Will the UK and other major nations be richer or poorer in 2024?

Get up to speed with the latest OECD growth forecasts

HENRY NICHOLLS/AFP via Getty Images

The Organisation for Economic Co-operation and Development (OECD) has released the latest edition of its Economic Outlook report, which makes for sobering reading. Growth is expected to be lacklustre in 2024, with many countries still struggling with high inflation and interest rates, weak trade activity, and low business and consumer confidence levels.

That said, it's not all doom and gloom. The report notes that growth could potentially "be stronger if households spend more of the excess savings accumulated during the pandemic", as, believe it or not, many people still have stacks of COVID cash squirrelled away...

Read on to find out how 30 of the world's largest economies will fare in 2024 and discover the predicted best and worst performers. All dollar amounts in US dollars unless otherwise stated.

Argentina: -1.3% growth

JUAN MABROMATA/AFP via Getty Images

In 2024, global growth is projected to drop to 2.7%, down from 2.9% in 2023, while the average growth for OECD countries in 2024 is forecast at 1.4%.

Argentina is poised to be the worst performer of all the nations covered by the OECD, with its economy expected to contract by 1.3%. Battered by runaway inflation – which could peak at over 157% – and by high rates of poverty, the Argentinian economy is in crisis. The country's new leader, right-wing populist Javier Millei, is planning to shake it up by dollarising the nation, wiping out the fiscal deficit, and shutting down the central bank.

On the other hand, the OECD has advised the new government to adopt "more effective" social spending practices to support the poorest in society and minimise public debt.

Netherlands: 0.5% growth

INTREEGUE Photography/Shutterstock

The Netherlands' economy is set to grow by just 0.5% this year. This disappointing figure is below the Eurozone average, which is predicted to come in at 0.9%.

Currently mired in a technical recession, the Dutch economy will muddle through 2024 according to Rabobank, one of the country's leading financial institutions. While challenges such as high inflation, hefty interest rates, and an "overheated" economy (to quote Rabobank's report) will cool somewhat over the course of the year, the Netherlands won't be out of the woods for some time yet. Its strong labour market is considered to be its saving grace.

Norway: 0.5% growth

Richard M Lee/Shutterstock

Another member of the 0.5% club, Norway won't be breaking any records for economic growth in 2024.

Norway's high inflation is proving challenging to reduce and is expected to stay on the steep side at 3.9%. This means interest rates will likely remain hiked as Norway's central bank works to bring down prices – which doesn't bode well for growth.

Austria: 0.6% growth

Arcady/Shutterstock

Like the Netherlands, Austria is experiencing a technical recession, having recorded two consecutive quarters of economic contraction. The country's economy has faltered due to high inflation, punishing interest rates, and the general global downturn. The good news is that Austria is expected to return to growth this year, albeit to a very modest degree.

Lower inflation – the rate is projected to slip from 2023's average of 7.7% to 3.9% – coupled with healthy real wage growth will likely spark a relative boom in consumer spending, throwing the economy a lifeline. This is reflected in a more optimistic forecast from the Austrian Institute of Economic Research (WIFO), which expects growth to hit 1.2% in 2024.

Germany: 0.6% growth

reisezielinfo/Shutterstock

Teetering on the brink of recession, or "slowcession", as economic analysis firm ING referred to it in 2023, Germany has definitely seen better days financially.

Factors such as a softening of inflation and interest rates, along with a slow recovery of German exports, should help to pep up the economy of the manufacturing powerhouse in 2024. But the OECD doesn't foresee meaningful growth, with the figure held at just 0.6%.

The German government is more optimistic and anticipates the economy will expand by 1.3% in 2024.

Italy: 0.7% growth

columbo.photog/Shutterstock

Italy's growth for 2024 is pegged at 0.7%, the same rate as in 2023. This chimes with a recent forecast by the country's official statistics agency, though it's lower than the Italian government's projection of 1.2%.

Italy flirted with recession in 2023 but kept itself above water. Though the country will probably ride on the edge, it should also avoid a downturn in 2024, with consumer spending energised by lower inflation and interest rates combined with targeted income tax cuts.

In addition, an expected gradual upswing in global trade should revive Italy's exports.

