ULTA Stock Tumbles 27% in 6 Months: What's Next for Investors?

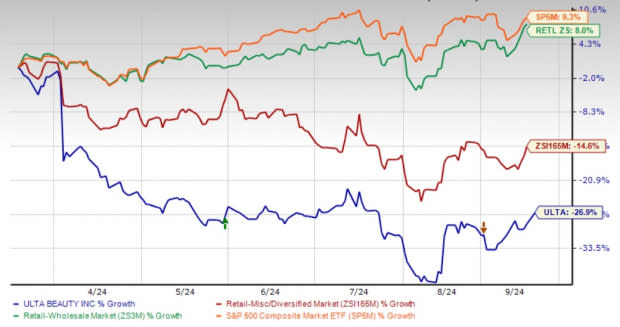

Ulta Beauty, Inc. ULTA has seen its shares plummet as much as 26.9% in the past six months, lagging the industry's drop of 14.6%. This specialty beauty retailer has also trailed the broader Zacks Retail - Wholesale sector and the S&P 500's respective growth of 8% and 9.3% during the same period. Closing the trading session at $389.29 yesterday, the stock stands well below its 52-week high of $574.76.

Ulta Beauty has long been a leader in the beauty retail space, known for its wide array of products and services under the “All Things Beauty, All in One Place” model. However, recent financial performance and emerging challenges in the industry indicate that the company may be facing more hurdles than anticipated, raising questions about its growth trajectory and investor appeal.

Image Source: Zacks Investment Research

Consumer Shifts & Competitive Pressures Hurt ULTA

A major factor contributing to Ulta Beauty’s struggles is the normalization of beauty category growth. After three years of unprecedented gains, the sector is seeing a slowdown, with U.S. beauty sales increasing only 3% in the first half of 2024. The broader beauty market is also undergoing a shift, with consumers increasingly prioritizing value over premium offerings in the face of inflationary pressures and economic uncertainties. This trend could pose long-term risks for Ulta Beauty’s high-end product lines, which have historically been a key driver of profitability.

Ulta Beauty is facing significant competitive pressures that are eroding its market share in the high-margin prestige beauty segment. The beauty industry has become a magnet for new entrants, with more than 1,000 new points of distribution for prestige beauty products introduced in the past three years. This influx of competition has made it harder for ULTA to maintain its leadership position.

According to Circana data for the 13 weeks ended Aug. 3, the company maintained its market share in the mass beauty segment but lost ground in prestige beauty, driven by weakness in makeup and hair care categories. More than 80% of Ulta Beauty’s store fleet has been affected by competitive openings in nearby locations, worsening the decline in store transactions. With many stores facing prolonged sales impacts due to increased competition, it is difficult for the company to sustain the level of growth investors have come to expect.

ULTA Faces ERP Issues & Promotion Missteps

In the second quarter of fiscal 2024, ULTA faced unanticipated operational challenges stemming from its Enterprise Resource Planning (“ERP”) system transformation. While the company completed the migration to a new ERP platform in July, the transition created disruptions in store inventory allocation, complicating its efforts to optimize the guest experience. Although management is working to address these issues, the operational friction during this critical period has impacted the company’s performance, and it remains to be seen how quickly these challenges can be fully resolved.

In an effort to combat softening sales trends, Ulta Beauty ramped up promotional activity in the second quarter, which backfired. While these promotions drove traffic and sales on the company’s digital platforms, they failed to generate meaningful uplift in its brick-and-mortar stores. The increased frequency of promotions also put pressure on the company’s average selling price without driving enough incremental purchases, squeezing margins.

Weak Comps and View Cut Signal Challenges for ULTA

All of the abovementioned factors weighed on Ulta Beauty’s comparable sales in the second quarter of fiscal 2024. During the quarter, the company reported net sales growth of just 0.9%, reaching $2.6 billion, while comparable store sales decreased by 1.2%. Considering the performance in the first half and a more cautious perspective, the company revised its full-year expectations downward.

Ulta Beauty now expects fiscal 2024 net sales in the band of $11-$11.2 billion compared with the earlier mentioned $11.5-$11.6 billion range. The company reported net sales of $11.2 billion in fiscal 2023. Comparable sales are expected to remain flat to down 2% year over year. The metric was earlier anticipated to rise 2-3%. Management expects an operating margin between 12.7% and 13% compared with the previously mentioned 13.7% and 14%. For fiscal 2024, earnings are envisioned in the $22.60-$23.50 band per share, lower than the earlier stated $25.20-$26 band.

