UK Growth Companies With High Insider Ownership To Watch In May 2024

As the FTSE 100 continues its record-breaking run, buoyed by strong performances in global markets, investors remain keenly focused on the health and trajectory of the United Kingdom's financial landscape. In this context, growth companies with high insider ownership present a unique appeal, as such stakes often signal confidence from those who know the businesses best amidst evolving market conditions.

Top 10 Growth Companies With High Insider Ownership In The United Kingdom

Name | Insider Ownership | Earnings Growth |

Getech Group (AIM:GTC) | 17.2% | 86.1% |

Gulf Keystone Petroleum (LSE:GKP) | 10.6% | 54.6% |

Petrofac (LSE:PFC) | 16.6% | 115.4% |

Spectra Systems (AIM:SPSY) | 23.3% | 26.3% |

Integrated Diagnostics Holdings (LSE:IDHC) | 26.7% | 27.9% |

Plant Health Care (AIM:PHC) | 19.7% | 94.4% |

TEAM (AIM:TEAM) | 25.8% | 58.6% |

Afentra (AIM:AET) | 38.3% | 198.2% |

Velocity Composites (AIM:VEL) | 29.5% | 140.5% |

Judges Scientific (AIM:JDG) | 11.6% | 25.3% |

Let's explore several standout options from the results in the screener.

Mortgage Advice Bureau (Holdings)

Simply Wall St Growth Rating: ★★★★☆☆

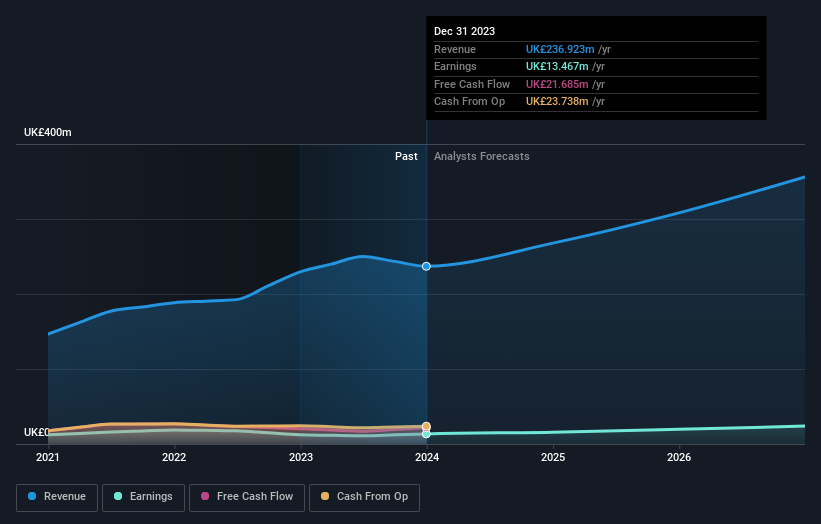

Overview: Mortgage Advice Bureau (Holdings) plc operates in the United Kingdom, offering mortgage advice services through its subsidiaries, with a market capitalization of approximately £500.65 million.

Operations: The company generates £236.92 million from its provision of financial services.

Insider Ownership: 20.2%

Mortgage Advice Bureau (Holdings) demonstrates a solid growth trajectory with its earnings increasing by 10.1% over the past year, and an expected annual profit growth rate of 19.3%, outpacing the UK market average of 12.7%. Despite this, its dividend coverage is weak, suggesting potential re-investment of earnings into business expansion rather than shareholder payouts. Recent executive appointments, including Emilie McCarthy as CFO, indicate a strategic push towards enhancing financial and operational leadership to support sustained growth.

IWG

Simply Wall St Growth Rating: ★★★★☆☆

Overview: IWG plc operates globally, offering workspace solutions across the Americas, Europe, the Middle East, Africa, and Asia Pacific with a market capitalization of approximately £2.06 billion.

Operations: The company generates revenue from workspace solutions across several regions, with £1.32 billion from Europe, the Middle East, and Africa, £1.05 billion from the Americas, and £273 million from the Asia Pacific.

