UK startups suffer 'worrying' drop in funding

Early stage funding for UK startups dropped by 15% in 2018 according to new data released on Tuesday.

Beauhurst, a consultancy and information company that tracks equity funding, released its flagship “The Deal” report on Tuesday. It showed seed stage funding for startups tailed off last year to its lowest level since 2014. Beauhurst analyst Henry Whorwood called the trend “worrying.”

“The seed-stage can often be thought of as the canary in the coalmine: if seed-stage activity drops off, the pipeline of investable companies at venture and growth stages also diminishes in time,” Whorwood wrote in the report.

“Seed” funding refers to the earliest investments in a startup business and often comes from individuals such as friends, family, and so-called “angel” investors, who are wealthy individuals who regularly invest in startups.

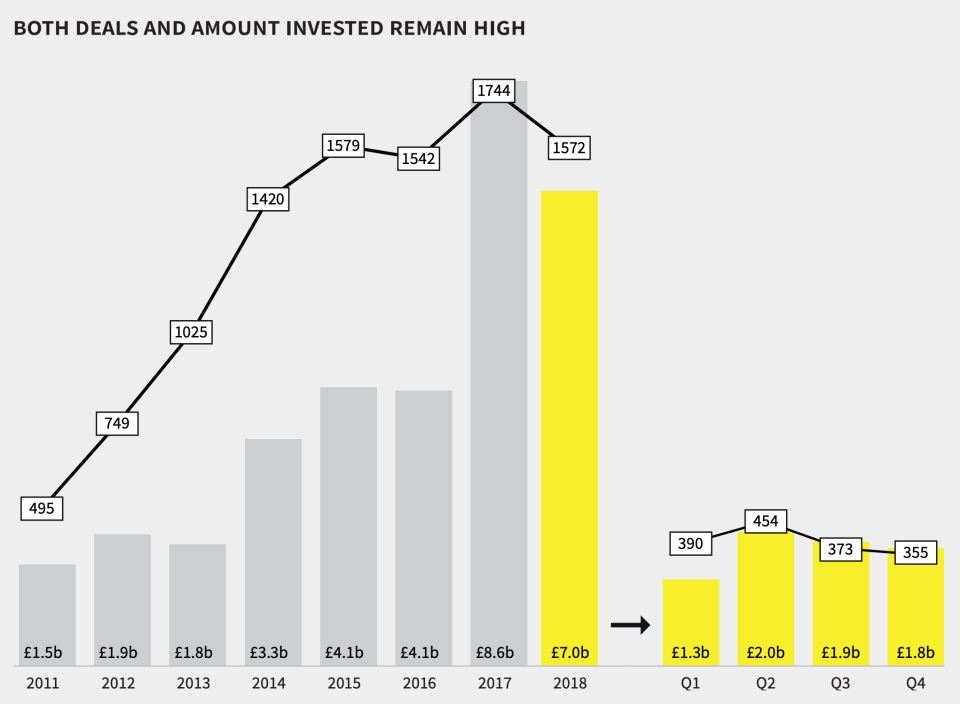

Overall, equity funding in the UK dipped slightly to £7bn in 2018, down from £8.6bn in 2017. The total number of deals also declined by 10% to 1,572.

Beauhurst CEO and cofounder Toby Austin down-played the decline, writing in the report: “This could be interpreted as a ‘correction’ from the dizzy heights of the previous year.

“Indeed, £7bn in equity investment is nothing to be sniffed at, particularly when considering that two years ago, the total figure was just £4.1bn.”

Notable funding deals last year included General Atlantic’s £189m investment in invoice factoring startup Greensill, banking startup Revolut’s £180m Series C round, and a £158m raise by machine learning company Graphcore from a consortium of investors.

Austin said he and his team are reluctant to predict exactly how the UK’s looming Brexit will effect investment but said: “There will likely be significant negative pressure on available capital, not least with the inevitable loss of cash from the EIB, ERDF and EIF who currently back a range of VC funds and grant providers.”

———

Oscar Williams-Grut covers banking, fintech, and finance for Yahoo Finance UK. Follow him on Twitter at @OscarWGrut.

Read more:

A hedge fund billionaire has given Cambridge £100m — one of the biggest UK university donations ever

British retail is in turmoil — but the City still loves JD Sports

SoftBank pumps $37m into robot dog company Boston Dynamics

Goldman Sachs and HSBC invest $20m in startup trying to make banks more like Apple

Yahoo Finance

Yahoo Finance