The UK generated over £94 trillion with cashless payments in 2018

The days of carrying cash are slowly fading, and the UK currently ranks higher than all other EU nations for cashless payments, racking in a massive revenue of £94tn (€120tn) via card and digital payments in 2018.

A report by payment fee comparison service Merchant Machine called Going Cashless has revealed after years of card payments slowly cutting into the dominance of cash transactions, cashless is now the most popular method of payment across the EU. The rise of cashless payments has been strengthened by the growing popularity of contactless cards, as well as a 15% drop in notes and coins used in 2018.

The UK is by far the leading nation for cashless payments in Europe. Germany ranked second in the study of cashless revenue with €56tn (£86tn) generated in 2018, while France gathered €27tn (£24tn) in cashless payments.

READ MORE: Time for a cashless society? Deadly bacteria found on UK cash and coins

Contactless debit and credit cards have become hugely popular since 2007, providing consumers with a fast and easy way to pay. The UK clothing industry benefited most from this technology last year, with contactless payments for purchasing clothing skyrocketing by 321%, topping all other key business types.

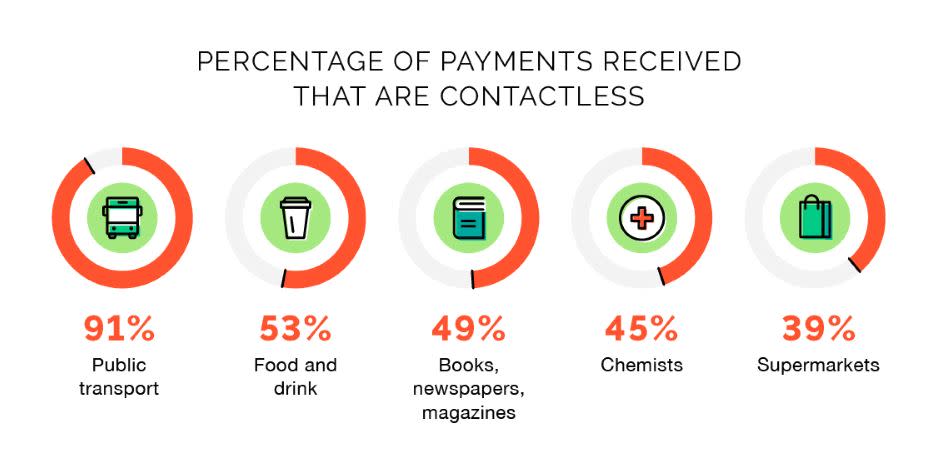

The public transport business also reaped the benefits of contactless technology, with 91% of all payments being made with contactless cards last year. Additionally, parking payments had 132% more contactless transactions in 2018 than the year before.

Ian Wright from Merchant Machine said: “The popularity and preference towards cashless payments appears evergrowing. While so many are aware of the decline of cash usage and increase in card transactions, the study helps to break down where these changes are most felt.”

READ MORE: All the ways Brits are clinging onto cash

This follows an announcement from banking and finance trade body UK Finance in June 2017 that cash use has halved over the past decade, while debit payments have become the most popular form of payment across the nation. Card payments surged by 14% in 2017 compared to the previous year, while the the number of cash transactions fell by 15% in the same period.

Experts have suggested the UK is heading towards a “cashless society”, but some warn that up to eight million Brits would suffer considerably in this kind of society — particularly those living in rural areas or with significant debt.

Yahoo Finance

Yahoo Finance