Ulta Beauty's (ULTA) Omnichannel Strength Aids Amid Challenges

Ulta Beauty, Inc. ULTA has revolutionized the beauty space by integrating mass, prestige and luxury brands within an accessible and engaging shopping environment. This unique and differentiated strategy, combined with a commitment to inclusive and welcoming guest experiences, has allowed the company to set new standards in consumer expectations while driving significant profitable growth.

However, the company navigated a dynamic and challenging environment in the first quarter of fiscal 2024 and expects this landscape to continue throughout the year. Additionally, Ulta Beauty faces challenges such as increased competitive intensity, soft merchandise margins and rising SG&A expenses. Let’s delve deeper.

Core Strengths

Ulta Beauty's strategic focus on five key areas enhances its growth potential. These include strengthening its product assortment, accelerating social relevance, enhancing digital experiences, leveraging its world-class loyalty program and evolving promotional strategies.

These initiatives are expected to drive comp growth in the low single-digit range in the first half of fiscal 2024, with an anticipated acceleration of 2% to 4% in the second half, reflecting the impact of new sales-driving initiatives and a robust product pipeline. The company also anticipates mid-single-digit growth in the beauty category, barring major economic disruptions, indicating a strong market outlook.

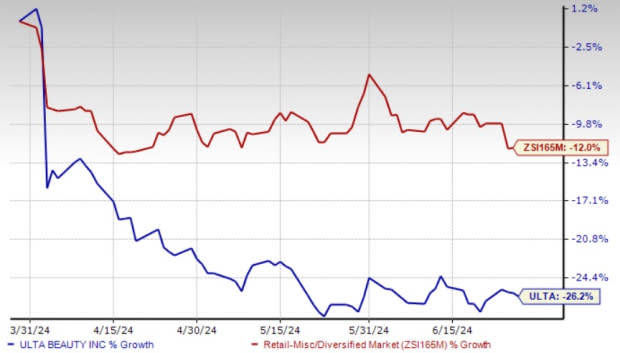

Image Source: Zacks Investment Research

The company's ability to generate traffic growth across both its physical stores and digital channels is a testament to its powerful operating model and excellent brand partnerships. By increasing marketing investments across TV, audio, and social platforms, Ulta Beauty has effectively captured a broader audience and reinforced its market presence.

Ulta Beauty has been witnessing market share gains in major beauty categories for a while now, with skincare standing out, thanks to consumers’ rising interest in self-care and the company’s focus on newness and innovation. The trend continued in the first quarter of fiscal 2024, wherein the skincare category delivered mid-single-digit comp growth. This was backed by solid growth in body care and mass skin care. Results largely gained from the launch of Sol de Janeiro and the expansion of core emerging brands into additional Ulta Beauty stores. Guests’ increased focus on self-care and maintaining healthy skincare routines keeps the skincare category well-positioned for continued growth.

Near-term Challenges

Ulta Beauty’s SG&A expenses have been rising year over year for a while now. Management expects SG&A deleverage in fiscal 2024 due to sales-driving investments (including marketing and store labor), efforts related to the transformational agenda and initiatives to operationalize investments made in 2023. SG&A is expected to increase by mid-to-high-single digits in fiscal 2024, including a low-double-digit increase in the first half and low-to-mid-single-digit growth in the second half.

Consequently, management trimmed its operating margin guidance for fiscal 2024. They expect an operating margin between 13.7% and 14% now compared with the previously mentioned 14%-14.3%. The company also expects the gross margin to decline modestly in fiscal 2024 due to soft merchandise margins and fixed cost deleverage. Shares of the company have tumbled 26.2% in the past three months, compared with the industry’s decline of 12%.

Wrapping Up

Despite anticipated moderation in growth following three years of unprecedented expansion and increasing competitive intensity, Ulta Beauty remains well-positioned to protect and expand its leadership role in the industry. The company’s progress across key business areas, with its strong culture and outstanding team, positions it well for sustained growth and enhanced market leadership.

Zacks Rank

Ulta Beauty currently carries a Zacks Rank #3 (Hold).

3 Strong Bets

Abercrombie & Fitch ANF, a specialty retailer, currently sports a Zacks Rank #1 (Strong Buy). The Zacks Consensus Estimate for ANF’s current financial-year sales and earnings suggests growth of 10.4% and 47.3%, respectively, from the year-ago reported numbers. You can see the complete list of today’s Zacks #1 Rank stocks here.

Abercrombie & Fitch has a trailing four-quarter earnings surprise of 210.3%, on average.

Macy's, Inc. M, an omnichannel retail organization, currently carries a Zacks Rank #2 (Buy). The Zacks Consensus Estimate for M’s current fiscal quarter’s earnings per share implies growth of 15.4% from the year-ago period number.

Macy's has a trailing four-quarter earnings surprise of 57.1%, on average.

Tractor Supply TSCO, a rural lifestyle retailer, currently carries a Zacks Rank #2. The Zacks Consensus Estimate for TSCO’s current financial-year sales and earnings indicates respective growth of about 3% and 2.5% from the year-ago reported number.

Tractor Supply has a trailing four-quarter earnings surprise of 2.7%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Macy's, Inc. (M): Free Stock Analysis Report

Abercrombie & Fitch Company (ANF): Free Stock Analysis Report

Tractor Supply Company (TSCO): Free Stock Analysis Report

Ulta Beauty Inc. (ULTA): Free Stock Analysis Report

Yahoo Finance

Yahoo Finance