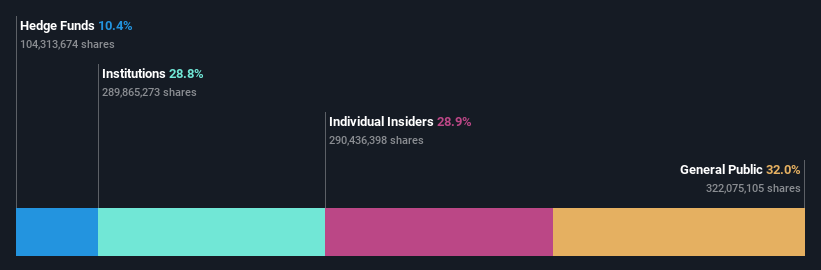

Insider Ownership: 28.9%

IWG has shown modest revenue growth, reporting a slight increase to $912 million in Q1 2024 from $911 million the previous year. Despite facing challenges with a significant net loss of £215 million in 2023, the company is expected to become profitable within three years. IWG's forecasted revenue growth at 7.8% annually is above the UK market average of 3.7%. The firm also completed a share buyback program, underscoring confidence from management despite current financial difficulties.

Playtech

Simply Wall St Growth Rating: ★★★★☆☆

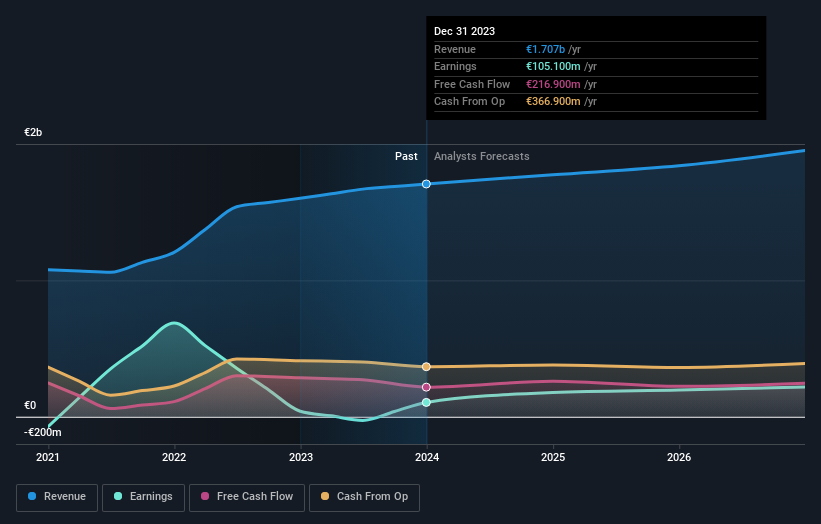

Overview: Playtech plc is a global technology company that offers gambling software, services, content, and platform technologies with a market capitalization of approximately £1.47 billion.

Operations: The company's revenue is segmented into Gaming B2B at €684.10 million, Gaming B2C at €946.60 million, and specific B2C operations including HAPPYBET and Sun Bingo totaling €91.60 million.

Insider Ownership: 13.5%

Playtech plc, despite a slower revenue growth rate of 4.4% per year, is set to expand earnings by 20.5% annually, outpacing the UK market's 12.7%. The stock is currently valued at 55.3% below its estimated fair value, indicating potential for price appreciation. Recent financials show a robust increase in net income from EUR 87.6 million to EUR 105.1 million year-over-year and the addition of Doreen Tan as an Independent Non-executive Director could bring valuable insights and networks to foster further growth.

Navigate through the intricacies of Playtech with our comprehensive analyst estimates report here.

Upon reviewing our latest valuation report, Playtech's share price might be too pessimistic.

Summing It All Up

Access the full spectrum of 61 Fast Growing UK Companies With High Insider Ownership by clicking on this link.

Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include AIM:MAB1 LSE:IWG and LSE:PTEC.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance