Half of Brits say lack of affordable housing one of UK's biggest problems

Half of the UK public say a lack of affordable housing is one of the biggest issues facing the country, according to a new survey.

The housing crisis remains high up on the public agenda even as many other challenges have hit households and dominated the headlines, including the health, social and economic impact of the coronavirus.

A poll of 2,000 adults, shared exclusively with Yahoo Finance UK, shows 62% agreed housing policy was an “important issue that has been neglected by successive governments.”

51% said the housing crisis was “one of the biggest issues affecting the UK.” Over-55s were the most likely to agree, despite being far more likely to own their own homes than younger generations.

“While the government is often keen to stress just how important the issue is, events like Brexit and COVID-19 have obviously been prioritised,” said Paresh Raja, CEO of bridging lender Market Financial Solutions (MFS), which commissioned the poll. “Over the coming months, the government must focus on the housing crisis.”

READ MORE: London property prices expected to fall over next three months

The pandemic has shone a light on many housing issues, with concerns over health risks from rough sleeping, cramped living conditions, temporary accommodation and flat or house shares with multiple tenants. A quarter of private renters polled by Shelter last month said their housing situation had made lockdown harder to cope with.

There is a widespread political consensus that Britain has a shortage of affordable homes for both rent and sale, but far less agreement about the causes and how to tackle them.

Official figures earlier this year showed the average home costs around 7.8 times more than average full-time earnings in England. The affordability ratio has worsened over the past two decades, with property prices far outstripping wage growth.

The latest industry data from lender Halifax last week showed average sale prices topping £250,000 in the UK for the first time on record, despite the health and economic crisis engulfing Britain.

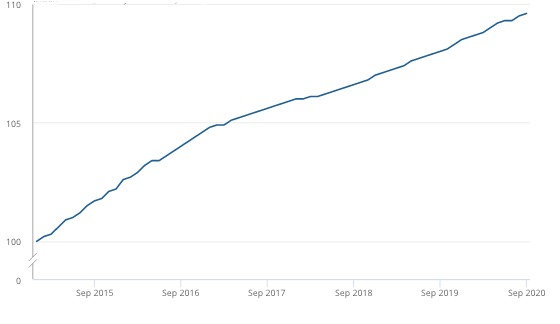

Meanwhile average rents have increased by 9.6% to an average of £507.50 a month since 2015, according to the Office for National Statistics (ONS).

In London, average rents are twice as high as other regions and eat up more than half poor households’ incomes, while property prices are six times their 1970 level. A report in September by the London Assembly’s housing committee said a lack of new affordable homes was a “key cause.”

Prime minister Boris Johnson’s administration has announced several measures, from floating government-backed low-deposit mortgages and providing £3bn loans for affordable housebuilding to launching a controversial shakeup of planning rules.

READ MORE: Can the UK construction and housing boom ride out a tough winter?

It has also introduced a temporary stamp duty holiday in England and Northern Ireland, in a bid to revive the property, construction and related industries during the COVID-19 downturn. Buyers pay no stamp duty on the first £500,000 of a property’s value until 31 March next year.

The move is widely seen to have driven up prices in recent months, but it will help some first-time buyers able to get on the ladder in the short-term.

Almost a fifth of those surveyed in the MFS poll, carried out by Opinium in late October and early November, said it had led them to consider whether to buy before the deadline. The proportion was highest among younger adults, at 32% among 18-34-year-olds.

Raja said there was also a responsibility on those in the property industry to help address housing issues. “It is also up to those involved in the property market – lenders, estate agencies and brokers – to ensure they are doing everything in their power to help prospective homebuyers.”

READ MORE: Average UK house sale price tops £250,000 for first time ever

Watch: What do stamp duty cuts mean for buyers and house prices?

Yahoo Finance

Yahoo Finance