UK trade push with Gulf nations reeks of desperation

The UK’s trade dealings are looking increasingly desperate.

As Britain approaches the possibility of a no-deal Brexit on 29 March, it risks severing close trade ties with the European Union, where it conducts 49% of its £1.3 trillion in annual trade.

It’s also rushing to lock in about 40 current trade deals covering more than 70 countries to ensure the EU-arranged agreements remain operational after Brexit. These nations account for a further 11% of total UK trade. So far, nine smaller countries have signed up.

In the midst of this, the UK’s international trade secretary, Liam Fox, flew to Dubai this past weekend to conduct further trade and business discussions with the United Arab Emirates.

The UAE’s economy minister confirmed this week that Britain had approached the UAE and other Gulf countries about a possible post-Brexit trade pact.

The six nations in the Gulf Cooperation Council (GCC) — the UAE, Saudi Arabia, Kuwait, Oman, Qatar, and Bahrain — are comparatively small partners for the UK. Just 3% of Britain’s trade is conducted with these countries, equivalent to £40bn in 2017. Much of this trade involves imports of energy and oil products and exports of British-made aircraft and arms, along with industrial products and other manufactured goods.

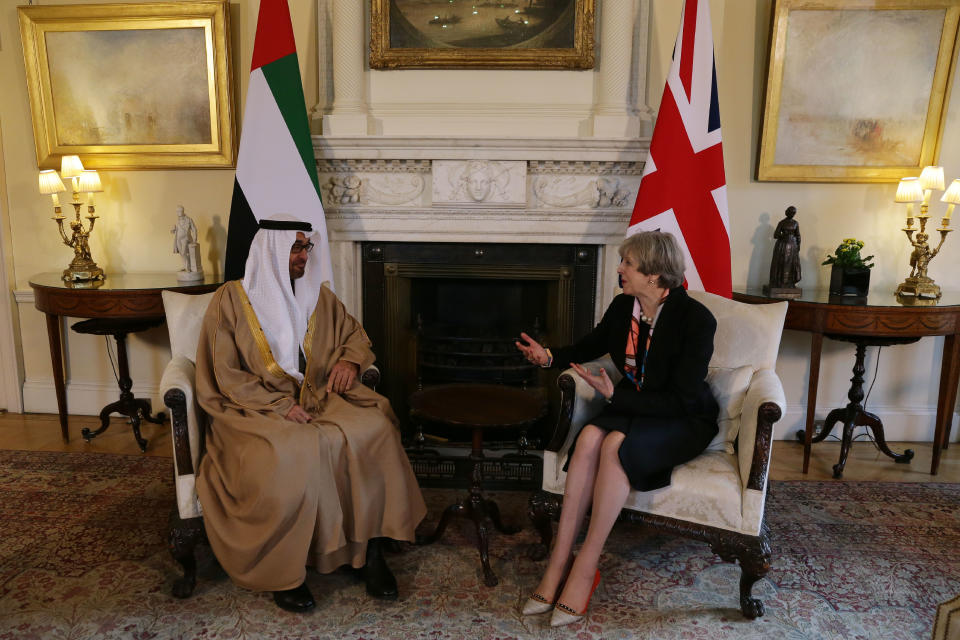

Prime minister Theresa May has said she is looking for the “strongest possible trading relationships between the UK and the Gulf” after her country leaves the EU.

But trade experts have difficulty understanding the rationale for these efforts with such a small region that is known to court controversy.

Western relations with Saudi Arabia and the UAE are under pressure after the murder of US-based Saudi-critic Jamal Khashoggi and the UAE’s seven month detention of British academic Matthew Hedges.

This could complicate the negotiations and make it difficult to sell any deal to the UK population.

“It’s very difficult to get trade deals with the Gulf. There’s all manner of complications with this,” said David Henig, a UK-based former trade negotiator who now leads the UK Trade Policy Project at the European Centre for International Political Economy.

“It’s not completely ridiculous, just really tricky,” Henig told Yahoo Finance UK, noting that the region is deeply protectionist and has only negotiated a handful of trade deals so far.

The GCC are currently working on trade talks with China, Australia, and New Zealand.

Additionally, the UK will be a less compelling trade partner for the GCC nations if Airbus (AIR.PA) follows through on threats to shift its wing-building out of Britain in the absence of a smooth Brexit. The question looms for GCC nations: What’s the point of doing a trade deal with a country that doesn’t sell the things you want?

John Sfakianakis, chief economist at the Gulf Research Center, argues that despite the risk that the UK aerospace industry could be eroded after Brexit, there’s still reason for the two sides to hold trade talks and move to lower tariffs and trade barriers.

“If the UK manufacturing capacity gets reduced, that’s where the relationship with the UAE becomes even more important … UK exports of services is quite substantial to the UAE,” he told Yahoo Finance UK.

The UK exports just over £2bn worth in British services each year to the UAE, but that’s just half the amount it exports in goods.

The government insists this is a relationship worth pursuing, noting there are opportunities for exports and partnership in financial services, education, health care, and infrastructure, among others.

There are over 5,000 British companies operating in the UAE alone, including BP (BP.L), Shell (RDSB.L), BAE Systems (BA.L), and HSBC (HSBA.L).

But the balance of power doesn’t necessarily favour the UK, noted Giorgio Cafiero, CEO and co-founder of Gulf State Analytics.

“It’s unclear who has the upper hand in trade negotiations between UK and Gulf states,” Cafiero told Yahoo Finance UK. “There’s a belief in the UAE that they are a rising power … they are no longer subservient to the United Kingdom.”

“Of course, as a former super power, the United Kingdom is not willing to accept this new dynamic. However, given the crisis of Brexit … London is not in a position to try to speak down to the UAE,” he said.

Yahoo Finance

Yahoo Finance