UK house prices slip as market loses momentum

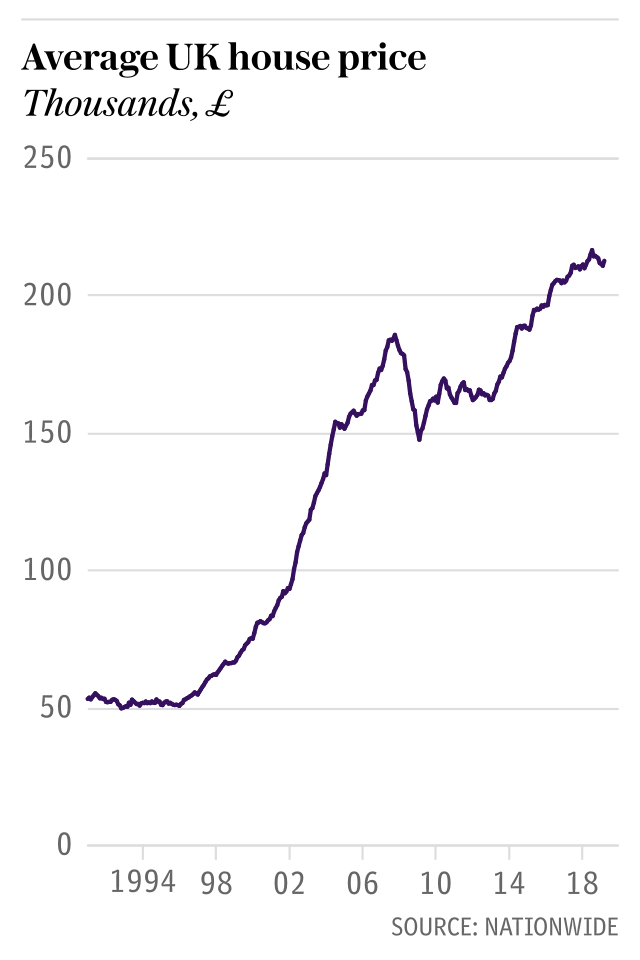

Britain's house prices fell 0.2pc in May, while annual growth slowed to 2.4pc, down from 2.6pc in April, according to figures from mortgage lender Nationwide.

May's dip makes it the third fall in house prices over the past four months, with a modest 0.1pc rise recorded in April. The average UK house price is now £213,618.

Robert Gardner, Nationwide's chief economist, said surveyors were continuing to report subdued levels of new buyer enquiries, while the supply of properties on the market remains "more of a trickle than a torrent".

While house price growth was consistent with the 2-3pc growth recorded over the past 12 months, Mr Gardner said there were "few signs of imminent change".

Nationwide has maintained its forecast for house prices to rise by around 1pc in 2018, with the market dependent on how "broader economic conditions evolve" and a potential increase in interest rates, it said.

The Bank of England has said it expects to raise interest rates later in 2018, after announcing it would hold rates earlier this month. Markets are anticipating three rate hikes over the next three years.

The lender also reported that over the past 20 years the proportion of properties privately rented has doubled, from 10pc to 20pc, while there have been corresponding falls in the proportion of housing stock that is owner-occupied and socially rented.

A report from the Resolution Foundation last month claimed that half of millennials will still be renting in their forties, and a third could still be renting by the time they claim their pensions.

Jonathan Samuels, boss of property lender Octane Capital, said: "Tight supply and subdued demand are the key contributors to the ongoing limbo gripping the UK property market.

"A lethargic economy populated by cautious and squeezed consumers has created a property market lacking both momentum and direction.

"Low stock levels and continued cheap borrowing rates will prevent a material decline in prices but equally a rise greater than very low single digits is highly unlikely."

Yahoo Finance

Yahoo Finance