The UK has surged to become one of the biggest exporters in the world – but this isn’t all good news

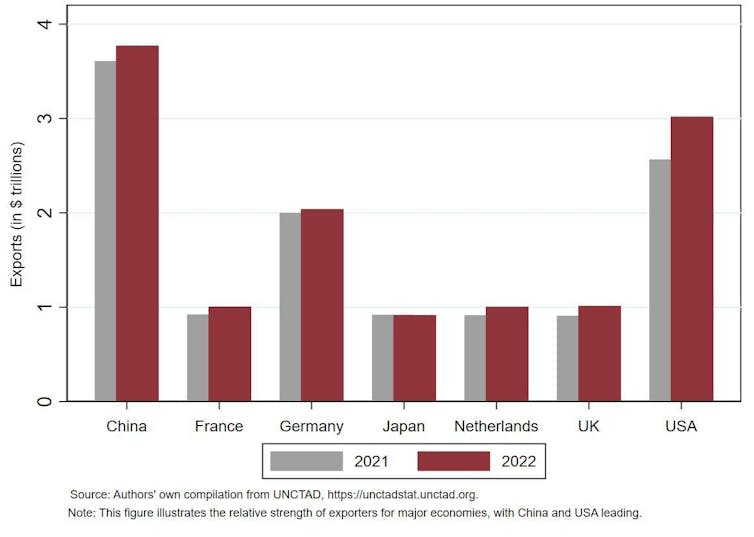

The UK’s rise to become the world’s fourth largest exporter sparked a wave of celebration among the country’s policymakers, politicians and trade analysts. According to new data, the UK overtook major economies like France, the Netherlands and Japan, and sat behind only China, the US and Germany in 2022 with US$1.02 trillion (£808 billion) in exports.

At first glance, this seems a significant coup, showcasing the UK’s economic resilience. But before cracking open the champagne, it’s worth considering what these numbers truly mean and whether they tell the full story.

Looking at the top-line export figures alone can be misleading when gauging a country’s true economic competitiveness. This is because total exports report the value of products, including the costs of everything that goes into making them. But some of this – parts and labour known as “intermediate inputs” – will be imported.

Think of the value of a Mini car made in the UK and exported abroad. With it being assembled domestically, the finished car counts as a UK export. However, a good portion of its total value (more than 60% in some cases) is added earlier in the supply chain by companies in other countries. The UK then imports the value of the parts and labour to complete the car production.

So the UK’s export ranking may not accurately reflect its economic strengths and productive capability. The US$1.02 trillion headline may hide a large portion of value created far from the UK shores.

And the net value of the UK’s output produced domestically as a percentage of GDP (after adding all output and subtracting intermediate inputs) confirms this. This has been on a steady decline since the 1990s, reaching a value of 16.7% in 2022. On top of that, the value of imported intermediate inputs (the things the UK buys in to produce its finished products) increased in 2022 by 4.8% and 11.9% from EU and non-EU countries respectively. Both figures indicate an increasing UK reliance on imported goods.

So why is there a problem here? Since the exports are rising, even if the amount of value the UK feeds in is reduced, total exports still add value to the economy, right? Again, it’s not straightforward.

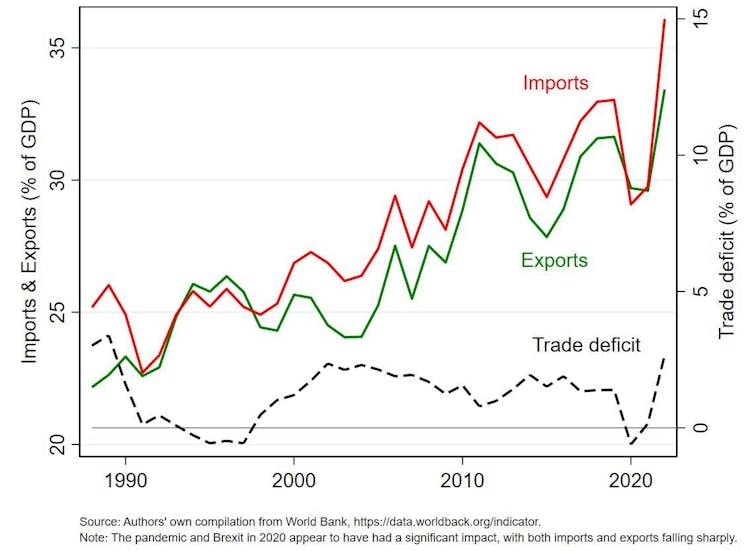

In 2022, there was an impressive rise in UK exports, but the data also shows an even faster increase in imports into the UK. This produced a trade deficit (when a country imports more than it exports) of almost £66.8 billion, the highest since 1989.

One reason for this was the Bank of England (BoE)’s aggressive cycle of interest rate hikes to combat inflation.

Raising UK interest rates attracts foreign investment, increasing demand for the pound, which strengthens its value. A stronger pound makes imports cheaper but exports more expensive, potentially leading to the UK importing more than it exports.

But from the early 2000s, imports exceeded exports consistently. This can’t be explained solely by the BoE interest rate decisions. And even though having a trade deficit is not necessarily indicative of an unhealthy economy, a prolonged deficit may raise concerns around the UK’s export-led economic growth narrative.

Economic theory suggests that persistent trade deficits, especially where imports are taking the place of domestically produced goods, may highlight weaknesses in certain industries due to low productivity, a lack of international competitiveness, or both.

It can also point to over-reliance on certain imports, which can effectively make the economy complacent and limit efforts towards innovation and efficiency. This, in fact, is what UK productivity data reveals – it has under-performed relative to comparable economies like France or Germany, with the UK annual average productivity growth rate being just 0.5%.

Interestingly, even though the sharp drop in imports and exports in 2020 can be explained by the COVID pandemic and Brexit in January of that year, the Brexit announcement itself did not appear to damage the UK’s international trade.

Quite the opposite actually, with both the UK’s imports and exports increasing from 2016 to 2020. This may have been due to businesses building up stockpiles ahead of a new post-Brexit deal that companies feared would increase costs.

Looking to the future

Prime minister Rishi Sunak may well celebrate the UK becoming the world’s fourth largest exporter, but the future remains uncertain.

Leaving the EU’s single market introduced new trade frictions, despite the 2021 trade deal (the Trade and Cooperation Agreement) allowing smoother UK-EU trade and driving up both imports and exports in 2022.

To counterbalance these frictions, striking more bilateral trade deals could increase UK exports to faster-growing overseas markets. But this depends on the terms negotiated, and how well they remove tariffs and reduce other trade obstacles.

Additionally, the UK’s ability to maintain its momentum relies on increasing domestic productivity, innovation, workforce skills and growth in emerging technology sectors. This will allow it to improve competitiveness.

In future, the UK’s global export ranking will be meaningless without sustainable trade surpluses. Long-term policies that add value to the UK economy and increase the range of goods and services the country exports will determine if 2022’s figures marked an anomaly – or reinstate the UK as a global powerhouse.

This article is republished from The Conversation under a Creative Commons license. Read the original article.

The authors do not work for, consult, own shares in or receive funding from any company or organisation that would benefit from this article, and have disclosed no relevant affiliations beyond their academic appointment.

Yahoo Finance

Yahoo Finance