Under Armour Leadership Responds to Tough Questions

No meeting transcript was published. The slide presentation is unavailable. No call-in number was provided. The only way to know what happened at the Under Armour (NYSE: UA) (NYSE: UAA) shareholder meeting was to show up in person in May with proof that you own shares.

I go to the annual shareholder meeting, because this stock was once my largest holding, and I want to hear directly from CEO Kevin Plank on where he's taking the sportswear company. He was prominent in this year's meeting, but his new lieutenant, president and COO Patrik Frisk, was the MVP.

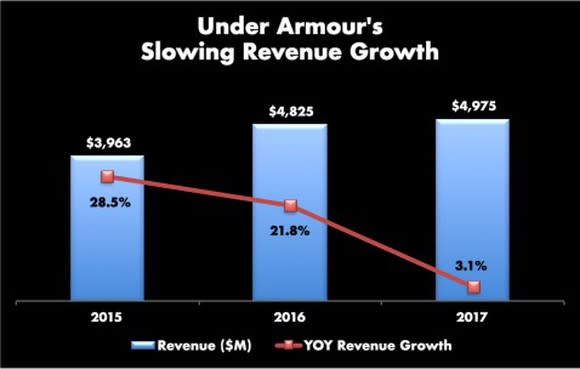

The company's stock has significantly trailed the market over the last three years, mainly due to declining revenue growth. It's no surprise that Under Armour is under pressure to deliver for investors. And even though recent results show some promise, shareholders know there are still issues. As an outsider and industry veteran, Frisk has a clear view of the company's performance and has been executing a turnaround plan since the day he arrived last July.

Under Armour's slowing growth is troubling to investors. Chart by author, data from Under Armour annual reports.

Management's pitch

Plank kicked off the management review portion of the meeting with a brief history of the company, a business that is now "slowing down to speed up." Rather than pursue revenue growth at any cost, the company is focused on improving internal processes to "amplify the company's ability to delight the customer." With that backdrop, Plank turned the meeting over to Frisk who laid out the details of how it's happening.

Frisk has been brutally honest about the state of Under Armour's go-to-market process since he arrived. With the company's rapid growth, its process to bring products to market "hadn't kept pace, lacked the required discipline, and had become overly complex ... too many products, too many colors, and too many categories." He explained that the company is "recalibrating and resetting" its innovation process to be more nimble and to deliver better products.

In the third quarter of 2017, Frisk launched a consumer segmentation study of 20,000 customers to "more clearly define our global consumer target." With the data collected, the company has defined its customer as a "focused performer" who values performance, style, and fit. With the customer at its center, Frisk aligned the company's corporate calendars to deliver "seasons" of products in a process that delivers new products faster and brings more accountability and discipline. Frisk wrapped up his remarks with a simple slide that explained the company's timeline for these improvement efforts. It said: "2017 -- Get Organized"; "2018 -- Get to Work"; and "2019 -- Execute".

CFO David Bergman concluded with the 2017 results and 2018 forecast of "low single digit" top-line growth. This forecast is a far cry from what shareholders had come to expect with the company's 26 quarters of 20%-plus revenue growth coming to an end in Q3 2016. The meeting was then turned over to shareholder questions.

Under Armour's new HOVR Phantom connected shoe has sold out. Image source: Under Armour.

Key concerns from shareholders

A number of shareholders expressed disappointment with the company's recent products and indicated that the "wow" factor has been missing. One asked Plank upfront, "What are you doing about making products that people want?"

Under Armour's women's segment was brought into question, too. Women's apparel and footwear have become a $1 billion business for the company, but growth has stalled. Perhaps this is a product issue, too. Several female shareholders appealed to Plank to improve its women's products and make clothes that have great style, color, and cut.

Lastly, an impassioned longtime shareholder questioned Plank's commitment to Under Armour. Recent reports indicate that Plank had been distracted with his outside ventures and had, in his words, "lost focus" on the company.

Management's perspective

On lacking the "wow" factor, Plank said, "We want to make products that people covet and desire." He pointed to recent progress with the current HOVR footwear line, which is sold out, and indicated that the "pipeline of innovation is full." Frisk added that its shorter product delivery timeline will help the company get a more "current read" on the market:

We are not relying on our own intuition anymore and using the customer to drive design. We also understand that less is more. From spring 2018 to spring 2019, we are going to have 40% less product [stock keeping units]. This will enable the team to spend more time building better products.

On women's products, Plank said, "We've found for our women customers, we need to be end-use specific and basics driven ... We want our women's apparel to be better, brighter, bolder." The company has promoted a "terrific leader" -- Morgan Goerke -- to general manager of women's training. Perhaps this focus is making a difference already. And the newly launched Misty Copeland collection for women is "performance focused, but doesn't ignore style." Plank is excited about women's products in the pipeline, and he looks forward to women coming back next year to "let us know how we are doing."

On Plank's focus, the company founder thanked the shareholder for his question and responded:

My time is driven completely and focused on shareholders. My focus is on Under Armour. Under Armour is everything I do ... I love this company. I love this brand.

This meeting inspired me with more confidence than last year. Frisk brings discipline and organization to Plank's renewed commitment to the company. Last year, the message was: "We're focused on delivering shareholder value," but with no real plan to get there. This year, management has a clear (and sensible) plan on how to deliver great products that customers love and is executing on it.

More From The Motley Fool

Brian Withers owns shares of Under Armour (A Shares) and Under Armour (C Shares). The Motley Fool owns shares of and recommends Under Armour (A Shares) and Under Armour (C Shares). The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance