Undervalued Small Caps In Hong Kong With Insider Actions To Watch

Amidst a generally quiet week in global markets, Hong Kong's small-cap stocks have shown resilience, with the Hang Seng Index experiencing a slight decline. This backdrop sets an intriguing stage for investors looking at undervalued opportunities within this segment. Identifying stocks with strong fundamentals and positive insider actions can be particularly compelling in such market conditions, offering potential growth avenues against broader economic uncertainties.

Top 10 Undervalued Small Caps With Insider Buying In Hong Kong

Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

Xtep International Holdings | 10.3x | 0.7x | 45.65% | ★★★★★★ |

Wasion Holdings | 12.1x | 0.9x | 28.00% | ★★★★☆☆ |

Sany Heavy Equipment International Holdings | 7.7x | 0.7x | -19.09% | ★★★★☆☆ |

Nissin Foods | 14.7x | 1.3x | 40.28% | ★★★★☆☆ |

China Leon Inspection Holding | 10.3x | 0.7x | 23.74% | ★★★★☆☆ |

China Overseas Grand Oceans Group | 2.8x | 0.1x | -2.06% | ★★★★☆☆ |

Transport International Holdings | 11.4x | 0.6x | 44.87% | ★★★★☆☆ |

Giordano International | 8.7x | 0.8x | 35.73% | ★★★☆☆☆ |

Kinetic Development Group | 4.3x | 1.9x | 13.35% | ★★★☆☆☆ |

Shenzhen International Holdings | 8.1x | 0.8x | 12.86% | ★★★☆☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

iDreamSky Technology Holdings

Simply Wall St Value Rating: ★★★☆☆☆

Overview: iDreamSky Technology Holdings is a company primarily engaged in game and information services, including SaaS and other related services.

Operations: Game and Information Services, including SaaS and related services, generated CN¥1.92 billion in revenue. The company's gross profit margin stood at 35.14% as of the latest reporting period.

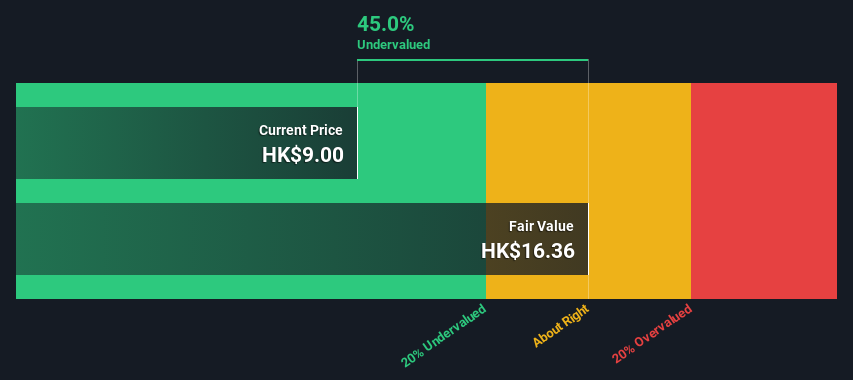

PE: -9.2x

iDreamSky Technology Holdings, reflecting a promising outlook with earnings expected to surge by 104% annually, recently showcased insider confidence through significant share purchases. This activity underscores a strong belief in the company's future among those who know it best. Hosting its Annual General Meeting on June 28, the firm emphasized stability and growth prospects. Despite relying solely on external borrowing—a riskier funding strategy—its financial agility appears robust, aligning well with its market positioning as an attractive investment in Hong Kong's dynamic tech sector.

Kinetic Development Group

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Kinetic Development Group is a company involved in property development, primarily focusing on residential and commercial properties in China, with a market capitalization of approximately CN¥1.23 billion.

Operations: The company has experienced a notable increase in gross profit margin, escalating from 9.05% in Q3 2013 to 59.07% by the end of Q2 2024, reflecting significant operational efficiency improvements over the period. Revenue growth also showed a robust trend, rising from CN¥102.90 million in Q3 2013 to CN¥4745.07 million by mid-2024, demonstrating substantial expansion in its business scale.

