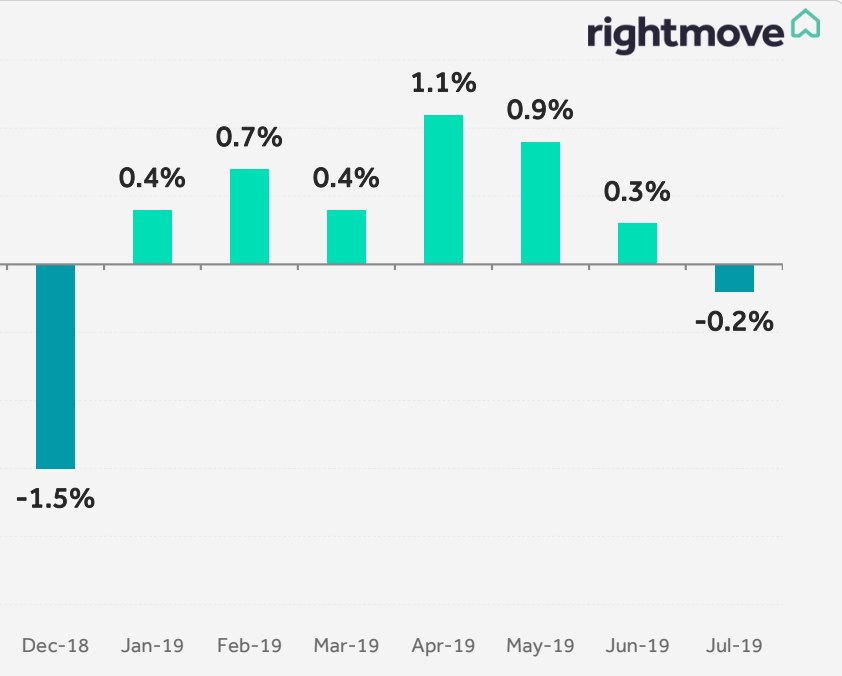

UK house prices sink for the first time in 2019

For the first time this year, house prices in Britain have fallen over the past month, according to new figures.

The average asking price in the UK fell by around £660 to just under £309,000 between June and July, according to data released by property website Rightmove on Monday.

One expert said the “ripple of caution” over Brexit that has dogged the property market was spreading across the country, with prices flat or falling in every single English region bar the southwest.

The fall may be welcomed by those looking to buy, but analysts are likely to see it as yet another warning sign of a slowdown in the wider UK economy just months before the scheduled Brexit date in October.

The time it takes for homeowners to find a buyer is at a six-year high for this time of year, while less property is coming to market as would-be sellers hold back.

The figures suggest wealthier buyers and sellers with less of a pressing need to move are holding back the most.

READ MORE: Britain’s biggest housebuilder shrugs off Brexit uncertainty

The highest-value homes, excluding inner London, have seen the steepest falls in value over the past month, dropping 1.1% from an average of £553,700 to £547,700.

Rightmove’s July house price index report predicted a “buyers’ market” in the second half of 2019.

Miles Shipside, Rightmove director and housing market analyst, blamed the “current political climate” for denting public confidence.

But he added, “With record employment, low interest rates, and good mortgage availability, buyers have a lot in their favour apart from the lack of political certainty.

READ MORE: Summer ‘travel chaos’ as Heathrow and Stansted airport staff plan strikes

“It could be a good opportunity to negotiate a relative bargain in the second half of the year, if they can set aside the continuing Brexit distractions.”

“Since the Brexit vote, the market has become driven by sentiment far more than the traditional economic drivers of affordability,” Lucian Cook, head of residential research at Savills, said.

“There are early indications that this ripple of caution, that is constraining price growth, is spreading more widely into some of the markets further north.”

The figures are likely to be seen as another warning sign on the state of Britain’s economy, which some analysts believe has contracted in the first half of 2019.

Official figures next month will reveal if recent reports showing severe declines in performance in services, retail, manufacturing, and construction reflect a shrinking UK economy overall.

Manufacturing firms had their worst month in more than six years as Brexit and global trade tensions took a heavy toll, while retail sales suffered a record fall in June as consumers tightened their belts.

READ MORE: Pound plummets amid fears of no-deal Brexit and economic slowdown

Yahoo Finance

Yahoo Finance