London property prices are falling — but still 50% higher than in 2007

Property prices in London are still 50% higher than over a decade ago, despite falling faster than any other UK region over the past year.

The latest figures from Nationwide show a 1.7% decline in average prices paid in London over the three months to September compared to the previous year.

Average prices across the country were 0.3% higher over the same period year-on-year, but have dropped 0.2% over the past month to an average of £215,000.

Prices were most buoyant in the north-west of England, rising 2.5% year-on-year in the third quarter of 2019.

But Nationwide’s figures suggest the capital’s property market remains in a league of its own, despite a slowdown that has seen nine quarters in a row of declining prices.

READ MORE: Property sales expected to fall as ‘never-ending Brexit saga’ spooks market

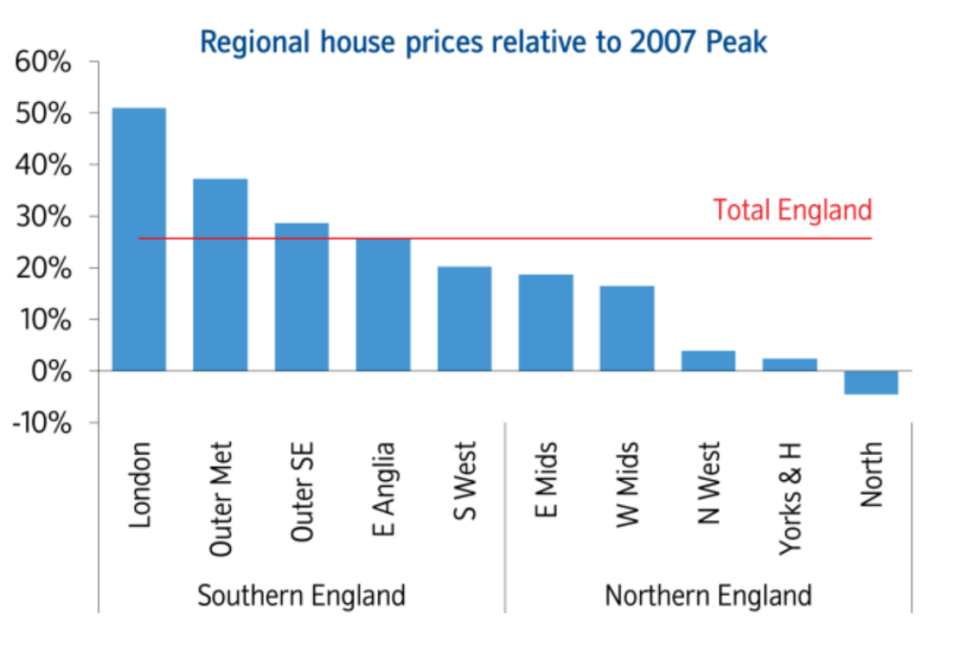

London prices are still about 50% higher than in 2007 just before the financial crisis, and only about 5% lower than the all-time highs reached in the first quarter of 2017.

By contrast average UK prices are only 17% higher than they were 12 years ago.

The capital also remains the most expensive region of the country, with the average price paid in the third quarter just under £461,000.

Mark Harris, chief executive of mortgage broker SPF Private Clients, said the declines in London were “welcome for those struggling to get on the housing ladder or move up” but not far off all-time highs.

“This suggests that this correction has not yet made the capital affordable, but maybe stopped it getting quite so far out of reach. Average figures mask significant differences across both the country and the capital, so it is hard to get a true picture of how the market is performing.”

Robert Gardner, Nationwide's chief economist, said: “London was the weakest performing region in Q3, closely followed by the surrounding outer metropolitan region, with annual price declines of 1.7% and 1.5% respectively.

“House price growth across northern England slowed to 1.4%, but remained ahead of that in the south, which experienced a 0.8% fall in Q3. These trends are not entirely unexpected, however, as affordability is still more stretched in the south, with prices further above their pre-financial crisis levels.”

He said national annual house price growth had “almost ground to a halt” in September, the 10th month in a row of increases below 1%.

Yahoo Finance

Yahoo Finance