UK public borrowing lower than expected in August due to strong VAT revenue

Public borrowing came in lower than expected in August thanks to strong VAT receipts, offering some welcome news to the Chancellor Philip Hammond ahead of November's Budget.

The Office for National Statistics reported that state borrowing was £5.7bn in the month, lower than the £7.1bn that City of London analysts had expected.

VAT receipts were up a healthy 5.6 per cent on the same month a year earlier, taking the growth rate for the current 2017-18 fiscal year to 3.1 per cent.

Decent sales tax revenues represent a possible sign consumer spending is holding up despite the spike in inflation resulting from by the post-Brexit vote slump in sterling.

However, income tax and corporation tax receipts were down 0.6 per cent and 4.3 per cent on the same month in 2016-17.

Current Government spending was down 0.1 per cent on a year earlier.

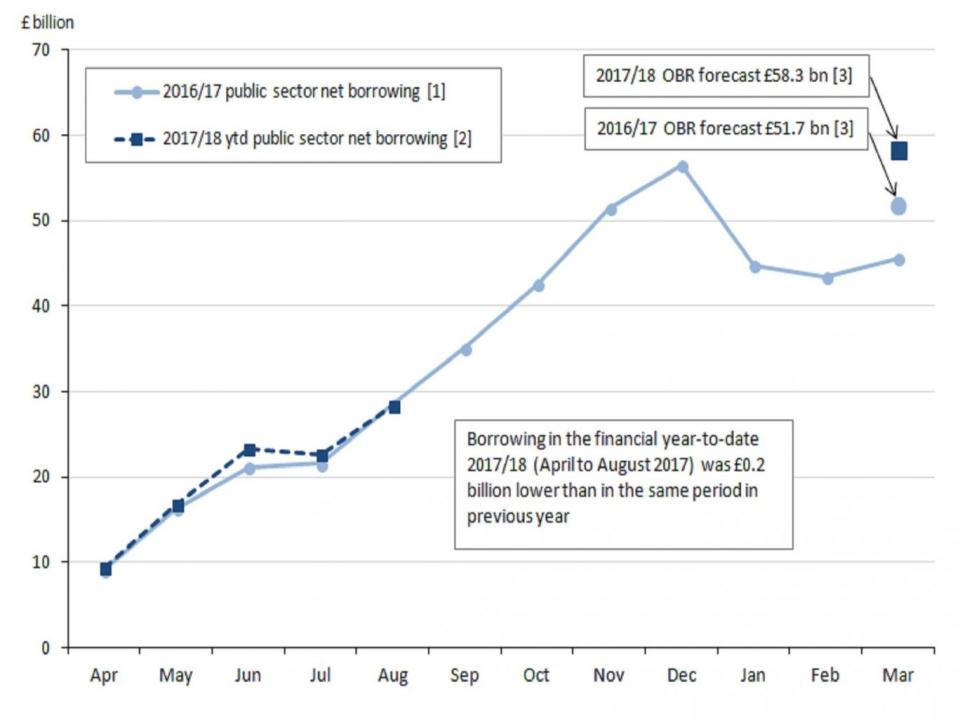

Total borrowing so far this financial year is £28.3bn, only slightly down on the £28.5bn at the same stage in 2016-17.

The Office for Budget Responsibility's most recent forecast in March was for public borrowing to come in at £58.3bn in 2017-18, up from the £45.6bn borrowed in 2016-17.

The OBR will announce its new public borrowing forecasts at the time of the next Budget on 22 November.

Undershooting forecasts

"If the trend in the public finances seen so far this fiscal year continues, then borrowing would undershoot the OBR’s forecast by £13bn," said Paul Hollingsworth of Capital Economics. "Even if that figure shrinks a little, the Chancellor is still likely to have some extra money to play with – on top of the scope already contained within the fiscal rules. As a result, some easing back on austerity, to help households struggling in the face of the squeeze on real incomes, looks likely."

Other analysts were doubtful the improvement would last.

"The public finances were helped in the latter months of 2016/17 by a number of special factors that will not be repeated in 2017/18. Furthermore, a still lacklustre economy and higher interest debt payments look likely to weigh down on the public finances over the coming months," said Howard Archer of the EY Item Club.

If the Bank of England raises interest rates to curb inflation at its November meeting, something many analysts now expect, that would push up the Government's own debt interest bill.

UK 10 year Gilt yields are currently 1.367 per cent, already up from just 0.975 as recently as 7 September.

Yahoo Finance

Yahoo Finance