UK fires double stimulus salvo to soften coronavirus hit

By William Schomberg, David Milliken and Andy Bruce

LONDON (Reuters) - Britain unveiled a 30 billion-pound stimulus plan on Wednesday to help the economy as it faces the risk of a coronavirus recession, hours after the Bank of England slashed interest rates in a double-barrelled response to the crisis.

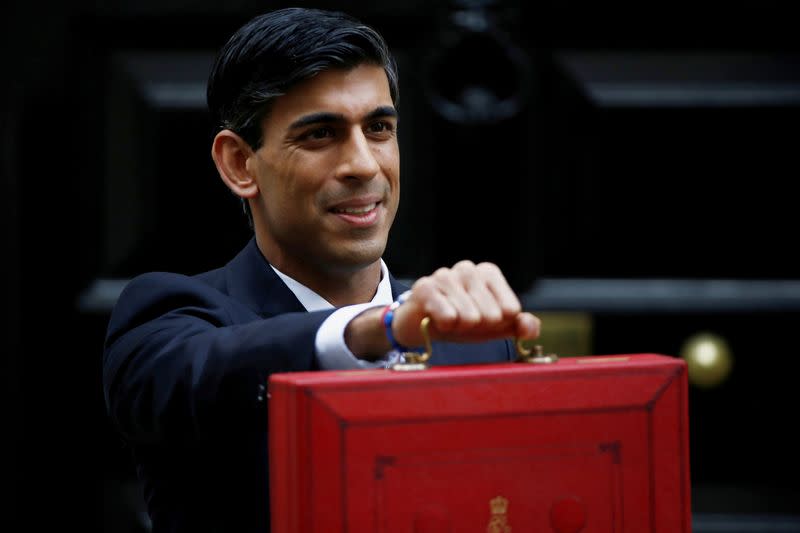

Prime Minister Boris Johnson's new finance minister, Rishi Sunak, announced the higher spending as part of a much larger debt-fuelled five-year investment surge that budget forecasters said represented the biggest stimulus splurge since 1992.

Sunak said Britain faced a temporary but significant hit from the virus, which has stoked fears of a global recession.

"Up to a fifth of the working age population could need to be off work at any one time. And business supply chains are being disrupted around the globe," Sunak said in an annual budget speech to parliament on Wednesday.

"I will do whatever it takes to support the economy."

The 39-year-old former Goldman Sachs analyst, who has been in the job for just a month, said he would ease a cash-flow crunch for companies with measures including a year-long suspension of a property tax for smaller firms and help in providing sick pay.

Businesses and self-employed people could defer tax payments and he relaxed sick pay qualification rules.

The cost of helping businesses and individuals was around 7 billion pounds while 5 billion pounds would go to the health service and other departments fighting the spread of the virus. A further 18 billion pounds would go toward additional stimulus.

Johnson had hoped his first budget would showcase his ambition to direct investment towards poorer regions, where voters helped him to a big election victory in December, and he ordered Sunak to open the spending taps to make it happen.

Public investment of more than 600 billion pounds over the next five years, hitting levels not seen since 1955, represents a turning point for Britain after a decade of austerity under Johnson's Conservative Party.

The Office for Budget Responsibility, whose forecasts underpin the budget, said the deficit would hit nearly 3% of GDP in the 2021/22 fiscal year, up from a previous forecast of 1.6%, even before the coronavirus slowdown was taken into account.

"A recession this year is quite possible if the spread of coronavirus causes widespread economic disruption," it said.

The United Kingdom has reported 456 confirmed cases of coronavirus so far, and six deaths.

PwC chief economist John Hawksworth said Sunak was raising spending in the face of uncertainties about coronavirus, the global economy and Britain's ability to secure a European Union trade deal. "Time will tell if this gamble pays off," he said.

The OBR said Sunak's plans would add 125 billion pounds to Britain's public debt by the mid-2020s, or 4.6% of GDP. That would mean the debt-to-GDP ratio holds steady at around 75% rather than falls as previously planned, and there was no guarantee that borrowing costs would remain at recent record lows.

BOE RATE CUT

Against a backdrop of plunging global stock markets and signs of a nascent slowdown in Britain, the Bank of England cut its key rate by half a percentage point to 0.25% early on Wednesday, echoing last week's emergency move by the U.S. Federal Reserve.

It also introduced a new programme for cheap credit and reduced a capital buffer to help banks to lend.

"It is a big deal," Governor Mark Carney said, estimating that the BoE's measures were equivalent to "north of 1%" of economic output.

Britain's economy unexpectedly flat-lined in January, before the coronavirus impact kicked in, data showed.

Despite slower growth forecasts and higher spending, Sunak said he would be able to meet the fiscal rules set by his predecessor Sajid Javid.

But the OBR said the coronavirus outbreak increased the risk that he would miss one of those rules - to balance day-to-day spending against tax revenues in three years.

Sunak said a duty on fuel would be frozen for a ninth year in a row -- a move likely to disappoint climate change campaigners -- but hinted it might rise before long.

Diesel subsidies for some businesses would end, as would a capital gains tax exemption for owners of multi-million pound businesses, raising around 3.5 billion pounds annually.

(Writing by William Schomberg; Additional reporting by UK bureau; Editing by Guy Faulconbridge, Catherine Evans and Toby Chopra)

Yahoo Finance

Yahoo Finance