UK house prices: ‘Only the Autumn Budget could derail this train’

UK house prices grew at their fastest annual rate since November 2022, although analysts have already started to warn about the effects of a potentially bruising Autumn budget.

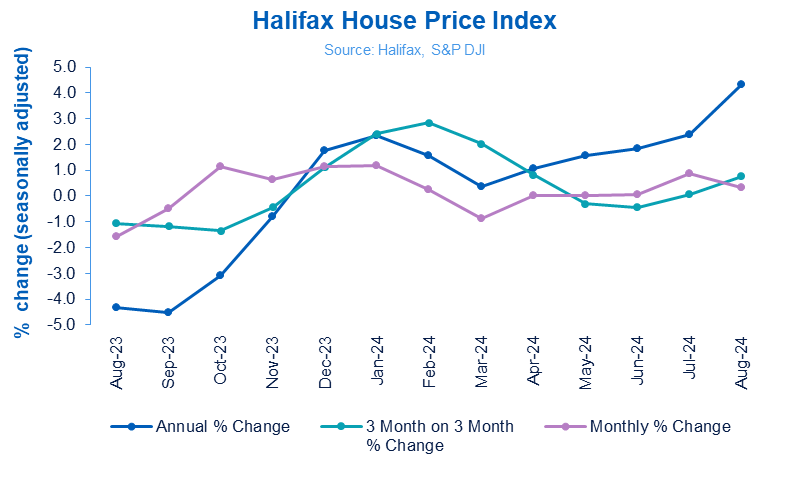

Prices rose by 4.3 per cent year on year and 0.3 per cent month on month, taking the price of the average property in the UK to £292,505, according to the latest Halifax housing price index.

London continued to have the most expensive property prices in the UK with an average of £536,056, up by 1.5 per cent compared to last year.

“Recent price rises build on a largely positive summer for the UK housing market,” head of mortgages at Halifax Amanda Bryden said. “Prospective homebuyers are feeling more confident thanks to easing interest rates [but] affordability remains a significant challenge for many potential buyers still adjusting to higher mortgage costs.”

A very ‘un-August August’

Typically, purchase activity drops by around 10 per cent in august.

However, the “feel-good factor from the Bank of England reducing the base rate”pushed more buyers and sellers into the market, Peter Stimson, Head of Product at MPowered Mortgages said.

“It wasn’t an average August,” Emma Jones, Managing Director at Whenthebanksaysno.co.uk said. “Continued rate cuts from lenders throughout the summer months really started to feed through into demand and enquiry levels were far higher than usual.”

Fears over potential tax changed in the Autumn budget also encouraged people to lock in deals before any hikes in capital gains tax or inheritance tax.

“You get the feeling a lot of people want to purchase a home and get locked into a rate now before any potential reverse in mortgage pricing due to the Autumn Budget,” Jones added.

Stephen Perkins, managing director at Yellow Brick Mortgages said: “For August, demand was fierce, fuelled by falling mortgage rates as lenders fight for market share. This will continue to push up house prices, which remain resilient. Only the Autumn Budget could derail this train.”