The UK housing market is 'stuttering' — and London house prices are falling

Shutterstock

The UK housing market continued to "stutter" in October with demand from buyers and agreed sales declining further, a major survey shows.

Price falls are now widely-reported in London, according to RICS' monthly UK residential market survey.

RICS chief economist Simon Rubinsohn said the national slowdown is being driven by factors including the cost of moving, Brexit-related uncertainty, and last week's interest rate hike.

LONDON — The UK housing market continued to "stutter" in October with demand from buyers and agreed sales declining further, while price falls are now widely-reported in London, according to RICS' monthly UK residential market survey.

The survey of chartered surveyors found interest from buyers continued to decline over October, with 20% more respondents seeing a fall in new buyer enquiries over the month. Agreed sales were also reported to have fallen, with 20% more respondents noting a decline in transactions over the month at the national level.

RICS chief economist Simon Rubinsohn said the national slowdown is being driven by factors including the cost of moving, Brexit-related uncertainty, and last week's interest rate hike.

"The combination of the increased cost of moving, a lack of fresh stock coming to the market, uncertainty over the political climate and now an interest rate hike appears to be taking its toll on activity in the housing market," he said.

London prices are falling

In London, respondents continue to report a decline in prices, with 63% more respondents reporting a fall rather than a rise in prices over the month — the poorest reading since 2009. On a national level, 1% more surveyors reported a price rise rather than a fall, a dip from the +6% reported in September.

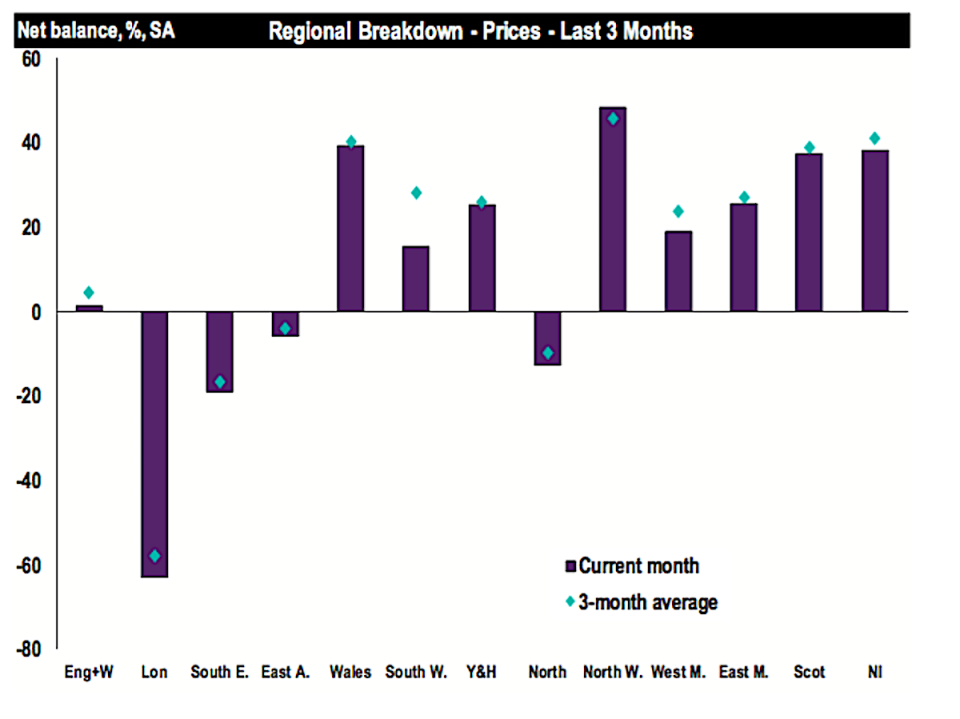

Here's how it breaks down regionally:

RICS

The dire outlook for London house prices reflects other mainstream forecasts.

Estate agents Savills forecasts that prices in Greater London will fall 1.5% over 2017 then fall by a further 2% in 2018, before stabilising in 2019 and returning to growth the year after.

The London slowdown — which is already starting to bite, with Nationwide measuring negative price growth in the third quarter this year — is being driven by bloated prices in the capital, slow progress in Brexit negotiations, and worries about further interest rate hikes from the Bank of England, which drive up mortgage costs.

NOW WATCH: Tesla's biggest problem is one nobody saw coming

See Also:

SEE ALSO: Middle East investment is pouring into London's skyline despite Brexit headwinds

Yahoo Finance

Yahoo Finance