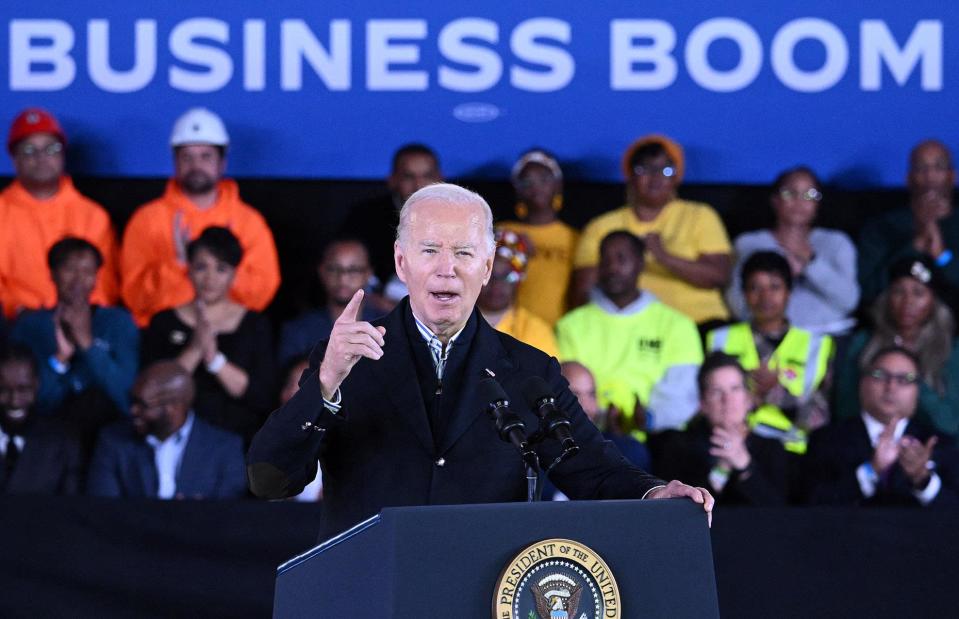

UK: 0.7% growth

HENRY NICHOLLS/AFP via Getty Images

The OECD has downgraded the UK's growth prospects for 2024. In June it placed it at 1%, but that figure has now been trimmed to just 0.7%. Persistently high inflation, which has been slower to fall in the UK than in many other countries, is the nation's Achilles heel. The UK is expected to see an inflation rate of 2.9% in 2024, which will be the second-highest in the G7 and sit well above the Bank of England's 2% target.

Disposable incomes, which have been clobbered by the cost of living crisis, are expected to improve only marginally as interest rates stay elevated in a bid to rein in inflation. One significant drain on personal finances will be the UK's record tax burden; the OECD blames government policies such as freezing the income tax brackets for adding to already-weighty fiscal household pressures.

France: 0.8% growth

Victor Jiang/Shutterstock

Partially thanks to its tight labour market, France is set for modest growth. Consumer spending is expected to increase, but the effect will probably be tempered as interest rates, though flattening, will remain fairly high.

According to the OECD, with other economic indicators looking far from promising, growth in France will be subdued over the course of 2024. That said, the French government is more confident, with a forecast of 1% growth against the OECD's 0.8%.

Canada: 0.8% growth

LARS HAGBERG/AFP via Getty Images

Higher interest rates and sluggish exports are damaging the Canadian economy, which is in the midst of a slowdown. But while these headwinds will continue to blow in 2024, they're predicted to settle down as the year progresses.

Meanwhile, rising unemployment also threatens to weaken the economy, with laid-off workers in the loose labour market determined to tighten their spending. Consequently, the OECD forecasts an underwhelming 0.8% growth for Canada. This aligns with S&P Global's prediction and is slightly lower than GlobalData's assessment of 0.9%.

Sweden: 0.9% growth

ArDanMe/Shutterstock

While Sweden is expected to report negative growth in 2023, it's tipped to return to positive territory in 2024. High inflation rates and stiff borrowing costs have weighed heavy on the Swedish economy but are expected to fall back over the next 12 months. As consumer spending recovers, the end result will be uninspiring growth but growth nonetheless.

Danske Bank is even more optimistic. It's predicted a growth rate of 1.3% in 2024, highlighting reasons such as the government and private sector's substantial manufacturing investments and the weak Swedish krona, which should help bolster exports.

Switzerland: 0.9% growth

Pani Garmyder/Shutterstock

Switzerland's economy is forecast to grow 0.9% in 2024 too. In contrast to the Swedish krona, the Swiss franc has stayed strong and while this is helping to bring down inflation, it's not doing the country's exports any favours, particularly with global demand so low.

Inflation and interest rates will remain high by Swiss standards through to 2025, meaning consumer spending and exports could both take a hit. Against the odds, however, household expenditure has remained remarkably strong – and might stay that way in 2024.

Finland: 0.9% growth

astudio/Shutterstock

Finland, which is already reeling from high inflation and interest rates, may also face falling house prices at the start of 2024. However, as these alleviate through the year and the prices for energy, food, and borrowing begin to drop, the country's economic fortunes will no doubt improve, albeit not by a massive amount.

Despite talk of recession – the Finnish economy contracted in the third quarter of 2023 – Finland is predicted to avoid a pronounced downturn and achieve growth of 0.9% in 2024.

Japan: 1% growth

RICHARD A. BROOKS/AFP via Getty Images

Japan is faring better than expected and its economy is forecast to expand beyond the potential growth rate in 2024. However, the OECD's predicted rate of 1%, which the International Monetary Fund (IMF) agrees with, is still no cause for celebration.

Among the positives are a tight jobs market, strong real wage growth, and government subsidies for green tech, all of which are stimulating consumer spending and investments. But inflation is unlikely to return to the target level until 2025, exports may flatten over the next few months, and the national debt is likely to remain exceptionally high.

South Africa: 1% growth

Per-Anders Pettersson/Getty Images

Mirroring Japan, South Africa's growth rate is projected to stand at 1% in 2024. The power cuts plaguing the country should wane thanks to investments in energy infrastructure, which have the added bonus of livening up the economy.

Consumer spending will likely remain positive despite high inflation and interest rates, though these are anticipated to fall as the year progresses. However, the country still has more than its fair share of economic challenges, which range from weak exports to excessive public debt.

Belgium: 1.1% growth

Jan van der Wolf/Shutterstock

Belgium also has lots of issues to address. Bucking the global trend, inflation in the country is actually set to rise in 2024, with the rate predicted to increase from 2.4% to 3%. A key underlying cause is Belgium's doggedly high energy prices, with The Brussels Times reporting in October 2023 that the nation's electricity bills are the third-highest in the world.

These jacked-up prices are likely to have a detrimental impact on consumer spending, which will be further stunted by a loosening labour market. The end result, according to the OECD, will be growth of 1.1% in 2024, down from 1.4% in 2023.

New Zealand: 1.3% growth

Victor Maschek/Shutterstock

New Zealand's economy is also forecast to slow down in 2024, with the annual rate falling from 2.1% to 1.3%. Interest rates are predicted to stay high, with "sticky" inflation proving tricky to control and blunting consumer spending as a result.

On the upside, increased inward migration should support growth and the figure may even improve if tourists come in higher numbers than expected, which is a distinct possibility.

Australia: 1.4% growth

ChameleonsEye/Shutterstock

Australia is tipped to see growth of 1.4% in 2024, meaning it will fare slightly better than its neighbour Down Under. While the figure is bang on the OECD average, it will technically be a decline as the Australian economy is expected to have grown by 1.9% in 2023.

While inflation is forecast to fall, triggering a probable relaxation of interest rates, the numbers are unlikely to be on target in 2024. This will impact consumer spending and drag the economy throughout the year. Fortunately, these headwinds should be offset to an extent by strong growth in the working-age population and flourishing tourism exports – and, as the IMF has noted, Australia's economy is proving more resilient than many.

Spain: 1.4% growth

JOSE JORDAN/AFP via Getty Images

Spain's growth rate has held up astonishingly well, but the OECD has hardened its stance of late. Earlier this year, it predicted growth of 1.9% for the country in 2024, although this figure has since been downgraded to 1.4%, the OECD average.

Although they're on a downward trajectory, inflation and interest rates will remain above target throughout 2024. As a result, consumer and business spending and investment will slow, but demand shouldn't fall to drastically damaging levels.

According to the OECD, Spain's key difficulties include its huge national debt and substantial rate of youth unemployment.

USA: 1.5% growth

MANDEL NGAN/AFP via Getty Images

The USA is predicted to surpass the OECD average and record a respectable 1.5% growth in 2024. In a relative sense, America's economy boomed in 2023, although the effects of continuous high interest rates will likely reverberate, harming spending and investment.

Thankfully, by the end of 2024, inflation should have eased enough to pave the way for interest rate cuts, with the jobs market staying tight all the way through. The US Federal Reserve also predicts growth of 1.5% in 2024, as does the IMF.

Chile: 1.8% growth

Andrea DiCenzo/Getty Images

As per the OECD forecast, the Chilean economy stagnated in 2023, with minimal movement. However, it should pick up again in 2024, with a solid 1.8% growth predicted. (The IMF has predicted this figure will be even higher, at 2%).

Among Chile's strengths are its rising real wages, falling inflation and interest rates, and a buoyant demand for its mineral exports, essential for the transition to carbon neutrality. However, the country's economy is still vulnerable to everything from climate change-related events (such as extreme rain or drought) to a slowdown in China that could sap trade.

Iceland: 2% growth

Oleg Senkov/Shutterstock

The ideal growth rate for a developed country is between 2% and 3%. This means Iceland is expected to achieve optimum growth in 2024, though its rate has exceeded 6% in recent quarters.

While inflation may be falling, real wage growth has been minimal. Other factors, including rising unemployment and lower tourist numbers, are also set to impact growth, which, while technically "ideal" at 2%, is still down on the 2023 figure. It's predicted to rise to 2.3% in 2025.

