UK house prices increase at fastest rate in more than a year

UK house prices increased at the fastest annual rate in more than a year in the run-up to the UK general election, official figures show.

The latest property price data from the Office for National Statistics (ONS) show average prices rose by 2.2% in the year to November, a significant uptick on the 1.3% year-on-year growth recorded in October.

The average home broke through the £250,000 mark in England, up 1.7% to £251,000, with every part of the UK except the east of England showing gains in values.

Wales recorded the biggest rise, with the average property soaring 7.8% in a year to £173,000.

“Wales has experienced record annual growth in November 2019,” said HM Land Registry in its latest report with the ONS.

“This is driven by a shift towards higher value property being transacted between October and November in areas with a typically larger volume of transactions, such as Cardiff and Newport, coupled with a fall in prices during the same period in 2018,” the report said.

READ MORE: UK government blamed for ‘alarming’ lack of affordable homes

London also saw a turnaround in November, with prices up 0.2% in the year to November versus a 0.5% decline in the year to October. “After almost two years of poor growth, London house prices appear to be showing some signs of improvement,” said ONS inflation head Mike Hardie.

The capital and south-east in particular have seen a slowdown in price growth in recent years, with Brexit uncertainty and tax reforms widely seen to have cooled an overheating market.

Semi-detached homes rose fastest in price of any property type over the year, up 3% to an average of £224,550, while flat prices rose at the slowest rate of 1%.

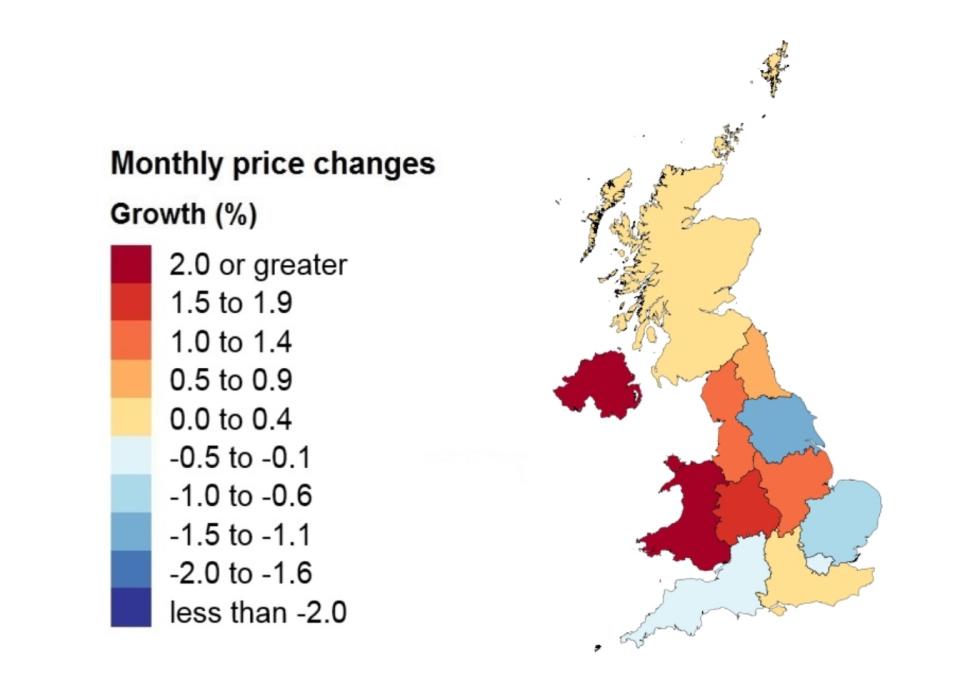

The ONS also published monthly figures, showing average prices in the UK turned positive between October, when they dropped 0.7%, and November, when they rose 0.4%.

But the number of sales was significantly lower than a year earlier, down from 68,839 in September 2018 to 61,633 last September. The Royal Institution of Chartered Surveyors (RICS)’s November survey suggested uncertainty over the election and Brexit were limiting activity.

Marc von Grundherr, director of London estate agent Benham and Reeves, said: “Promising signs from a battle-weary property market with a notable lift in the rate of house price growth both on a monthly and annual basis, and while the recovery continues to be slow but steady, we are in a far better place than we found ourselves the previous year.”

READ MORE: Persimmon sales slump after ‘poor workmanship’ on new builds

He added that the so-called “Boris bounce” had also increased market confidence since November, while an increasingly expected Bank of England cut to interest rates could fuel buyer demand further.

Mark Harris, chief executive of mortgage broker SPF Private Clients, said the election had given prices a “kickstart,” and suggested December’s figures would make for more relevant reading about the market.

Jeremy Leaf, former RICS residential chairman and a north London estate agent, said price growth had also been “underpinned by a shortage of stock and insufficient housebuilding in areas where people most want to live.”

Yahoo Finance

Yahoo Finance