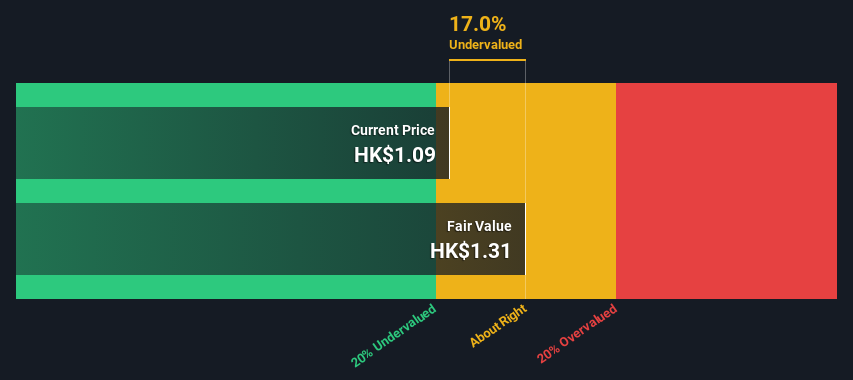

PE: 4.3x

Kinetic Development Group, navigating through a landscape of revised corporate bylaws and a trimmed dividend, recently signaled insider confidence with strategic share purchases. Their financial structure leans heavily on external borrowing, reflecting a higher risk yet potentially rewarding profile. With insiders buying shares, it hints at optimism about the company's prospects despite the challenges. The firm is poised to announce Q1 results soon, which could provide further insights into its trajectory amidst these changes.

Dive into the specifics of Kinetic Development Group here with our thorough valuation report.

Understand Kinetic Development Group's track record by examining our Past report.

Transport International Holdings

Simply Wall St Value Rating: ★★★★☆☆

Overview: Transport International Holdings operates primarily in franchised bus operations, with additional interests in property holdings and development, generating a market capitalization of HK$5.17 billion.

Operations: Franchised Bus Operation generates the majority of the company's revenue, totaling HK$7.57 billion, while Property Holdings and Development contribute HK$87.36 million. The Gross Profit Margin has seen an upward trend over recent periods, reaching 0.28 in the latest report.

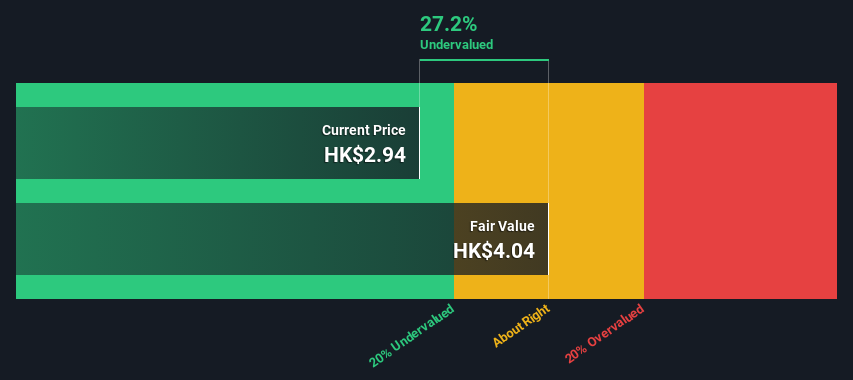

PE: 11.4x

Recently, Winnie J. Ng, a non-executive director at Transport International Holdings, demonstrated insider confidence by acquiring 124,000 shares for HK$1.11 million. This significant purchase reflects a belief in the company’s prospects despite its challenges with declining earnings and lower profit margins year-over-year. With leadership changes injecting fresh expertise into the board and a steady dividend payout affirmed last May, there's cautious optimism around its strategic direction amidst tough financial headwinds.

Next Steps

Access the full spectrum of 16 Undervalued Small Caps With Insider Buying by clicking on this link.

Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Looking For Alternative Opportunities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SEHK:1119 SEHK:1277 and SEHK:62.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance