UK government: no-deal Brexit could wipe 9.3% off GDP growth

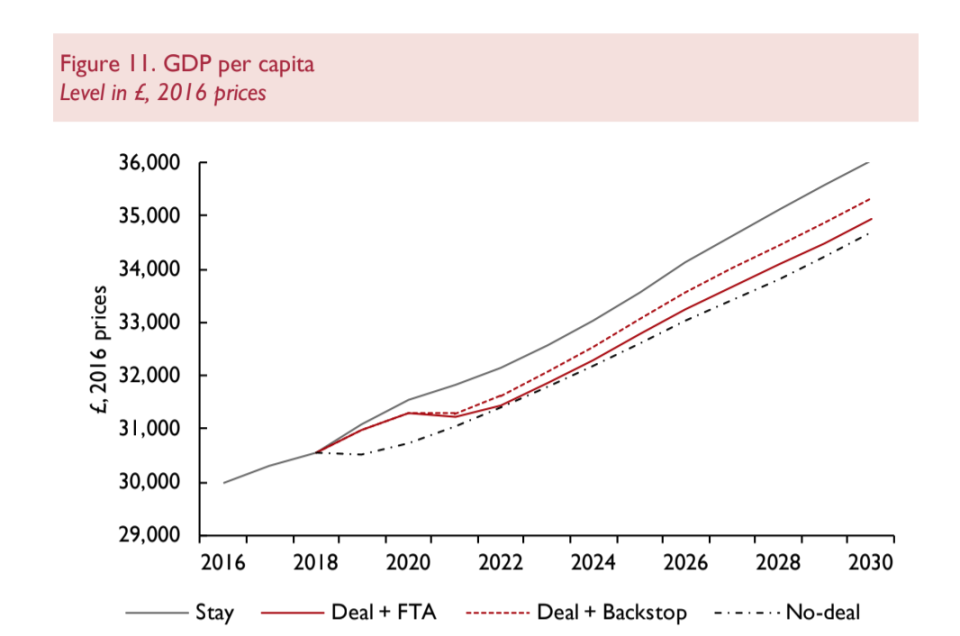

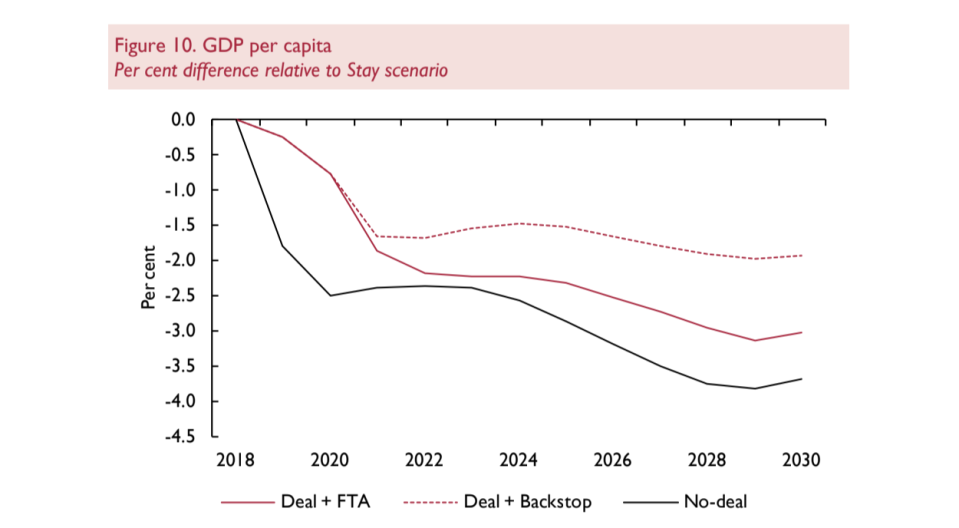

New analysis from the UK government warns that a no-deal Brexit could leave the economy 9.3% smaller in 15 years than it would be if the country remained in the European Union.

The analysis also says that the draft Brexit deal agreed by UK prime minister Theresa May and European leaders would still leave British growth 3.9% lower that it otherwise would be over the same period.

The figures suggest the UK economy will take an enormous hit under any version of Brexit compared to remaining in the EU.

The documents released did not report an exact financial cost to the economy, but experts have put 3.9% lower growth at around £100bn ($128.05bn) by the 2030s – which would exceed the UK’s contributions to the EU over the same period.

The “Long-Term Economic Analysis” paper published today stated that the government may have to borrow an additional £119bn ($152.4bn) by 2035 in the event of a no-deal Brexit.

Borrowing could increase by £26.6bn ($34.06bn) if Theresa May managed to get her own proposed deal through parliament.

The document was produced by departments across government, including the Treasury, the Home Office and departments for exiting the EU, industry, environment and international trade.

Chancellor Philip Hammond recently said that all possible Brexit scenarios under consideration will cost the UK economy when compared to remaining in the EU. However, he has defended May’s proposed deal as a way to “minimise” the harm.

Speaking on Radio 4’s Today programme, Hammond said that a result of the current proposed deal would lead to a “slightly smaller” economy over the next 15 years, while “in a purely economic sense” the UK would be worse off due to complications to trade.

He continued: “What the Prime Minister’s deal does is absolutely minimises those costs, and reduces to an absolute minimum the economic impact of leaving the EU, while delivering the political benefits, in terms of being able to do third-country trade deals, having control of our fishing waters, and the many other issues that will be delivered politically.”

The document compares predictions for the deal agreed by the UK cabinet at Chequer s with a Norway-style agreement as part of the European Economic Area (EEA), a Canada-style free trade agreement and leaving the European Union with no deal at all.

The report suggests that as all potential outcomes will reduce migration from Europe, national income will be reduced.

Even if there is frictionless trade and migration numbers are the same, the UK would see growth 0.6% lower than if it remained within the bloc, according to the analysis.

The 9.3% hit to future growth is predicted if there were no net migration at all from the EU.

The so-called Chequers deal, close to the proposal agreed by May and other EU leaders, would introduce some friction to trade, with no net migration from the EEA. Growth would be lower by 3.9% over the course of 15 years, compared to anticipated growth if the UK remained tied to the EU.

Levels of growth could be between 1.4%, and 4.9% and lower if a deal similar to Canada’s free trade arrangement were adopted, assuming net migration remains the same as at current levels. If net migration fell to zero, the cost would be a 6.7% hit to expected growth.

The report also warns that the areas hit hardest by no deal or a Canada-style agreement would be the West Midlands, north-east and north-west of England and Northern Ireland. Under the Chequers plan, London will suffer the most.

Rain Newton-Smith, CBI Chief Economist, said of the figures: “These forecasts paint a bleak picture over the long-term of a no-deal Brexit or a Canada-style deal. It surely puts to bed some of the more far-fetched ideas that a hard-landing Brexit will not seriously hurt the economy.

“This is about real people’s lives and jobs in the years ahead and it’s clear to business that while the government’s deal is not perfect, it certainly fits the bill in reducing short-term uncertainty and opens up a route to a decent trade deal in the future,” he added.

“Politicians of all parties should speak to businesses in their constituency to hear about the impact a bad Brexit will have on them and their workforce. And the longer a ‘no deal’ scenario remains possible, the more corrosive the impact on jobs and investment plans.”

The report comes as May continued her tour of the UK in an attempt to raise support for her deal, which will be voted on by parliament on 11 December. Today she is speaking at a factory near Glasgow, where she will defend the deal’s potential effects on Scotland.

Scotland’s first minister Nicola Sturgeon recently released an analysis that she believes demonstrates Scotland will suffer financially under the deal.

The Scottish National Party (SNP) joined Labour, the Liberal Democrats and the Democratic Unionist Party (DUP) in saying they will vote against the deal in Parliament in December.

The prime minister also faces opposition from within her own party, from both its Eurosceptic wing and Remain-supporting Conservatives.

The Labour party has also demanded the government release its legal advice on Brexit in full this week.

The government has so far refused, saying it will only publish a “full reasoned position statement” on the withdrawal agreement. One source told the BBC May’s agreement would not allow the UK to unilaterally withdraw from the backstop agreement over Northern Ireland, which Brexiteers fear will leave the country subject to EU legislation indefinitely.

Hammond said that advice provided by attorney general Geoffrey Cox would not be made public, saying it would be “impossible for the government to function” if legal advice was released.

Hammond said: “No, there’s a very important principle here – that the government must be able to commission impartial legal advice which absolutely tells it like it is to enable it to shape its decisions, while always complying with its legal obligation in the negotiations.”

The chancellor continued: “It would be impossible for government to function if we create a precedent that the legal advice that the government receives has to be made public.

“We must have, as every other citizen has, the right to take privileged legal advice which remains private between the lawyer and the client.

“So the client has the ability to ask the difficult questions, to receive full and frank legal advice, and then to make decision based on that full and frank advice.”

Yahoo Finance

Yahoo Finance