How Under Armour (UAA) Looks Just Ahead of Q2 Earnings

Under Armour, Inc. UAA is likely to register a decline in the top line when it reports second-quarter 2020 numbers on Jul 31, before the market opens. The Zacks Consensus Estimate for revenues is pegged at $549.9 million, indicating a decline of 53.9% from the prior-year reported figure.

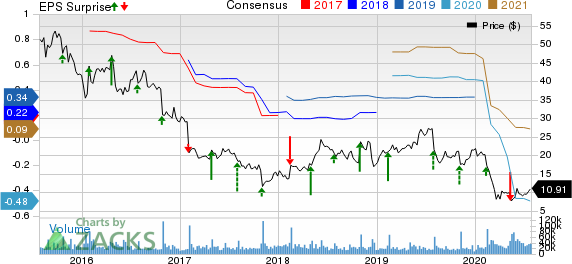

Further, the Zacks Consensus Estimate for second-quarter bottom line slipped to a loss of 39 cents from a loss of 38 cents over the past seven days. The Baltimore, MD-based company had reported loss of 4 cents a share in the year-ago period.

We note that the company’s bottom line has underperformed the Zacks Consensus Estimate in the last reported quarter. This developer, marketer and distributor of apparel, footwear, and accessories has a trailing four-quarter negative earnings surprise of 7.8%, on average.

Key Things to Note

Under Armour has been bearing the brunt of the ongoing pandemic and stiff competition. Although the company has been taking every step to address the challenges, revenues and margins are likely to have remained under pressure. On its last earnings call, Under Armour had notified that second-quarter revenues are expected to be down by as much as 50-60% owing to the fact that 80% of business wasn’t operational globally at that point of time. Analysts had predicted a slow and progressive return to normalization, a highly promotional environment, and significant uncertainty in brick-and-mortar traffic and conversion as consumers return to stores.

We note that the Zacks Consensus Estimate for second-quarter revenues at North America, EMEA, Asia-Pacific and Latin America segments are pegged at $258 million, $61 million, $94 million and $18.7 million, respectively. These figures suggest respective declines of 68.4% and 58% for North America and EMEA on a year-over-year basis. The same for Asia-Pacific and Latin America indicate declines of 39% and 53%, respectively.

Furthermore, the Zacks Consensus Estimate for quarterly revenues for Apparel, Footwear and Accessories categories are pegged at $367 million, $125 million and $57 million, respectively, indicating declines of 50.4%, 56% and 46.4% year over year. Moreover, the consensus mark for Licensing stands at $16.5 million, suggesting a decrease of 35% from the same quarter a year ago.

Nevertheless, Under Armour has been focused on strengthening brand through enhanced customer connections and strict go-to-market process. Notably, the company had earlier highlighted that it has been witnessing more favorable trends across its e-commerce business in North America and EMEA since commencement of the second quarter. Also, the expansion of direct-to-consumer business, product innovation and foray into the technology-based fitness businesses appear encouraging. Apparently, the consensus estimate for Connected Fitness revenues stands at $35.3 million, which suggests an increase of 10.6% from the year-ago reported figure.

We note that the company has been taking several actions to stay firm during such a crisis. These includes cutting of incentive compensation, temporarily laying- off associates working in owned retail stores and U.S.-based distribution centers, curbing of non-essential operating expenses, and postponing planned capital expenditures.

What the Zacks Model Unveils

Our proven model does not conclusively predict a beat for Under Armour this earnings season. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Under Armour has a Zacks Rank #5 (Strong Sell) and an Earnings ESP of -2.06%.

Stocks With a Favorable Combination

Here are some companies that you may want to consider, as our model shows that these have the right combination of elements to post an earnings beat this time around:

Kroger KR has an Earnings ESP of +7.20% and a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here.

SpartanNash Company SPTN has an Earnings ESP of +4.84% and a Zacks Rank #1.

Costco COST has an Earnings ESP of +0.76% and a Zacks Rank #3.

Zacks Top 10 Stocks for 2020

In addition to the stocks discussed above, would you like to know about our 10 finest buy-and-hold tickers for the entirety of 2020?

Last year's 2019 Zacks Top 10 Stocks portfolio returned gains as high as +102.7%. Now a brand-new portfolio has been handpicked from over 4,000 companies covered by the Zacks Rank. Don’t miss your chance to get in on these long-term buys.

Access Zacks Top 10 Stocks for 2020 today >>

Click to get this free report Costco Wholesale Corporation (COST) : Free Stock Analysis Report The Kroger Co. (KR) : Free Stock Analysis Report SpartanNash Company (SPTN) : Free Stock Analysis Report Under Armour, Inc. (UAA) : Free Stock Analysis Report To read this article on Zacks.com click here. Zacks Investment Research

Yahoo Finance

Yahoo Finance