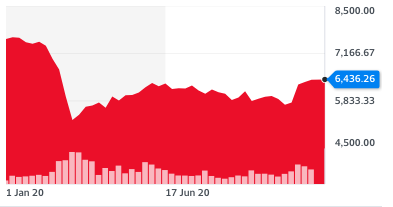

UK stocks at highest since June after US markets break new records

UK stocks were trading at their highest level since early June on Wednesday, as vaccine advances and hopes of a smooth US presidential transition buoyed financial markets.

European markets opened higher following Tuesday’s rally on Wall Street on Tuesday, which saw the Dow Jones (^DJI) break through the 30,000 mark for the first time to close 1.5% higher. The S&P 500 (^GSPC) had also reached a record high, up 1.6%, and the Nasdaq (^IXIC) gained 1.3%.

It comes after confirmation that the US government’s General Services Administration had acknowledged Joe Biden’s victory in the election, alleviating uncertainty over the transition from Donald Trump. Investors also welcomed the choice of former US Federal Reserve chair Janet Yellen as Biden’s Treasury secretary.

WATCH: What is a budget deficit and why does it matter?

Britain’s FTSE (^FTSE), France’s CAC 40 (^FCHI) and Germany’s DAX (^GDAXI) all rose at the open, though were close to flat from mid-morning. Leading stocks in London and Frankfurt were down 0.1% at around 9.45am, while France’s biggest stocks were up 0.2%

The FTSE was trading at five-month highs and not far short of levels seen pre-lockdown in early March. The more domestically focused FTSE 250 (^FTMC) was down 0.6%, amid reports all of England could be placed in the highest two tiers of restrictions when a nationwide lockdown eases next week. But it was still trading at its highest level since late February.

The Europe-wide Stoxx 600 (^STOXX) was down 0.1% but hit a post-pandemic high on Tuesday. Fund managers, strategists and brokers polled by Reuters this week expect a vaccine to return the Stoxx 600 to the near-record highs seen in February by the end of 2021, marking a 10.6% rise on Monday's closing price.

US stock futures were pointing to continued gains on Wednesday as trading began in Europe. S&P futures (ES=F) were trading 0.2% higher, Dow Jones futures were up 0.1% (YM=F), and Nasdaq futures (NQ=F) were up 0.4%.

Asian markets had been mixed. Japan’s Nikkei (^N225) gained 0.5% and the Hang Seng in Hong Kong (^HSI) rose 0.2%, but China’s Shanghai Composite (000001.SS) dropped 1.2%.

“The Santa Claus rally has already been underway since the election with the extra cyclical Santa treat coming in the form of the recent vaccine news,” wrote Deutsche Bank analysts in a note.

The Santa Claus rally is a phenomenon of stock markets often rising in the last week of December and start of January.

The analysts added: “Though President Trump said in a tweet yesterday that ‘the GSA does not determine who the next President of the United States will be,’ the move has allayed market fears that the US will face extended political uncertainty in the coming weeks, and comes as increasing numbers of states have moved to certify their election results, with Pennsylvania the latest to announce yesterday.”

They noted energy stocks had seen particularly strong gains this week as oil prices reached a post-pandemic high.

WATCH: What does a Biden presidency mean for global economy?

Yahoo Finance

Yahoo Finance