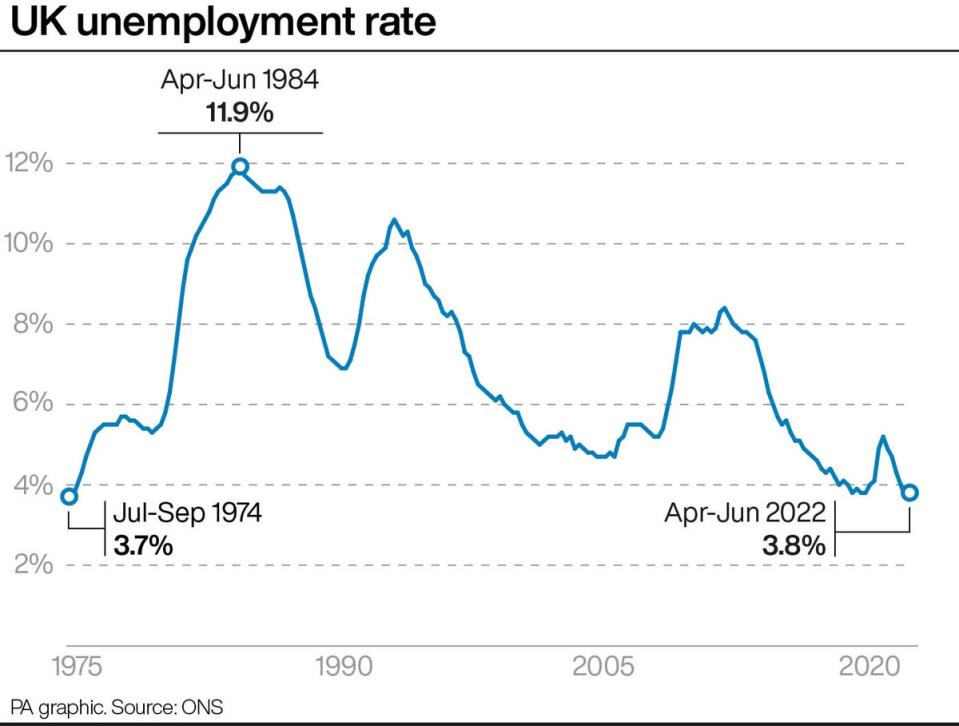

Unemployment falls to lowest point in 48 years but pay lags behind inflation amid cost of living crisis

Unemployment in the UK fell over the last three months to the lowest rate since 1974.

The number of workers on payrolls rose by 71,000 between July and August to 29.7 million, according to Office for National Statisics (ONS) data.

The unemployment rate for May to July 2022 fell from 3.8 per cent the previous quarter to 3.6 per cent, the lowest rate since May to July 1974.

However, employees saw their pay fall behind sky-high inflation despite another rise in earnings as the cost-of-living crisis hit hard.

Total weekly hours worked also fell by 3.5 million and remain below pre-pandemic levels.

The ONS said regular pay, excluding bonuses, grew by 5.2 per cent over the three months to July but with Consumer Prices Index (CPI) inflation taken into account, real pay tumbled by 3.9 per cent year-on-year.

The latest figures show the UK economy grew slower than expected in July as worker shortages and soaring costs weighed on activity amid the heightened risk of recession.

The ONS said gross domestic product (GDP) rose by 0.2 per cent in July, after a sharp fall of 0.6 per cent in June when the additional bank holiday for the Queen’s platinum jubilee led to a decline in activity.

City economists had forecast a stronger 0.4 per cent recovery after the fall a month earlier. Reflecting weakness in the economy, GDP growth was flat over the three months to July, with a slump in the UK’s dominant service sector offset by stronger activity in industrial production and construction.

Retailers are competing for workers among themselves, and also with competing sectors like hospitality, Linda Ellett, KPMG‘s head of consumer markets, retail and leisure, said.

“It’s people in stores, people in the warehouses and logistics — they’re no longer seen as attractive roles,” Ms Ellett said. At the same time, retailers are “concerned about seasonal staff, particularly in the supply chain,” she added. About two weeks ago, John Lewis said it would recruit 10,000 holiday staff, offering workers would receive free meals in the period to help with the rising cost of living.

“If things like food and hygiene products are available, then that’s savings that workers can make, so that is a creative way of making employment more attractive that costs less to the retailer than paying more money to workers,” Ms Ellett said.

The government's move to freeze energy bills at £2,500 is set to rein in the peak in inflation, but wages are still unlikely to keep pace with rising costs.

The ONS added that total pay including bonuses lifted by 5.5 per cent for the three-month period, falling by 3.6 per cent with inflation taken into account.

Glassdoor’s UK economist Lauren Thomas says: “The ONS’s latest labour market report tells us that summer’s red-hot labour market is starting to feel an autumn chill, with vacancies down for the second month in a row after nearly two years of nonstop growth.

“One notable bright spot for employees: the healthcare sector, where openings are still high. Employers struggling to hire should focus on the over-65s, whose employment rates are tied for the second-highest on record.

“Students are another possibility to focus on; they’ve driven a large share of the rise in economic inactivity during the pandemic, but many will be returning to the labour market after their programmes end.”

Yahoo Finance

Yahoo Finance