UK nears top of list of countries most difficult to get on property ladder

The UK has neared the top of a list of countries where it is most difficult for first-time buyers to get on the housing ladder.

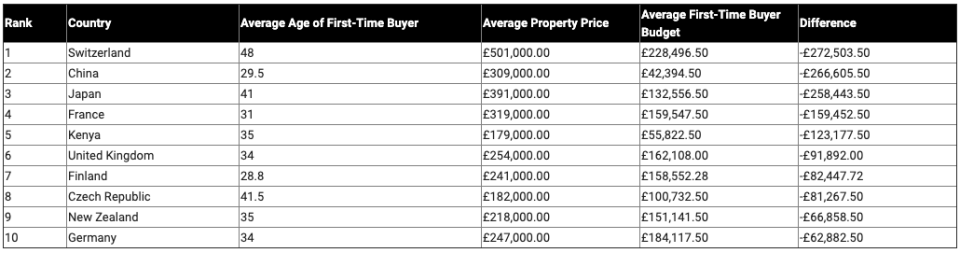

A new global property study by Money.co.uk showed that Brits prospects rank sixth worst, ahead of Kenya, France, Japan, China and Switzerland.

The study, which ranked countries by average age of first-time buyer and average budget compared with average property price, showed brits are on average 34-years-old by the time they’ve bought their first property.

In Switzerland, which tops the list, the average age for first time buyers is 48.

With a difference of £91,892 ($122,859), a first-time buyer in the UK will have to stump up at least 15-20% of this to secure a mortgage based on average salary.

With the average age of first-time buyers now 34, many Brits can't afford to buy property until they're older.

READ MORE: Record decline in UK consumer borrowing but mortgage loans hit record high

Belgium and Iceland rank among the top places to buy your first house young. Both countries have the youngest demographic of first-time buyers in the study, with the average age being 27.

The study also shows that Icelanders earn the highest annual salary out of the 25 countries, taking home £52,433. Belgium comes in 5th place earning £42,860 a year. With a healthy income, both countries are guaranteed to be well within budget to afford their first time property.

The news comes alongside data released today that showed mortgage loans have hit a record high.

While households have reined in consumer borrowing, mortgage lending has soared in recent months after plummeting when the first UK lockdown paralysed the property market.

The pandemic and months of lockdown have triggered a rush to move home among those able to buy, fuelled further by stamp duty cuts in England and Northern Ireland.

The latest figures show 97,500 loans were approved for home purchases in October, marking a new high after September’s record-breaking 92,100 approvals.

Watch: Why are house prices rising during a recession?

Yahoo Finance

Yahoo Finance