UK firms face sharpest downturn since Brexit vote

Brexit uncertainty continues to plague UK companies as private sector output hit its lowest level since the Brexit vote, according to new figures.

The flash UK PMI data, a preliminary report before the final data is released next week, showed that output decreased for two of the past three months, recording its sharpest drop since July 2016.

The IHS Markit/CIPS Flash UK composite output index data comes in wake of modest falls reported in manufacturing and service sector output. The headline figure hit 48.5 in November, down from 49.6 in October. Anything below 50 is considered a contraction.

The flash PMI is based on approximately 85% of usual monthly replies.

READ MORE: UK business leaders dismayed by choice between Johnson and Corbyn

Chris Williamson, chief business economist at IHS Markit, said: "With an upcoming general election adding to Brexit-related uncertainty about the outlook, it's no surprise to see UK businesses reporting falling output and orders in November. The decline signalled by the flash PMI follows stagnation in October and adds to what has been the survey's worst spell since the recession of 2008-9.”

He said the weak survey data puts the economy on course for a 0.2% drop in GDP in the fourth quarter and also “pushes the PMI further into territory that would normally be associated with the Bank of England adding more stimulus to the economy.”

The flash index report found service providers continued to link weaker demand to delayed decision-making in response to domestic political uncertainty, especially among large corporates. Some survey respondents also commented on more subdued consumer spending patterns in November. As a result, new business volumes dropped for the third month running, partly reflecting the sharpest fall in sales to overseas clients since the start of 2019, the report said.

Meanwhile, the latest rise in operating expenses was the weakest since August 2016. Service providers noted that lower non-staff costs had helped to alleviate some of the pressure from rising salary payments at their businesses in November.

READ MORE: Johnson unveils £6bn U-turn on tax cuts for business

Howard Archer, chief economic adviser to the EY ITEM Club, said: “The new flash purchasing managers’ survey for the UK manufacturing and services sectors disappointingly marked its debut with weak news on the economy. Indeed, it showed overall manufacturing and services contracting at the fastest rate for 40 months in November, having been flat in October.”

Duncan Brock, group director at the Chartered Institute of Procurement & Supply (CIPS), said: “With the longest stretch of weak numbers for a decade, the headline figure is a sad sight to behold. Over the past few months we have seen manufacturing companies oscillate between stock building and unravelling and in November, the sharpest drop in stocks of purchases since June 2018 showed inventory levels being unpicked again as another Brexit deadline passed. Manufacturing output has dropped every month since June.

"With a general election added to the Brexit mix of general uncertainty and delayed decision-making, it would be a brave commentator who would suggest the possibility of any Christmas cheer as we head into the last month of the year."

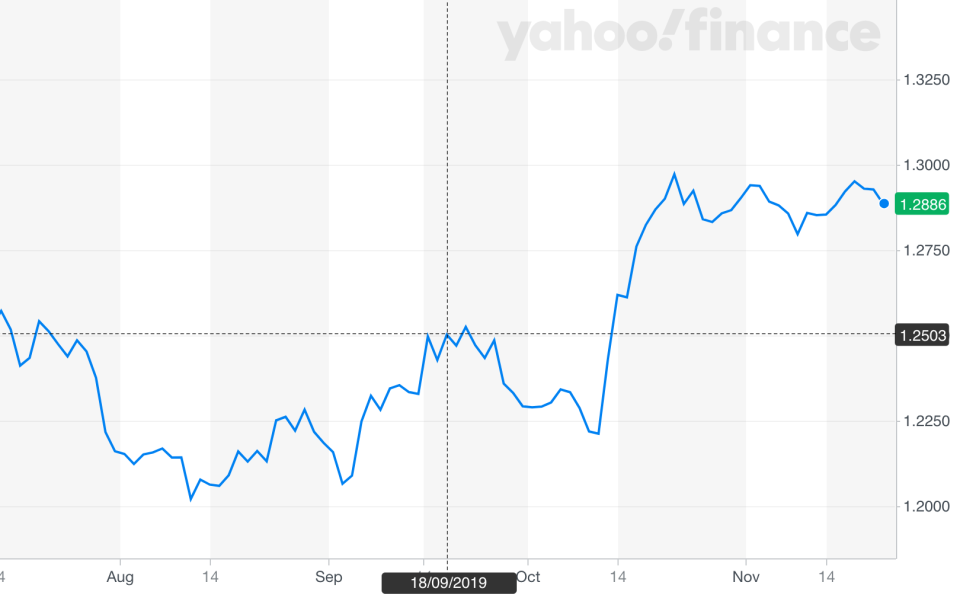

The pound was down by nearly 0.20% against the US dollar for the day, at $1.28.

Yahoo Finance

Yahoo Finance