Coronavirus: UK could face tax hikes amid fears of 'biggest deficit in history'

Experts are warning Britain may need to hike taxes in years to come, with the coronavirus crisis leaving a gaping hole in the public finances.

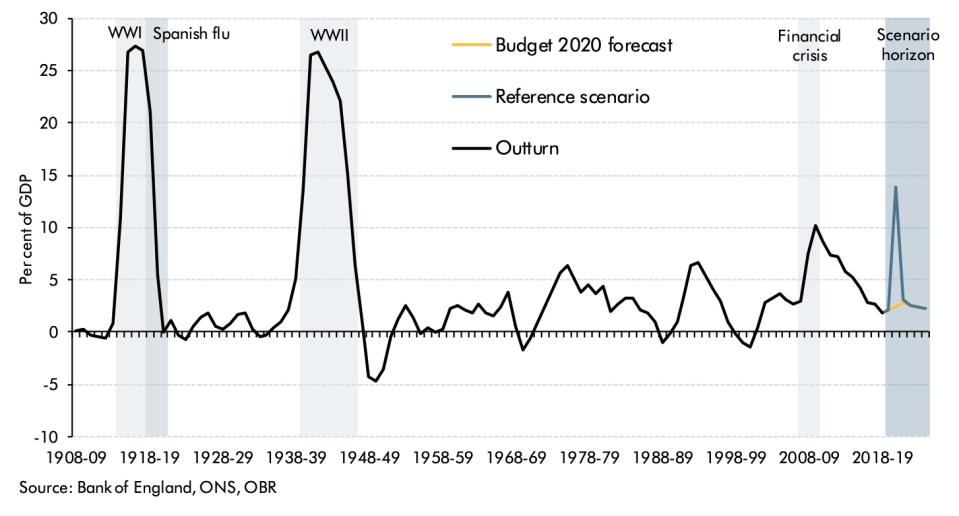

Office for Budget Responsibility (OBR) figures this week showed Britain could be facing the deepest recession in three centuries as the lockdown cripples the economy. The budget watchdog said a three-month lockdown could send public borrowing this year to its highest level since the Second World War.

Debate is already growing over how the government fixes its deteriorating balancesheet once the virus and lockdown eventually fade.

Limited public appetite for spending cuts after a decade of austerity could make higher taxes the more politically acceptable alternative.

The Resolution Foundation called on Thursday for a “tax surcharge” on high earners once the economy starts to recover, targeting those who were able to keep working during the lockdown.

Why the deficit and borrowing is soaring

Borrowing in 2020-21 could be £218bn ($273bn) higher than the OBR expected just months ago as the budget deficit widens, reaching 14% of GDP.

“Lower revenues, higher spending and higher debt will place unprecedented pressure on the UK’s public finances in the months and years ahead,” according to a new Resolution Foundation report.

The government faces a sharp drop in income just as spending pressures soar. Tax receipts could be £130bn lower than previously assumed. The lockdown is wiping out many companies’ and workers’ earnings, while new tax reliefs and holidays will also stretch the Treasury coffers.

Meanwhile the government has announced unprecedented spending measures, on top of rising NHS and unemployment benefit costs from the crisis.

It includes income protection schemes, more generous benefits, extra NHS funding, business grants and sick pay rebates and bailouts in the transport and charity sectors. Overall the package could cost £60-80bn in 2020-21, according to PwC analysis.

Read more: No free money for Brits despite calls for universal basic income

Total public debt is likely to exceed total GDP for the first time since the 1960s, according to the Resolution Foundation. The Bank of England’s extra £200bn in quantitative easing (QE) adds to debt, as well as higher borrowing.

Cheap debt and recovery could plug the gap

The eye-catching figures do not worry economists as much as might be expected.

In the short term, investors remain happy to buy UK government debt at record low yields, with expanded QE propping up the market. “There is no problem with the government borrowing more for now,” wrote PwC analysts.

In the longer term, some expect the budget deficit to largely shrink by itself. Chancellor Rishi Sunak said as much this week, telling journalists: “The best way out... is to just grow the economy.”

Borrowing will fall as the lockdown lifts and the economy recovers, with tax receipts rebounding and temporary spending measures cut. Debt is higher but stable with interest payments “manageable,” Resolution Foundation researchers note, though it is much more exposed to rising inflation or rates.

Long-term scarring to the economy

It is far from clear the economy will “return swiftly to its pre-virus path” and the deficit shrink by itself however — as assumed in the OBR’s analysis.

“We think it will take the economy a few years to recover,” analysts at Capital Economics wrote in a note on Thursday.

The longer the virus and lockdown persists, the greater the immediate hit to the public finances. A 12-month lockdown could push the deficit to its highest in history, according to the foundation. Infection fears could also hobble economic activity even after restrictions lift.

Past recessions have had a long-term scarring effect too, with persistent unemployment or under-investment. Many firms and the financial sector are in better health than past crises, and the government hopes emergency loans, wage subsidies and other measures will save firms and jobs.

But businesses warn cash is not reaching them fast enough, if at all. With unemployment already rising and many firms on the brink, even a relatively short lockdown could cause lasting damage.

Capital Economics predicts 110,000 firms could face bankruptcy. Tax receipts may not fully recover, just as calls grow for more long-term spending on healthcare and frontline workers’ pay.

PwC expects the deficit to shrink but only to 4-7% of GDP, above the 3% ceiling in the government’s current fiscal rules.

‘Tax rises for those least affected by the crisis’

Such a weak recovery will heap pressure on the government to eventually slash the deficit.

The Resolution Foundation says new fiscal rules are needed to reassure bond markets and the public, such as closing the current deficit within five years of recovery.

One way to close the gap is cutting spending, but the government has vowed to “turn the page” on austerity. More cuts could prove unpopular, and risk undermining growth.

Read more: Unemployment could more than double to 27-year high

This week has seen the Resolution Foundation, PwC and the Institute for Fiscal Studies (IFS) all say higher taxes could eventually be needed.

Only the Resolution think tank has floated proposals itself, however. They recommend “tax rises for those least affected by the crisis, rather than renewed austerity for those who have borne the brunt of it.”

But as PwC analysts note: “That is a matter to decide after the crisis.”

Yahoo Finance

Yahoo Finance