Coronavirus: UK house prices drop as BoE warns of 16% fall

UK property prices saw only a slight dip between March and April as the coronavirus crisis rippled through the housing market, new figures show.

But separate data suggests prices could sink much further this year, with the Bank of England’s financial stability report on Thursday suggesting residential properties could slide 16%.

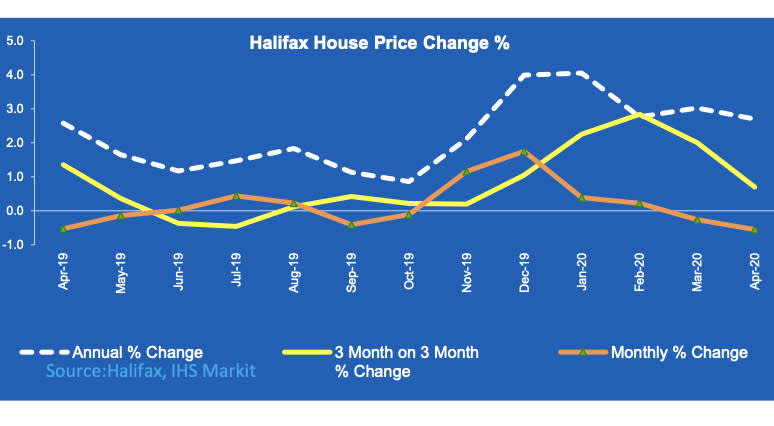

Data from Halifax’s closely watched house price index, compiled by IHS Markit, showed a 0.6% month-on-month drop in prices. The average mortgaged home sold through the lender went for just over £238,500 ($297,125) last month.

But prices were still 2.7% higher than a year earlier. Halifax said calculating average prices had “inevitably become more difficult” during the pandemic however, casting some doubt on the reliability of such data.

The market is close to standstill because of the pandemic, with the UK government warning against non-essential house moves or in-person viewings and valuations.

Many homeowners will be worrying over the value of their assets as the crisis hammers the UK economy, though it may be exactly what many would-be buyers are hoping for.

READ MORE: How economic crisis could scar a generation of young people

New Bank of England (BoE) figures published on Thursday suggest the UK economy faces its worst contraction in three centuries, and some economists and firms fear recovery would take years.

The BoE described its latest figures as an ‘illustrative scenario’ rather than forecasts, given significant uncertainty over its underlying assumptions. But it said such an economic hit was consistent with a 16% decline in property prices, similar to the drop seen during the global financial crisis just over a decade ago.

But the BoE added: “After falling, prices are then assumed to rise gradually as economic activity in the UK recovers and unemployment falls.”

Many estate agents expect prices to rebound swiftly as restrictions lift and buyers return to the market.

Lucy Pendleton of estate agent James Pendleton said: “A bullish picture going into this crisis actually means we are likely to see healthy prices when we return.

“There will be a period in which vendors test the water but you can expect them to stand behind valuations they were confident of achieving before the lockdown began. That will be especially true in the capital.

“There have been a small number of buyers seeking price reductions but these have been minor skirmishes prompted by opportunists rather than any reaction to the economic realities being faced by vendors.”

READ MORE: UK mortgage approvals hit seven-year low with market paralysed

Marc von Grundherr, director of London estate agent Benham and Reeves, said the hit to prices appeared “minimal” at present. “Once we are back up and running, buyers and sellers will return in their droves as we remain a nation of aspirational homeowners,” he added.

Halifax’s managing director Russell Galley also said he expected “short-term headwinds” on prices, but remained confident “in the health of the housing market in the longer term.

The market may be shifting in other ways too, from the rise of virtual viewings to the first hints of changing demands among buyers.

READ MORE: London rents drop as tenants secure discounts to stay put

"We have received a lot more enquiries over the past couple of weeks, with many people now looking to move to more rural areas once this is all over given the perceived reduced risk from future peaks and pandemics,” said Andrew Montlake, managing director at the UK-wide mortgage broker Coreco.

"Increasingly, people want to take advantage of the fact that coming out of this pandemic there will be more home working flexibility and better technology.”

Yahoo Finance

Yahoo Finance