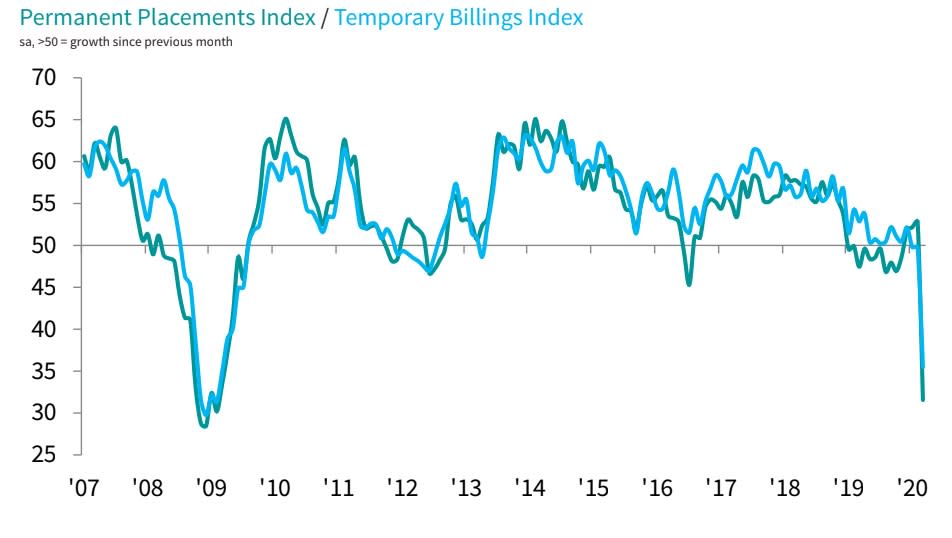

Coronavirus sparks biggest drop in hiring since the financial crisis in 2009

Britain’s record jobs boom is “falling away” as hiring plummets at the fastest pace in more than a decade, new figures show.

With the economy paralysed by the coronavirus and government lockdown, growing numbers of employers are laying off or furloughing staff and freezing recruitment.

A survey published on Wednesday shows employers’ overall demand for new staff falling in March, the first month of declining vacancies since the global financial crisis in 2009.

Data from the Recruitment & Employment Confederation (REC) and professional services giant KPMG also shows the sharpest decline in permanent staff placements by recruiters in 11 years.

Read more: UK workers ‘left with nothing’ by small print of government job schemes

The pandemic also appears to put a fragile recovery in average UK pay at risk, with real wages only recently exceeding their pre-2008 peak after a decade-long squeeze.

The survey shows average pay levels for new starters rising at their weakest pace in four years for permanent staff and seven years for temporary workers.

The pandemic is taking a toll on employment around the world, with the International Labour Organisation (ILO) warning tens of millions of workers could lose their jobs worldwide this year.

Figures released by the ILO on Tuesday predicted lay-offs and cuts to hours will wipe out the equivalent of 195 million full-time workers’ jobs globally in the second quarter.

Read more: UK construction firms slash jobs at fastest pace in a decade

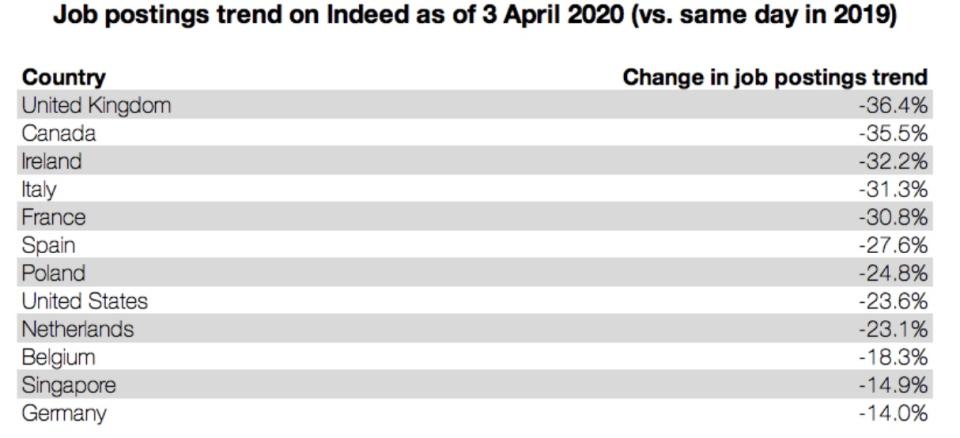

But separate analysis by jobs website Indeed suggests UK employers are cutting back more on hiring than many other large economies. Job postings on the site were down 36.4% in the UK on 3 April compared with a year earlier, higher than the US, Germany, France, Italy and Spain.

Vacancies have dropped just as lay-offs have mounted, with experts warning a steep rise in the official unemployment rate is looming. Almost a million people filed for universal credit in just a fortnight, and hospitality chiefs report hundreds of thousands of job losses in their industry alone.

A Bank of America Global Research report sent to clients on Tuesday found one in three UK workers had stopped work because of COVID-19, either sick, furloughed, laid off or left workless by business closures.

Meanwhile Google Trends data shows rising UK search traffic for jobs in ‘key worker’ roles, the NHS, supermarkets and delivery driver posts, reflecting some of the few areas recruiting to meet growing demand.

Read more: Millions of ‘minimum wage heroes’ earn pay rise despite business hit from COVID-19

James Stewart, vice-chair at KPMG, highlighted a “significant uptick” in demand for healthcare temporary workers and manual labourers, but said it bucked a negative trend. “Unsurprisingly, COVID-19 has already impacted the UK jobs market with recruitment activity falling away as uncertainty grips the nation.”

A desire to learn lessons from past crises sparked the government’s job retention scheme, with the taxpayer and government borrowing funding ‘furloughed’ workers wages who otherwise faced the axe.

Ministers hope it will save firms and jobs, speed recovery and prevent workers becoming long-term unemployed. Yet Neil Carberry, chief executive of the REC, said employers needed cash quicker than the government was disbursing it to survive.

The REC and KPMG survey found four in five recruitment firms were worried about cashflow as their income had dropped, and three in five were considering furloughing staff.

Yahoo Finance

Yahoo Finance