UK net-zero tech firms double in value in 12 months – report

The value of the UK’s net-zero tech sector has nearly doubled in the past year despite a major slowdown in investment growth, according to data.

Net-zero tech firms, which develop technology to offset carbon emissions, saw valuations rise from 24.4 billion dollars (£17.8 billion) in 2020 to 47.6 billion (£34.8 billion) in 2021, according to the Net Zero 2021 Report from start-up network Tech Nation

The sector has been bolstered by the arrival of 10 new companies in the past year but the hike in value was driven by funding rounds and stock market listings at established companies.

If these net-zero companies are to fulfil their potential to save our planet, they need more help, support and funding from investors, UK pension funds and policymakers worldwide

Dr George Windsor, Tech Nation

British electric vehicle manufacturer Arrival saw its valuation grow to 16.2 billion dollars (£11.8 billion) after listing on the Nasdaq in the US in March at a valuation of 13 billion dollars (£9.5 billion), the biggest floatation for a UK tech company.

Sustainable energy group Octopus Energy was valued at 4.9 billion dollars (£3.6 billion) after a funding round in September, and energy storage firm ITM Power jumped to a valuation of 2.9 billion dollars (£2.1 billion) after going public in June.

Eight UK net-zero tech firms have passed the billion-dollar (£730 million) valuation “unicorn” status.

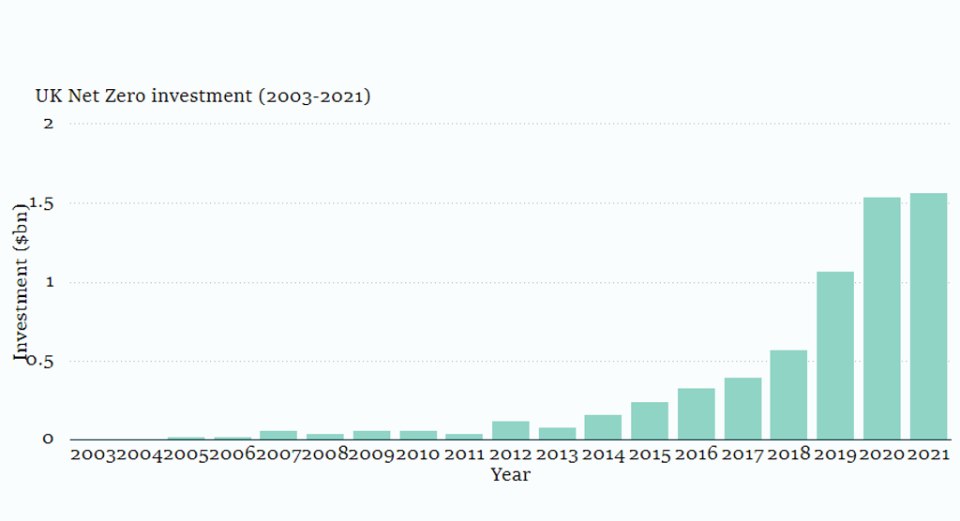

Investment in net-zero firms grew from 1.54 billion dollars (£1.1 billion) to 1.57 billion dollars (£1.12 billion) in 2021, but the figure was a major slowdown on the previous year.

Between 2019 and 2020, net-zero tech firms saw a jump in investment of 470 million dollars (£343 million).

Dr George Windsor, head of insights at Tech Nation, told the PA news agency: “If these net-zero companies are to fulfil their potential to save our planet, they need more help, support and funding from investors, UK pension funds and policymakers worldwide.”

Sweden topped the list of pounds invested per tonne of CO2 emitted, investing more than 10 times the amount in net-zero tech per tonne of CO2 emitted than any other nation.

Tech Nation called on investors and policymakers to prioritise supporting and investing in UK scale-ups ahead of Cop26 this week, setting a target of 15 billion dollars (£11 billion) by 2025.

Read More

Cop26 news: Prince Charles calls summit ‘last chance saloon’

Yahoo Finance

Yahoo Finance