The UK cities where property prices are rising fastest

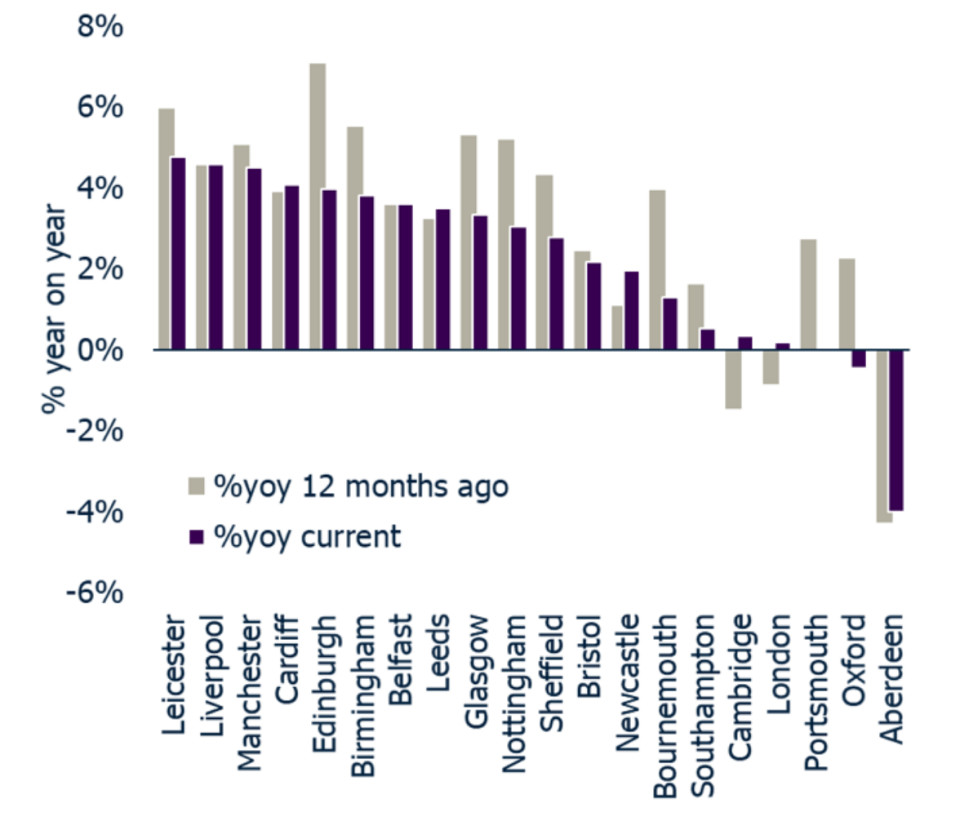

Leicester has the fastest-rising property prices in the UK of any major city over the past year, according to new figures.

The average property in the cathedral city in the East Midlands has increased 4.8% in value over the past year to £182,900, according to Zoopla.

The growth compares to an average of 1.9% across the country, the data from Zoopla and Hometrack’s UK cities house price index suggests.

Liverpool in north-west England had the second-fastest rising prices, up 4.6% to a still lower-than-average £124,700.

Manchester, Cardiff and Edinburgh also recorded growth of at least 4%, while Birmingham, Belfast, Leeds, Glasgow and Nottingham prices were up more than 3% in the year to August.

READ MORE: Major parties reveal plans to fix the housing crisis

Meanwhile several more expensive cities have seen prices decline or stagnate amid a sluggish market, Brexit uncertainty and tax reforms in recent years.

Oil capital Aberdeen in north-east Scotland saw the biggest drop, with prices down 4% and still below their 2007 peak. University city Oxford was the only other city that saw prices decline, down 0.4% but still high at an average of £409,100.

Portsmouth, London, Cambridge and Southampton also saw growth of less 1%.

A report by Zoopla and Hometrack published on Wednesday noted that values had stagnated in southern cities for much of the past four years, but were still 56% higher than their 2007 peak.

It said its experts expected current trends to continue in the near-term.

“There is no sign of any sudden weakening in market conditions as the Brexit debate returns to centre stage. Market trends are being dictated by the fundamentals of local economies and the affordability of housing across cities,” it noted.

The report added: “The acceleration in house price inflation since 2013, reaching almost 20% in London in 2014, and the subsequent slowdown since 2016 are part of the unfolding house price cycle.

“Price growth has slowed to more sustainable levels as the market adapts to a changing profile of demand, resulting from tax and policy changes and increased mortgage regulation.”

Yahoo Finance

Yahoo Finance