UK lenders expect 'significant' squeeze on unsecured debt to households in 2018, finds survey

Lenders expect to impose a “significant” squeeze on the availability of unsecured debt to UK households this year, according to the latest survey of the sector by the Bank of England.

The results will please policymakers at the Bank, who raised concerns last year about the rapid accumulation of additional credit card and personal loan debt by families and flagged it as a potential risk to financial stability.

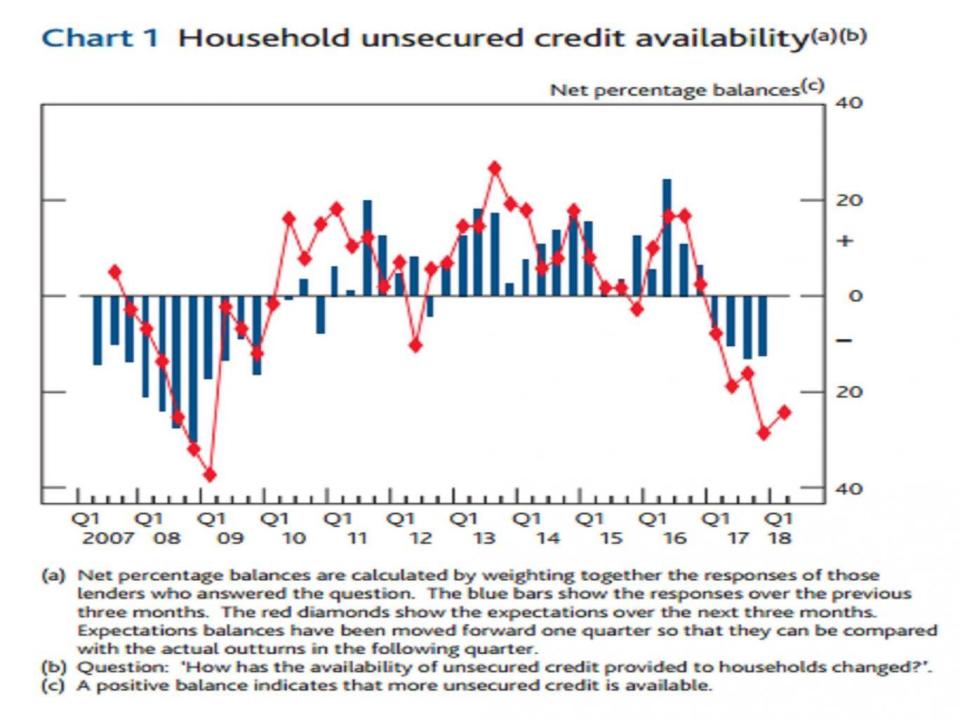

The Bank’s latest Credit Conditions Survey also showed that lenders have been reducing unsecured credit availability for the past four quarters, after increasing it significantly over 2016.

There was also a sharp reported drop in demand for unsecured loans, with the exception of credit cards, in the final quarter of 2017.

This is all broadly consistent with hard data collected by the Bank which showed the annual rate of consumer credit growth slowed to 9.1 per cent in November, down from a peak rate of 10.9 per cent in November 2016.

This was the slowest annual expansion since December 2015.

The saving ratio of the UK household sector – the difference between aggregate income and spending – fell to 5.2 per cent in the third quarter of 2017, the second lowest level in 20 years, stoking fears over the extent to which personal borrowing has been supporting overall GDP growth.

Turning off the taps...

Other research by the Bank and the Financial Conduct Authority released earlier this week showed that UK credit card and personal loan borrowers tend to remain indebted for longer than the regulators previously thought.

It found that around 90 per cent of the total outstanding stock of consumer debt in November 2016 was held by people who also owed debt two years earlier.

Overall UK GDP is estimated to have grown by 0.4 per cent in the third quarter of 2017 and City of London forecasters are pencilling final quarter growth of between 0.4 and 0.6 per cent.

That would take calendar year growth for 2017 to between 1.7 and 1.8 per cent.

This would be the weakest expansion since 2012, at a time when other G7 economies are picking up speed.

Yahoo Finance

Yahoo Finance