Ulta Beauty Estimates: More Pain Ahead?

Reflecting the negative sentiment around Ulta Beauty, the Zacks Consensus Estimate for EPS has seen downward revisions. Over the past seven days, analysts have lowered their estimates for both the current quarter and fiscal year by 1.7% and 0.9% to $4.50 per share and $23.21, respectively. These estimates suggest year-over-year declines of 11.2% and 10.8% from the third quarter and fiscal 2023 figures, respectively. This downward adjustment reflects a negative sentiment among analysts and suggests potential challenges in achieving projected profitability.

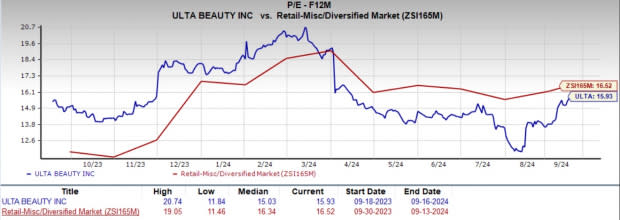

Image Source: Zacks Investment Research

Is ULTA’s Price Discount a Sign of Deeper Issues?

Although Ulta Beauty’s stock is currently trading at a discount compared to its industry peers, this valuation disparity might not be as favorable as it seems. The lower price could be indicative of underlying issues rather than representing a clear investment opportunity.

ULTA is currently trading at a discount to its historical and industry benchmarks. The stock has a forward 12-month P/E ratio of 15.93, which is below the high level of 20.74 scaled in the past year. This compares with the forward 12-month P/E ratio of 16.52 for the industry.

Image Source: Zacks Investment Research

Will Ulta Beauty’s Initiatives Turn the Tide?

While Ulta Beauty faces multiple hurdles, it has put several strategic initiatives in place to reinforce its position and drive long-term growth. These efforts focus on optimizing its omnichannel capabilities, enhancing its loyalty program, strengthening its brand portfolio and leveraging partnerships.

Like other specialty retailers, such as Sally Beauty Holdings SBH and DICK'S Sporting Goods DKS, Ulta Beauty has bolstered its omnichannel strategy to meet both in-store and online needs as consumer preferences shift toward digital-first shopping. The company offers flexible options like buy online, pick up in-store, curbside pickup and ship-from-store. Enhanced technology investments, including a revamped app and improved website, have created a seamless shopping experience. Ulta Beauty’s digital ecosystem continues to be a major growth driver, contributing to more than 20% of total sales in the second quarter of 2024.

The company’s Ultamate Rewards loyalty program, which boasts more than 43 million members, remains one of its most valuable assets for driving customer engagement and repeat purchases. To enhance customer loyalty, Ulta Beauty has continued to introduce personalized offers, exclusive rewards and tier-based incentives within the program. By strengthening its loyalty program, the company aims to deepen its connection with core customers, increase retention rates and encourage higher spend per visit.

Recognizing the evolving needs of beauty consumers, Ulta Beauty has prioritized innovation in both its product offerings and customer experiences. The company is increasingly incorporating personalization tools, such as virtual try-ons and artificial intelligence (AI) technologies, to enhance the shopping journey. Exclusive partnerships with sought-after beauty brands and retailers like Target TGT are also enhancing its product range and extending its reach.

Investors’ Roadmap for ULTA Stock

Ulta Beauty’s recent stock price decline reflects a series of struggles, including a slowdown in beauty category growth, rising competitive pressures, shifting consumer patterns and operational disruptions from its ERP system transition. A lowered fiscal 2024 guidance and negative analyst sentiment suggest that Ulta Beauty may face continued difficulties. While the company’s efforts to expand its omnichannel capabilities and enhance its loyalty program are notable, they may not fully offset current headwinds. Given the persistent issues and uncertain outlook, ULTA presents a high-risk investment at this juncture, making it prudent for investors to approach it with caution. The company currently carries a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Target Corporation (TGT) : Free Stock Analysis Report

DICK'S Sporting Goods, Inc. (DKS) : Free Stock Analysis Report

Ulta Beauty Inc. (ULTA) : Free Stock Analysis Report

Sally Beauty Holdings, Inc. (SBH) : Free Stock Analysis Report