifted ahead of the election that David Zahn, head of European fixed income at Franklin Templeton, declared gilts to be “a safer place to be in than Europe at the moment” in a recent interview on Bloomberg TV.

What Bloomberg Strategists Say

“There’s an uncanny opportunity for British markets and industry to become something of a haven in the midst of geopolitical uncertainty in Europe, the US and beyond. The country’s centrist policies and relative calm may bode well for risk premiums and the currency, and spur a friendly backdrop for homebuilders and renewable energy.”

— Tim Craighead, BI equity strategist

While that’s a nice inheritance for Starmer — and for the Bank of England, which is preparing to lower interest rates in coming months — attention will snap back to fiscal stability and the potential for economic growth.

Relentless messaging on fiscal discipline in the UK has left investors confident that Starmer and his pick for Chancellor Rachel Reeves won’t do anything radical on spending or borrowing. And both have vowed to improve the UK’s ties with the EU, particularly in areas like trade and immigration.

UK markets are also benefiting from the BOE’s slower pivot toward easing than the European Central Bank. Traders now see the odds of a first cut by the BOE in August as a coin-toss, even as the European Central Bank has already lowered its benchmark rate and is expected to do so again by October.

France’s National Rally has also sought to assure investors that it won’t upend the nation’s finances if the party wins an outright majority, but the fiscal situation was already weighing on investor sentiment before the snap election was announced.

“There’s a wider range of unknowns in France at the moment compared to the UK, and that’s what puts the UK debt outlook, and our allocation outlook, slightly more positive than in France,” said Rufaro Chiriseri, head of fixed income for the British Isles at RBC. The Canadian wealth manager is “slightly overweight” gilts, she added.

To be sure, the outlook for the UK even after a leadership overhaul isn’t exactly rosy. Starmer is inheriting stretched public finances and the worst decline in living standards in decades, and the Brexit premium weighing on UK assets won’t vanish overnight.

Some of the party’s manifesto pledges could also prove troublesome for certain sectors. For example, shares in North Sea oil companies fell after Labour announced plans for a windfall tax on the sector and ruled out issuing new oil licenses, with Serica Energy Plc and Enquest Plc most impacted. A bid to takeover Royal Mail-owner International Distribution Services Plc could also implode.

Jon Mawby, co-head of absolute and total return credit at Pictet Asset Management Ltd, said in a recent interview that long-dated UK sovereign debt is vulnerable to a selloff, given the next government will likely have to increase public spending and issue more debt to deliver on campaign pledges.

Most investors, though, are betting that UK assets will provide a refuge in the coming months from political chaos elsewhere, particularly as the US hurtles toward a heated presidential election in November.

“Relative political stability around elections, strong and improving macro performance, a higher terminal rate,” said Kamal Sharma, an FX strategist at Bank of America Corp. “There are clear reasons why markets should retain a short euro-sterling bias.”

--With assistance from Alice Atkins, Michael Msika and Joe Easton.

(Updates gilt chart and adds strategist view.)

Most Read from Bloomberg Businessweek

The Fried Chicken Sandwich Wars Are More Cutthroat Than Ever Before

Japan’s Tiny Kei-Trucks Have a Cult Following in the US, and Some States Are Pushing Back

RTO Mandates Are Killing the Euphoric Work-Life Balance Some Moms Found

The FBI’s Star Cooperator May Have Been Running New Scams All Along

©2024 Bloomberg L.P.

Yahoo Finance

Yahoo Finance