UK's Serious Fraud Office confirms investigation into Bombardier

The Serious Fraud Office (SFO) confirmed on Thursday that it is investigating Bombardier Inc. (BBD-B.TO) over suspected bribery and corruption charges. They stem from alleged possible contracts and orders from Garuda Indonesia, an Indonesian state-run air carrier.

As this is a live investigation, the SFO said it could not provide further comment.

Headquartered in Montréal, Canada, Bombardier has production and engineering sites in over 25 countries across the segments of aviation and transportation. The company’s shares are traded on the Toronto Stock Exchange (BBD).

In response to the investigation, Bombardier made the following statement to Yahoo Finance:

“In May 2020, former CEO of Garuda and one of his associates were convicted in Indonesia of corruption and money laundering following a series of transactions involving various aircraft manufacturers, including the sale of CRJ1000 aircraft dating back to 2011. No charges have been laid against Bombardier or its employees in connection with this matter. In accordance with best practices when such allegations come to our attention, we have launched an internal review conducted by external counsel and we are cooperating with the investigation open by the UK Serious Fraud Office which has contacted Bombardier further to the Indonesian judgments. We have no further update to provide at this time.”

Watch: Why can't governments just print more money?

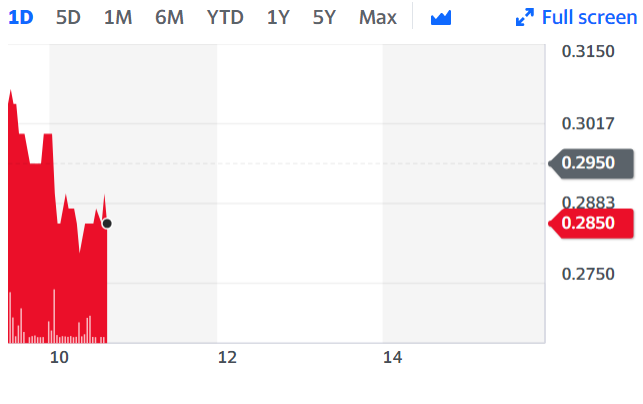

Company shares sank by 3.4% at about 3.40pm in London on Thursday.

The company also reported its Q3 results on Thursday. It said its total revenues of $3.5bin (£2.63bn) were lower by 5% year-over-year due to coronavirus pandemic-related disruptions and divestitures.

It also said it expects higher deliveries of its flagship Global 7500 business jet, rising to 12 jets during the last three months of 2020, up from eight during the third quarter.

It is removing its assets, including its rail division to French train maker Alstom SA (ALO.PA), in an effort to reduce its debt and become a “pure-play business aircraft company,” Bombardier said in statement on the results on Thursday.

“We are very excited about our future as a focused business jet company, about our opportunities to grow the services business, and to leverage our industry-leading product portfolio,” said Éric Martel, president and chief executive officer of Bombardier in company statement.

“We look forward to sharing the details of our plans in the near future, as we finalize our debt management strategy and cost-cutting initiatives to ensure our profitability in the current market and strong growth once the pandemic subsides.”

Despite the COVID-19 trouble, the business had an order intake of $1.5bn for the quarter following notable contract awards, including those in Spain, India and the US.

“With several contract awards having been delayed globally over the past six months due to the COVID-19 pandemic, we now expect a strong order recovery in the final months of 2020 with a healthy mix of options being exercised as well as service contracts,” the company said.

WATCH: Alstom confirms talks on Bombardier deal

Yahoo Finance

Yahoo Finance