South Korea: 2.3% growth

humphery/Shutterstock

In contrast, the South Korean economy is expected to perform better in 2024, with predicted growth of 2.3% compared to 1.4% in 2023.

Exports, particularly of semiconductors, will eventually recover in 2024, while inflation is anticipated to reach its target level by the start of 2025, boosting consumer spending. But the effect will be dulled by high interest rates, which are unlikely to be reduced significantly for a good while yet. This could explain the Bank of Korea's more pessimistic growth forecast for 2024, which sits at 2.1%.

Ireland: 2.4% growth

Roy Harris/Shutterstock

After contracting in 2023, the Irish economy is projected to experience growth of 2.4% in 2024. However, Ireland's growth rate is skewed somewhat due to the high number of multinationals that report their income in the country.

The more specific modified domestic demand (MDD) indicator gives a better sense of how Ireland's actual economy is faring. MDD growth is predicted to slip from 2.1% in 2023 to 1.7% in 2024 due to the ramifications of high inflation and interest rates, which will remain elevated despite fractionally falling.

Mexico: 2.5% growth

CLAUDIO CRUZ/AFP via Getty Images

The OECD expects Mexico's economy to grow by 2.5% in 2024, down from 2023's rate of 3.4%. The Bank of Mexico has higher hopes, having settled on 3% growth after upgrading its initial estimate.

A tight labour market, strengthened by US companies reshoring their manufacturing in the country, and real wage rises have all contributed to strong consumer spending. That's despite high inflation and interest rates, which admittedly are falling.

While less impressive than 2023, rates of consumption are poised to stay high. Other economic buttresses include the abundance of government infrastructure projects in development.

Poland: 2.6% growth

Wojtek Laski/Getty Images

After shrinking 0.4% in 2023, Poland's economy is predicted to bounce back in 2024 and grow by 2.6%. Inflation peaked at 14.4% in 2022, fell to 11.9% in 2023, and is expected to drop to 5.7% in 2024, which is still well above the target range. In any case, the slowing of price rises will likely lead to a rebound in consumer spending.

The OECD has also cited significant investment, backed by the EU Recovery and Resilience funds, as a crucial driver of growth in Poland.

Türkiye: 2.9% growth

ruelleruelle/Alamy

Türkiye's projected 2024 growth rate of 2.9% is quite incredible, given the country's high rate of inflation. The figure for 2023 is forecast to average 52.8% and, though trending downwards, it's predicted to stay high through 2024 at 47.4%.

With interest rates also elevated, consumer spending will almost certainly remain weak in the near future. However, this downside is offset by solid exports and a construction boom sparked by 2023's devastating earthquakes.

Costa Rica: 3.5% growth

Dylan Martin / Alamy

Costa Rica's economy is forecast to grow by 3.5% in 2024. While its reputation as a Latin American powerhouse is waning as public services deteriorate, the country remains a growth leader on the continent.

Domestic demand is expected to increase and investment should pick up as the year progresses. While inflation is projected to fall to 1.9% in 2024, the OECD puts it back at 3.1% in 2025.

China: 4.7% growth

ISAAC LAWRENCE/AFP via Getty Images

China's economy has been underperforming and is set to slow further in 2024. Its GDP growth figure is forecast at 5.2% for 2023 and is expected to fall to 4.7% in 2024. These numbers are a far cry from the 8.4% it achieved in 2021, not to mention the 14% it pulled off in 2007.

The troubled property sector, unsustainable local government debt levels, and rising unemployment will likely stifle growth, and the general mood will likely be one of "save not spend". It's worth underlining that despite the negatives, China's growth rate remains enviable by global standards.

Indonesia: 5.2% growth

Ulet Ifansasti/Getty Images

The OECD is bright and breezy about Indonesia's growth prospects. The rate is expected to stand at 4.9% in 2023, climb to 5.2% in 2024 and stay in the same region in 2025.

Keeping GDP above 5% will be instrumental to ensuring the jobs market can stay in shape. Easing inflation and interest rates will undoubtedly stimulate spending through 2024, while an upswing is on the cards for the construction industry as the country's new capital city, Nusantara, takes shape.

India: 6.1% growth

PradeepGaurs

India's growth in 2024 is set to surpass that of China and other rivals. The OECD forecasts a rate of 6.1%, up from the 6% it predicted in September, though still lower than the 6.3% projected for 2023.

Tumbling inflation and interest rates are forecast to perk up spending, while exports and public investment are expected to remain strong. The effects of adverse weather events related to El Niño and climate change and muted global economic activity are among the main stumbling blocks. However, these negatives are expected to abate as the year progresses.

Now find out which nations spend the most on healthcare

Yahoo Finance

Yahoo Finance