The UK property boom is now bigger than the 2007 housing bubble in the US

REUTERS/Sang Tan

Bank of England governor Mark Carney said again that he was worried about the growth of buy-to-let (BTL) mortgages in Britain. Speaking to a panel of MPs today, the Evening Standard quoted him as saying:

We think developments in the buy-to-let market have warranted heightened scrutiny and have done so for some time.

As a general rule, any time you see a very sharp and sustained increase in activity in one area … it at least bears heightened scrutiny.

The problem with BTL mortgages is that their interest rates reset at higher rates if the BoE rate changes, and they are often given to borrowers who have lower credit ratings than regular homeowners. (Plus, of course, they rely on a continued supply of new renters to make the payments, not merely the owner's own income.) And every BTL mortgage reduces the supply of new homes for sale to regular mortgage applicants, because by definition every BTL holder doesn't want to actually live in the house they're buying. So BTL jacks up prices by reducing supply, and concentrates ownership in the hands of those most vulnerable to credit shocks.

So let's put some hard numbers on that.

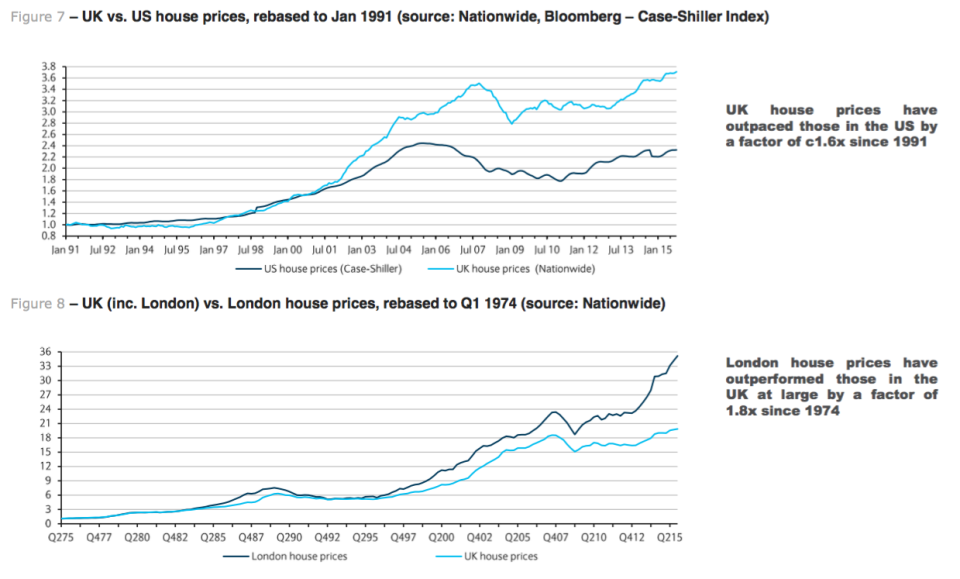

These scary charts from Barclays suggest that if the UK is in a bubble, it's proportionately worse than the US housing bubble was when it popped in 2007 during the credit crisis.

When UK and US prices are indexed to 1991, you can see that US prices took a breather after 2007 and then resumed their moderate upward path. Not so in Britain! The 2007 crash was steeper, but then the UK market roared sharply back and went even higher:

REUTERS/Sang Tan

Property in the UK isn't merely proportionately more valuable than it was at the height of the 2007 credit bubble, it's also significantly more valuable than property in the US is now.

The London market, in the second chart, is even worse. Indexed to 1975, London houses have added double the value of the average in the UK. The London market is distinct because it's basically a separate city-state from the UK, and because it is surrounded by an unbuildable "green belt," which makes it more like an island than a conurbation.

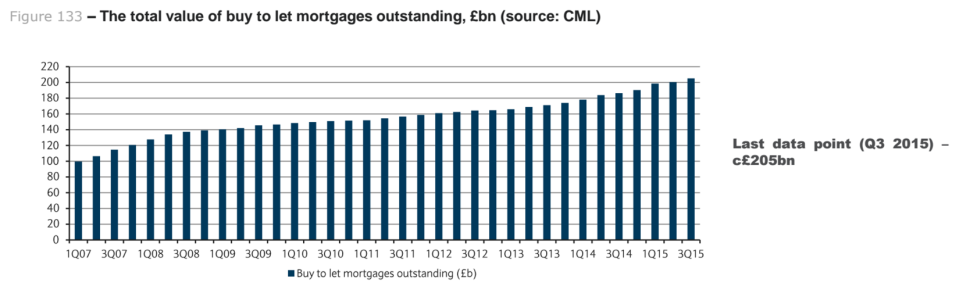

Inside that, here is the run-up in BTL mortgages:

REUTERS/Sang Tan

That £205 billion ($294 billion) in mortgages that holders are hoping will never decline in value. BTL loans are 16% of all mortgages in the UK, a proportion that is itself also a new record.

None of this answers the question of whether the UK is in a boom or a bubble. But the fact that the market shrugged off the bubble-burst of 2008 suggests the market has underlying fundamentals that are more robust than the credit markets that serve them.

NOW WATCH: How to make a 'flat white' — the Australian coffee drink that has Americans all confused

See Also:

SEE ALSO: The housing bubble in Sweden is so severe there is a shortage of toilets

Yahoo Finance

Yahoo Finance