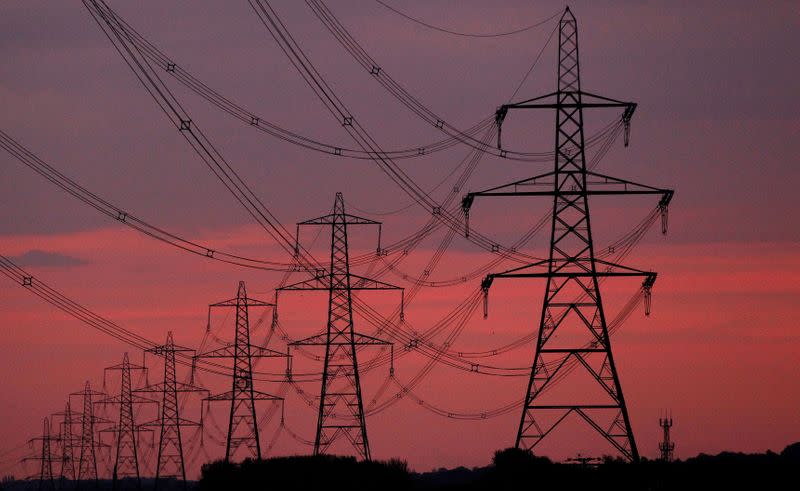

UK energy regulator says more suppliers may go bust over high prices

By Susanna Twidale

LONDON (Reuters) -More British energy suppliers could go bust because of continued high wholesale energy prices, energy regulator Ofgem said on Thursday.

Some 12 energy supplies have already collapsed this year affecting more than 2 million customers. Nine folded in September, as they struggled to cope with record gas prices.

"Given the continued volatility in the market it is likely more suppliers will exit the market," Ofgem Chief Executive Jonathan Brearley told the Energy UK conference.

Britain's energy minister Kwasi Kwarteng told the conference the government would not bail out failing energy suppliers.

Most energy suppliers hedge customer needs in advance but some firms, with less capital available, have struggled to keep pace with wholesale gas prices which have surged as much as 400% or more this year. They were up about 380% on Thursday.

A cap on household domestic electricity and gas bills, which came into effect in 2019, has limited the impact of wholesale prices for consumers Brearley said, but warned this will eventually need to rise to reflect the changes.

"(The cap) is designed to reflect fair costs and therefore will need to adjust over time to reflect the changes in fuel costs we are seeing today," Brearley said.

He said the regulator had tightened rules on new entrants joining the energy supply market in the past few years but that it would seek to go further.

"If we do see sharp and unethical practices, we will use the full extent of our powers," he said, without giving more details on what the regulator could do.

(Reporting by Susanna Twidale; Editing by Jason Neely and Edmund Blair)

Yahoo Finance

Yahoo Finance