Coronavirus: UK factories demand Brexit deal and furlough replacement as output keeps falling

Business chiefs are demanding a Brexit deal and replacement for the furlough scheme to safeguard UK manufacturing firms and jobs, as figures showed factories’ output continuing to decline in September.

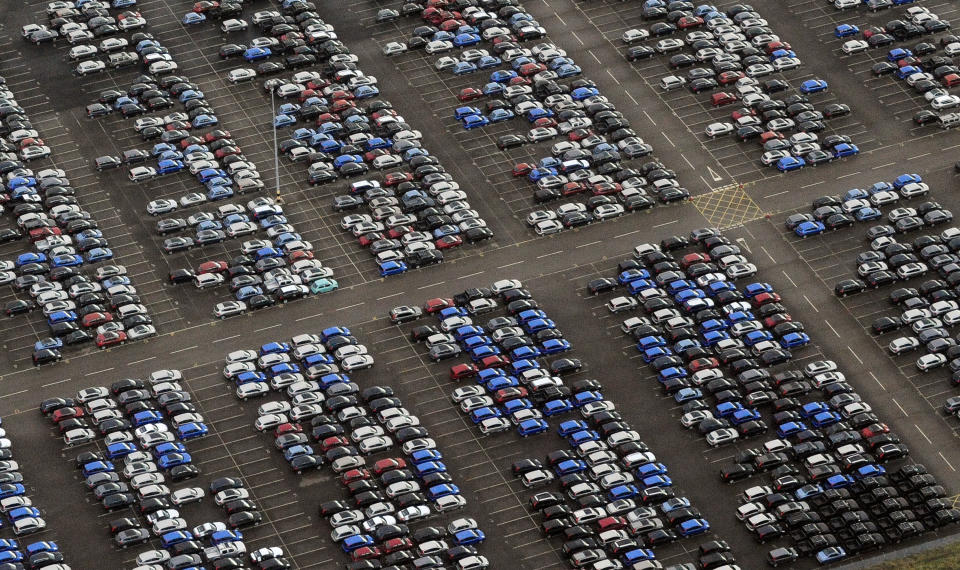

A survey by the Confederation of British Industry (CBI) found firms in 10 of 17 sub-sectors of manufacturing reporting production had fallen in the three months to September. Companies said output was 17% below “normal” levels because of COVID-19, and vehicle and transport equipment production saw some of the steepest declines in work.

The survey of 277 firms painted a mixed picture about the sector’s efforts to recover from the heavy toll of lockdown earlier this year and the continued effects of the coronavirus crisis.

In some ways the outlook appears to have improved since August, when every sector bar one had reported a decline in output. But the rate of decline remains high by historical standards, and the figures were worse than expected by analysts.

This month’s figures also mark the first time since April firms reported no improvement on their order books, even though both total export and import orders remain far weaker than long-run averages.

Anna Leach, deputy chief economist of the CBI, welcomed a slowing in output decline, but said stalling order numbers showed demand remained low.

READ MORE: No-deal Brexit ‘final nail in coffin’ for UK factories

“As manufacturing firms continue to battle against headwinds from a resurgence of the virus, weak global demand and uncertainty over our trading relationships, the government must step up its support,” said Leach.

“As the job retention scheme comes to an end, a successor must be found, while a deal with the EU will help underpin businesses’ resilience.”

Tom Crotty, group director of chemicals giant Ineos and chair of the CBI’s manufacturing council, said he was unsurprised by the figures given the “very difficult summer” for firms.

“A solution to avoid a job retention scheme cliff-edge would be a welcome boost to manufacturers continuing to deal with the impact of COVID-19. It is also crucial that a deal is agreed with the EU, as it is essential to support the economic recovery across the UK.”

Independent analysts were more sceptical about the figures, however.

Samuel Tombs, chief UK economist at Pantheon Macroeconomics, said he doubted the recovery had gone into reverse, noting the measures were not seasonally adjusted and the past 10 years had seen declines reported in September. He also said manufacturers were asked to report how output compared to “normal” rather than the previous month.

Tombs said the figures showed recovery was “slowing, not unraveling.”

He noted recent strong growth over the summer had been partly driven by the completion of backlogs of work built up during lockdown. “While demand for consumer goods is strong, it is very weak for capital goods, as corporates are holding back from large investments in response to both COVID-19 and Brexit.”

The end of the Brexit transition period and risk of no-deal disruption at the end of the year could see production boosted by stockpiling, however. Tombs said EU firms may stock up on UK goods to safeguard against the risk of higher tariffs on UK products next year.

“Nonetheless, this merely will represent a shift in the timing of demand, not a net increase. A sustained recovery in output to pre-COVID levels still is not in sight.”

Yahoo Finance

Yahoo Finance