Coronavirus: Why UK's 'extremely poor' testing ability threatens Britain's economy

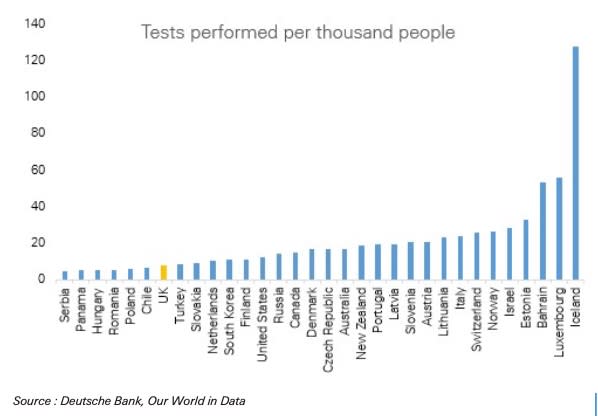

Britain could face a deeper economic hit than many other countries because of its “extremely poor” testing levels, a Deutsche Bank analyst has warned.

A UK government minister admitted on Thursday it was “dreadful” that even care workers were struggling to get tested for the coronavirus. Cabinet member Brandon Lewis confirmed in an ITV interview the official target remains 100,000 tests a day by the end of the month.

But the latest figures suggest Britain tested only around 18,000 people on Monday, less than a fifth of the planned level with just over a week until the target date.

The government is coming under enormous pressure over its slow progress in rolling out testing — and experts warn it could have dire consequences for the economy as well as public health.

No mass testing in sight

Many countries hope widely available testing and sustained efforts to trace all contacts of those exposed will contain the virus.

If successful they could allow much greater freedom of movement and business activity, by reducing the reliance on heavy restrictions and social distancing that have crippled the economy.

Read more: UK economy suffers record shock and ‘unprecedented’ job losses

But Deutsche Bank macro strategist Oliver Harvey wrote in a note to clients that Britain lagged “almost any” medium- to large-sized economy globally on testing.

“This will materially impact the government's ability to pursue a 'test and trace' approach when it comes to easing the lockdown,” he said.

No taste for ‘herd immunity’

One alternative to a ‘test and trace’ approach would be a Sweden-style “policy of managed herd immunity,” according to Harvey.

This would involve easing restrictions and allowing the virus to spread, albeit as slowly as possible and while sheltering the vulnerable. This would also allow far greater economic activity, and Harvey said there were signs it was “proving workable” for Sweden.

Read more: UK wages still below 2008 levels when COVID-19 hit

But the idea is already enormously controversial in Britain. A warning by scientists that Britain’s more relaxed initial policies could cause 250,000 deaths was what jolted the UK government into its current lockdown last month.

Harvey noted the UK public seemed particularly unlikely to accept the vastly higher scale of illness and deaths.One recent poll showed 87% of the public supported fresh lockdown extensions, and worries about the risk from COVID-19 are higher than most other countries.

UK economy ‘highly exposed’ to lockdown and consumer caution

Low testing capacity and high public concern about easing restrictions without more progress could therefore drag out Britain’s lockdown and its economic toll more than other countries.

“These factors suggest that the UK will be one of the laggards when it comes to either a lifting of the existing lockdown, or public buy-in when restrictions are eased,” the analyst wrote.

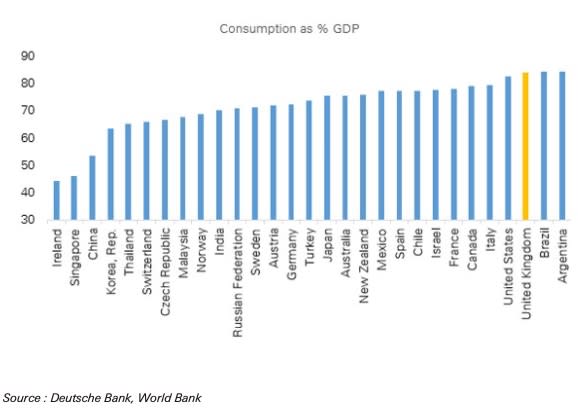

Yet Britain’s economic troubles could also be far greater than other economies even when restrictions do begin to lift. Harvey notes the UK economy is more heavily reliant on consumer spending than most other major countries.

Read more: Rivals GSJ and Sanofi to work together on a vaccine

This has not only meant a far greater hit from the lockdown so far as sectors like retail, restaurants, transport, culture and property have suffered from curbs on consumer movement. It also risks continued disruption if restrictions in these areas are lifted more slowly than other sectors such as manufacturing, which makes up a greater share of the economy in countries like Germany.

Even if restrictions are eased significantly, Harvey warns the UK public’s fears could persist much longer, hobbling the recovery of key sectors. This is likely to mean a harder long-term hit to the economy and to sterling.

He concluded: “The UK appears to be caught in a double whammy. On the one hand, a less developed exit strategy than many other developed economies and question marks over its eventual execution, and on the other an economy that is highly exposed from a sectoral perspective to lockdowns.”

Yahoo Finance

Yahoo Finance